<h1>Options Trading Limit Price: A Beginner's Guide to Key Concepts and Benefits</h1>

<p>In the realm of options trading, one of the crucial concepts traders must grasp is the limit price. A limit price enables traders to specify the maximum or minimum price they are willing to execute a trade, providing them with more control over their positions.</p>

<p>This article aims to provide a comprehensive overview of options trading limit prices, covering their significance, how they work, and their advantages for traders.</p>

<h2>Understanding Limit Orders</h2>

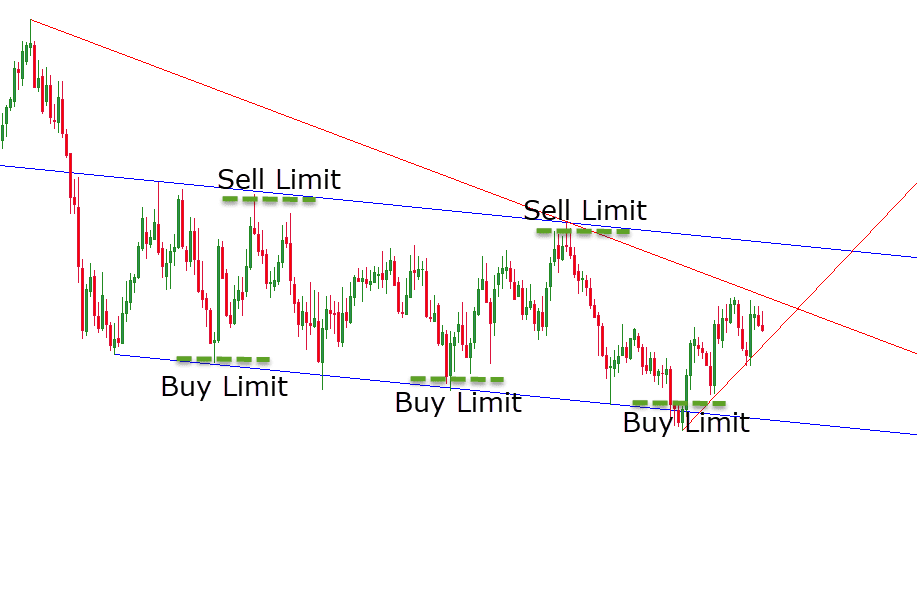

<p>A limit order is an order to buy or sell an option at a specific price or better. When placing a limit order, traders can specify a limit price that represents the maximum they are willing to pay for a call option or the minimum they are willing to receive for a put option. By setting a limit price, traders ensure that their orders are executed only when the market price reaches or exceeds their specified price, thereby controlling the potential risks and rewards involved in the trade.</p>

<h2>Benefits of Limit Prices</h2>

<p>Limit prices offer several key benefits to options traders:</p>

<ul>

<li><strong>Precise Order Execution:</strong> Limit prices allow traders to execute trades at their desired prices, reducing the risk of unintentionally executing trades at unfavorable market prices.</li>

<li><strong>Risk Management:</strong> By setting a limit price, traders can control the maximum potential loss or minimize the profit on an option trade, limiting their exposure to adverse price movements.</li>

<li><strong>Efficient Trading:</strong> Limit prices enable traders to place orders and walk away, knowing that their orders will be executed only when the market conditions are met, allowing them to focus on other market activities while their orders are pending.</li>

<li><strong>Advanced Trading Strategies:</strong> Limit prices are essential for more advanced trading strategies, such as bracket orders (combining a limit order with a stop order) and one-cancels-the-other (OCO) orders.</li>

</ul>

<h3>Tips for Effective Limit Price Trading</h3>

<p>To maximize the effectiveness of limit price trading, consider the following tips:</p>

<ol>

<li><strong>Research the underlying asset:</strong> Before placing a limit order, thoroughly research the underlying asset, considering its price history, volatility, and market trends.</li>

<li><strong>Set realistic prices:</strong> Limit prices should be set at levels that are likely to be met while considering the current market conditions and the potential for price movement.</li>

<li><strong>Time your orders carefully:</strong> The timing of your limit order can impact its execution. Consider placing orders during market hours when trading volume is higher.</li>

<li><strong>Monitor your orders:</strong> Regularly monitor your open orders to adjust or cancel them if necessary, ensuring that your trading goals are still aligned with market conditions.</li>

</ol>

<h2>FAQs on Options Trading Limit Prices</h2>

<ul>

<li><strong>Q: What is the difference between a market order and a limit order?</strong></li>

<li><strong>A:</strong> A market order is an order to buy or sell an option at the current market price, while a limit order is an order to buy or sell an option at a specific price.</li>

<li><strong>Q: Can I change or cancel a limit order once it has been placed?</strong></li>

<li><strong>A:</strong> Yes, limit orders can be changed or canceled before they are executed. However, if the order has already been executed, it cannot be changed or canceled.</li>

<li><strong>Q: How do I determine the appropriate limit price?</strong></li>

<li><strong>A:</strong> Determining the appropriate limit price requires research and consideration of the underlying asset's historical prices, volatility, and other market factors.</li>

<li><strong>Q: Are there risks associated with using limit orders?</strong></li>

<li><strong>A:</strong> Limit orders can be effective, but they also have potential risks such as price slippage, which occurs when the market price moves quickly and the order is not executed at the specified price.</li>

</ul>

<h2>Conclusion</h2>

<p>Understanding options trading limit prices is essential for traders looking to execute orders effectively and manage risk. By setting a limit price, traders gain control over the execution of their trades, ensuring that their orders are executed only at their desired prices or better. Effective utilization of limit prices can enhance trading strategies, improve risk management, and optimize trading outcomes. Remember to conduct thorough research, set realistic prices, and regularly monitor your orders to maximize the benefits of limit price trading.</p>

<p>Are you interested in further exploring the world of options trading limit prices? Share your questions and experiences in the comments below, and let's delve deeper together.</p>

Image: www.angelone.in

Image: tradeciety.com

Options Trading Limit Price

Image: www.asktraders.com