Introduction

Options trading can be a lucrative venture, offering significant potential returns. However, volatility and uncertainty can often lead to missed opportunities or unfavorable execution prices. Limit orders, powerful tools in the options trading arsenal, provide traders with greater control over their trades, ensuring precise order fulfillment. This comprehensive guide will delve into the intricacies of using limit orders for options trading, empowering you to navigate market dynamics and maximize profit potential.

What are Limit Orders?

A limit order is an instruction to buy or sell an option at a specific price or better. Unlike market orders, which are executed immediately at the prevailing market price, limit orders only execute if the market price reaches or exceeds the specified limit price. This mechanism provides traders with the ability to set predetermined entry and exit points, ensuring that trades are executed at desired price levels.

Types of Limit Orders

There are two primary types of limit orders: buy limit and sell limit. A buy limit order is used to purchase an option when its price drops to or below the specified limit price. Conversely, a sell limit order is placed to sell an option when its price rises to or above the limit price.

Benefits of Using Limit Orders

Limit orders offer several advantages for options traders:

- Price Control: Limit orders allow traders to specify the exact price at which they want to execute their trades, providing granular control over order execution.

- Favorable Entry and Exit Points: By setting appropriate limit prices, traders can target specific market conditions to enter or exit positions at optimal levels.

- Risk Mitigation: Limit orders can mitigate the risk of unexpected or adverse price movements, preventing trades from executing at undesirable prices.

- Increased Precision: Limit orders provide a high level of precision in order execution, ensuring that trades are executed as close as possible to the specified price levels.

Using Limit Orders Effectively

To effectively use limit orders for options trading, consider the following tips:

- Understand Market Conditions: Determine the market trend, volatility, and liquidity before placing limit orders.

- Set Realistic Limit Prices: Analyze historic price data and potential price fluctuations to set limit prices that align with market expectations.

- Consider the Time Limit: Specify a time period for the limit order to remain active, preventing extended exposure to changing market conditions.

- Monitor Trades: Actively monitor open limit orders to adjust or cancel them based on changing market conditions.

Examples of Limit Order Applications

Let’s explore a few examples of how limit orders can be used in practice:

- Buying a Put Option: A trader may place a buy limit order for a put option with the limit price set slightly below the current market price. This order will only execute if the option price falls to or below the specified limit price.

- Selling a Call Option: Suppose an investor holds a call option that is in-the-money. They can place a sell limit order with a limit price slightly above the prevailing market price. The order will execute if the option’s price rises to or surpasses the specified limit price, securing a profit for the investor.

- Protecting a Position: An options trader with an open position may use a limit order to limit potential losses. Placing a sell limit order for the underlying asset at a pre-determined price can automatically close the position if prices fall beyond a certain threshold.

Special Considerations

While limit orders provide significant benefits, traders need to be aware of potential limitations:

- Order Execution Risk: Limit orders may not always execute, especially in highly volatile or illiquid markets.

- Time Decay: Option premiums decay over time, which can reduce the potential value of unexecuted limit orders.

- Opportunity Costs: Traders may miss favorable market opportunities if limit orders are not set strategically.

Conclusion

Limit orders are indispensable tools for options traders seeking precise order execution and controlled risk management. By understanding the concepts, benefits, and effective use of limit orders, traders can unlock the potential of this powerful strategy. Remember to conduct thorough research,

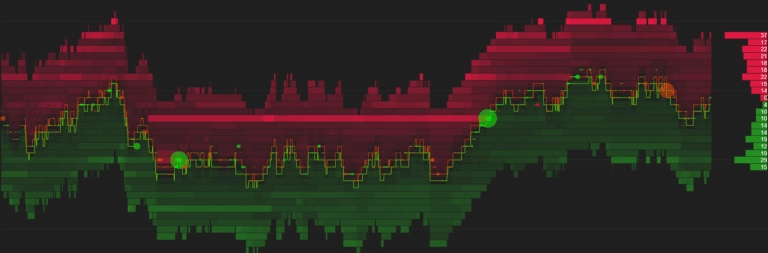

Image: www.tradingorderflow.com

Image: www.youtube.com

Using Limit Orders For Trading Options

Image: tradingonramp.com