In the dynamic world of option trading, where opportunities and risks intertwine, it becomes imperative to navigate the intricate market landscape with precision. Embracing the power of indicators can be a game-changer, providing invaluable insights into market behavior and empowering traders with a competitive edge. This comprehensive guide delves deep into the realm of indicators, exploring their history, principles, and practical applications in the context of option trading. Join us as we decipher the intricacies of these market barometers and unlock their transformative potential for your trading endeavors.

Image: centerpointsecurities.com

Option trading, a sophisticated financial instrument that grants traders the right but not the obligation to buy or sell an underlying asset at a predetermined price within a specific time frame, demands a multifaceted understanding of market dynamics. Indicators, mathematical tools that analyze price movements and market trends, serve as indispensable aids in this endeavor. But their significance extends far beyond mere quantitative analysis; indicators empower traders to predict price fluctuations, identify profitable trading opportunities, and manage risk effectively. Mastering the art of utilizing indicators can transform you from a novice trader into a market-savvy decision-maker.

Technical vs. Fundamental Indicators: Unveiling the Divide

The landscape of indicators is vast and diverse, each with its inherent strengths and applications. To navigate this vast terrain, it’s essential to grasp the fundamental distinction between technical and fundamental indicators. Technical indicators, the more prevalent type in option trading, draw their data directly from price movements and trading volume. They provide a window into market sentiment and price behavior, enabling traders to discern patterns, identify trends, and predict future price movements. Fundamental indicators, on the other hand, delve into the underlying fundamentals of an asset, analyzing factors such as earnings, economic data, and industry trends. While fundamental indicators offer valuable insights into the intrinsic value of an asset, they play a secondary role in option trading compared to technical indicators.

Trend Indicators: Mapping the Market’s Pulsating Rhythm

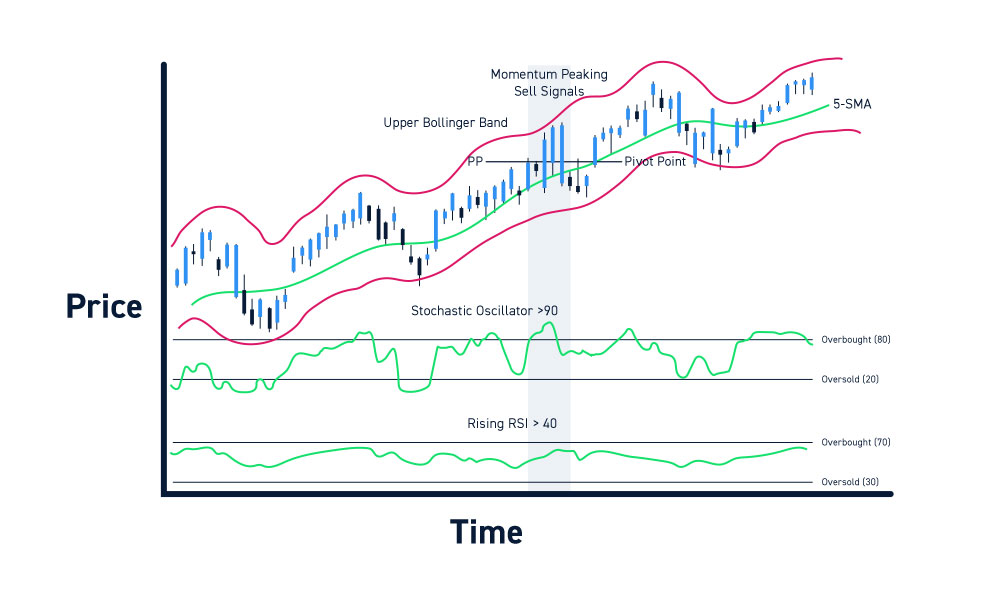

Trend indicators play a pivotal role in option trading, providing indispensable insights into the prevailing market direction. By identifying trends and determining their strength, traders can align their strategies accordingly, increasing their chances of success. Prominent trend indicators include moving averages, which smooth out price data and reveal the underlying trend, and trendlines, which connect a series of price highs or lows to establish a visual representation of the trend.

Momentum Indicators: Gauging the Market’s Internal Energy

Harnessing the power of momentum indicators empowers traders to measure the strength and persistence of price movements. These indicators help determine whether a trend is likely to continue or reverse, providing invaluable insights into market momentum. The Relative Strength Index (RSI) and the Stochastic Oscillator are widely used momentum indicators that help gauge overbought or oversold conditions.

:max_bytes(150000):strip_icc()/dotdash_final_The_Most_Important_Technical_Indicators_For_Binary_Options_Dec_2020-01-c9d67ed0703c4661932ce96fcfa0573b.jpg)

Image: www.investopedia.com

Volatility Indicators: Quantifying the Market’s Restless Heart

Volatility, the measure of price fluctuations, is a crucial factor in option trading. Volatility indicators, such as the Bollinger Bands and the Average True Range (ATR), help traders assess market volatility and forecast future price movements. Understanding volatility is essential for managing risk and determining the appropriate option strategies.

Indicators In Option Trading

https://youtube.com/watch?v=5deIwWtxAuQ

Confirmation Indicators: Seeking Harmony in Market Signals

In the realm of option trading, confirmation indicators play a crucial role in corroborating signals from other indicators, enhancing the reliability of trading decisions. Confirmation indicators, such as the MACD (Moving Average Convergence Divergence) and the Ichimoku Cloud, provide additional confirmation of trends, momentum, and support or resistance levels.

Conclusion

Incorporating indicators into your option trading strategy can be transformative, empowering you with a deeper understanding of market behavior and a competitive edge in identifying lucrative trading opportunities. By mastering the art of utilizing technical indicators effectively, you can navigate market dynamics with greater confidence, make informed decisions, and unlock new avenues for trading success. Remember, the judicious use of indicators can elevate your trading endeavors to new heights, enabling you to harness the full potential of the option market.