As an avid options trader, I’ve witnessed firsthand the rollercoaster of wins and losses inherent to this high-stakes game, which is a game most new beginners looking to play.

It is important to set realistic goals, conduct extensive research, and employ sound risk management principles.

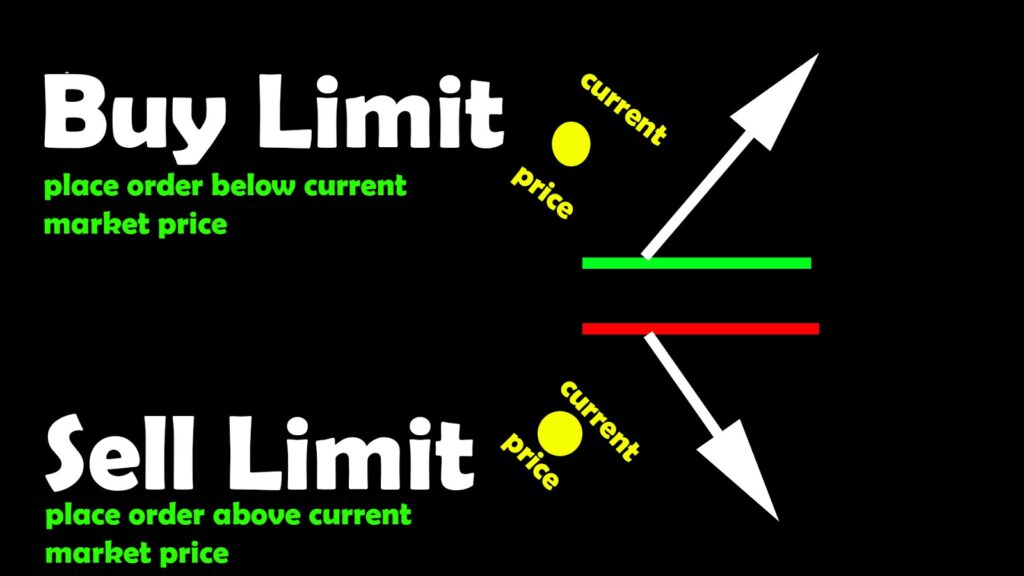

One such strategy that can mitigate risks is “limit price options trading.” Let’s delve into the intricacies of limit price options trading to help you navigate this market with greater confidence.

Image: bestpricedvdplaybd.blogspot.com

Introducing Limit Price Options Trading

Limit price options trading allows traders to execute buy or sell orders at a predetermined price. This differs from market orders, which are executed immediately at the prevailing market price. When placing a limit order, the trader specifies the maximum price they are willing to pay for a buy order or the minimum price they are willing to accept for a sell order. The order will only be executed if the market price reaches or exceeds the specified limit price.

Benefits of Limit Price Options Trading

Utilizing limit price options trading offers several advantages, including:

- Precise Execution: Limit orders ensure that traders execute trades at the desired price or better.

- Minimized Market Impact: Limit orders can help reduce the impact of large orders on market prices, especially during periods of high volatility.

- Slippage Protection: This trading strategy can prevent slippage, which occurs when the execution price differs from the intended price due to rapid market movements.

- Risk Management: Limit orders offer more control over risk, as traders can specify the maximum or minimum price they are willing to accept.

Understanding Order Types

When placing limit orders, traders must specify the order type, which determines the order’s behavior in the market. Common order types used in limit price options trading include:

- Limit Order: The most basic order type that executes at the specified limit price or better.

- Stop Limit Order: A combination of a stop order and a limit order. The order is initially placed as a stop order, which is triggered when the underlying asset reaches a specified trigger price. Once triggered, the order is executed as a limit order at the specified limit price.

- Trailing Stop Limit Order: An advanced order type that trails the market price by a specified amount. The order is modified as the market price moves, ensuring that the trailing stop price remains a certain distance away from the current market price. This order type is often used to protect profits or minimize losses.

Image: tradingxplained.com

Expert Tips for Limit Price Options Trading

To maximize the effectiveness of limit price options trading, consider the following expert advice:

- Choose Liquid Options: Trade options with high liquidity to ensure that your orders will be executed quickly and efficiently.

- Place Orders During Off-Market Hours: Submit limit orders outside regular trading hours to increase the chance of execution at your desired price.

- Monitor Market Conditions: Keep an eye on market volatility and order flow to adjust your limit prices accordingly.

- Use GTC Orders: Place “Good Till Canceled” (GTC) orders to keep your orders active until they are executed or canceled.

- Set Realistic Limit Prices: Avoid setting limit prices that are too far away from the current market price, as this may result in your order not being executed.

FAQ on Limit Price Options Trading

Before engaging in limit price options trading, ensure you have a clear understanding of the following:

- Q: What is the difference between a limit order and a market order?

- A: A limit order is executed at a specified price or better, while a market order is executed immediately at the prevailing market price.

- Q: What is the benefit of using a stop limit order?

- A: A stop limit order combines the features of a stop order and a limit order, providing greater control over the execution price and risk management.

- Q: Why is order liquidity important?

- A: High order liquidity ensures that your limit orders will be executed quickly and efficiently, reducing the risk of slippage.

- Q: How often should I review my limit orders?

- A: Regularly monitor market conditions and adjust your limit prices as necessary to maximize execution efficiency.

Limit Price Options Trading

Image: www.parkingpips.com

Conclusion

Limit price options trading is a valuable tool for options traders seeking greater precision, risk management, and control over their trades. By understanding the concepts, order types, and expert advice discussed in this article, you can refine your options trading strategy and take your trading to the next level.

Are you interested in diving deeper into the world of limit price options trading? Share your questions and insights in the comments section below.