Ride the Waves of the Market: Embracing Technical Indicators for Options Traders

In the realm of options trading, where time and uncertainty dance, technical indicators emerge as essential tools to navigate the turbulent waters and unravel profit-making opportunities. These gauges, derived from price action and market data, offer invaluable insights into market trends, momentum, and volatility, empowering traders to make informed decisions. Embrace these indicators and embark on a journey towards options trading mastery.

Image: www.pinterest.co.uk

Technical Indicators for the Options Trading Arena

A plethora of technical indicators stands ready to equip options traders with a strategic edge. From momentum indicators, such as the Relative Strength Index (RSI) and Stochastic oscillator, to trend-following indicators, like moving averages and Bollinger Bands, the options trader’s arsenal encompasses a diverse range of analytical tools.

- RSI (Relative Strength Index): Measures the magnitude of recent price changes to gauge whether an asset is overbought or oversold.

- Stochastic Oscillator: Evaluates price action relative to a range to identify overbought and oversold conditions.

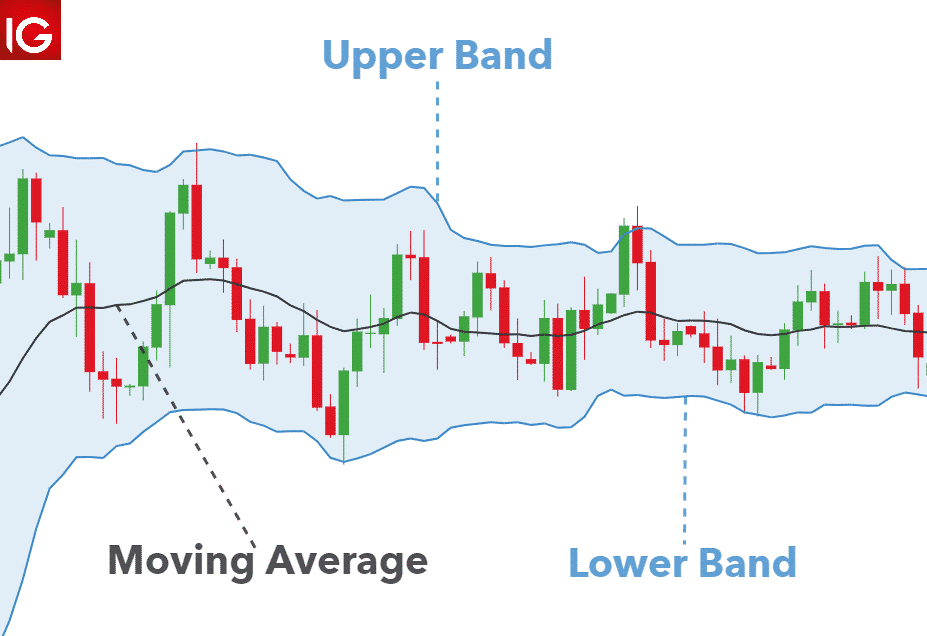

- Moving Averages: Smoothes out price data by calculating the average price over a specific period, revealing underlying trends.

- Bollinger Bands: Depict a range of volatility around a moving average, providing insights into potential price fluctuations.

Navigating the Market with Confidence

Technical indicators serve as guiding lights, illuminating the path towards profitable options trades. By analyzing price patterns and market sentiment, these indicators empower traders to:

- Identify market trends and capitalize on momentum shifts

- Determine potential reversal points and adjust strategies accordingly

- Assess market volatility and manage risk exposure

- Optimize entry and exit points to maximize returns

A Journey of Continuous Learning and Adaptation

The ever-changing market landscape demands constant learning and adaptation from options traders. Amidst the dynamic interplay of price action and market forces, technical indicators evolve to reflect the latest trading conditions. Embrace the continuous pursuit of knowledge and stay abreast of the latest advancements in the field to maintain a competitive edge.

Image: optionstradingiq.com

Unlocking the Secrets of Options Trading Success

Mastering options trading requires a harmonious blend of technical acumen and strategic prowess. Embrace the power of technical indicators as your trusted allies, guiding you through the complexities of the market. With dedication and perseverance, you can unlock the secrets of options trading and reap the rewards that lie within.

Indicators To Use For Option Trading

Frequently Asked Questions

Q: Are technical indicators a foolproof way to predict market movements?

A: While technical indicators provide valuable insights, they should not be considered infallible. The market remains unpredictable, and traders must exercise caution and employ sound risk management strategies.

Q: Can I rely solely on technical indicators for options trading?

A: Technical indicators form an integral part of an options trader’s toolkit, but they should be complemented by fundamental analysis, market news, and a deep understanding of the underlying asset.

Q: How frequently should I adjust my trading strategy based on indicator signals?

A: The frequency of strategy adjustments depends on the timeframe and trading style employed. Some traders make adjustments daily, while others adopt a longer-term approach.

Q: Which technical indicators are considered the most reliable?

A: The reliability of technical indicators varies based on market conditions and personal preferences. Moving averages, RSI, and Bollinger Bands are widely used due to their effectiveness and adaptability.

Q: How do I interpret conflicting signals from multiple indicators?

A: In cases of conflicting signals, consider the timeframe, market conditions, and overall trend to determine the most likely scenario. It may also be prudent to consult additional indicators or seek expert advice.