Options trading can be a powerful tool for investors, but it’s crucial to understand the mechanics of this complex market. One fundamental concept that every options trader should grasp is the limit price, a critical element in executing effective trades.

Image: www.parkingpips.com

What is a Limit Price in Options Trading?

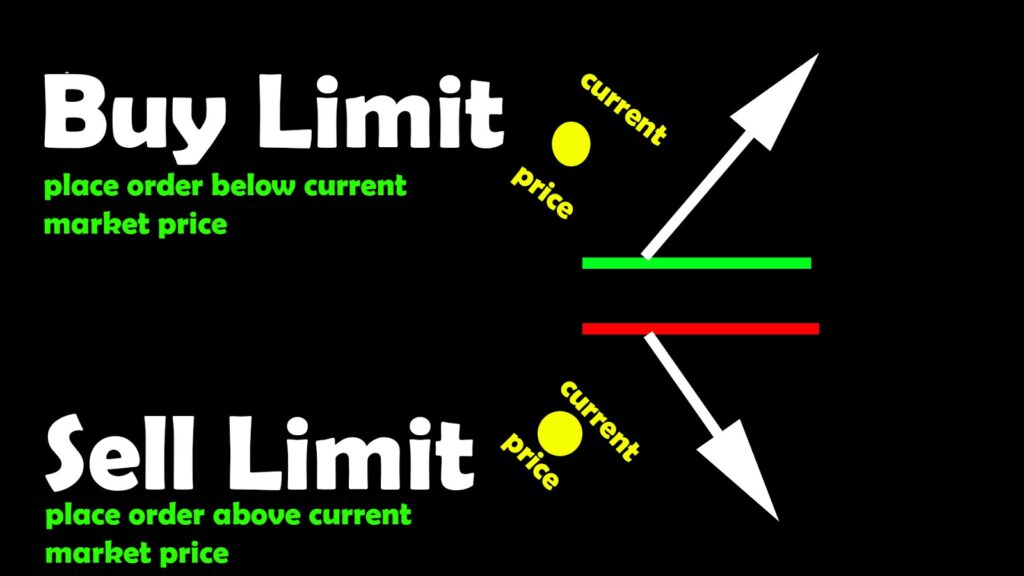

A limit price is the highest (for buyer/call options) or lowest (for seller/put options) price you’re willing to pay or receive for an options contract. By setting a limit price, you specify the parameters of your order, ensuring that the trade is executed only when the market reaches your desired conditions.

Types of Limit Orders

There are two primary types of limit orders:

-

Buy Limit Order: For buyers, a buy limit order specifies the maximum price they’re willing to pay for an options contract. The trade is executed only if the ask price (for a call option) or bid price (for a put option) touches or falls below the limit price.

-

Sell Limit Order: For sellers, a sell limit order sets the minimum price they’re willing to receive for an options contract. The trade is executed only if the bid price (for a call option) or ask price (for a put option) reaches or exceeds the limit price.

Importance of Limit Price

Setting limit prices is essential in options trading for several reasons:

-

Control Execution: Limit prices give you control over the price at which your trades are executed, preventing unintended execution at unfavorable prices.

-

Protect from Market Volatility: In fast-moving markets, limit prices can protect you from sharp price fluctuations, ensuring that you don’t overpay or receive an unsatisfying price for your options contracts.

-

Maximize Profits: By setting limit prices strategically, you can potentially optimize your profits by capturing favorable market conditions, which can be especially valuable in illiquid markets.

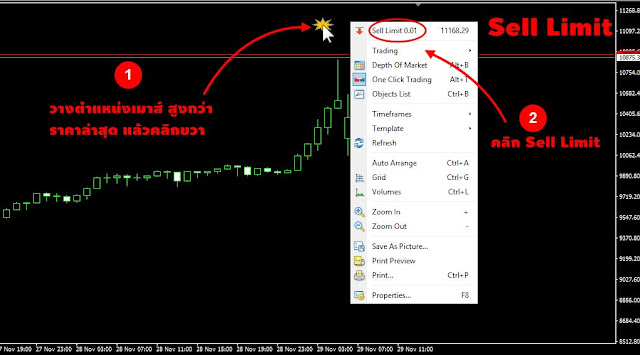

Image: exnessforexinthai.blogspot.com

How to Set Limit Prices

Determining effective limit prices requires careful consideration of several factors:

-

Market Trend: Analyze the current market trend to decide whether to set your limit price above resistance levels (for buy orders) or below support levels (for sell orders).

-

Volatility: Higher market volatility means wider price swings, which may necessitate setting tighter limit prices to avoid unfavorable executions.

-

Order Size: Larger orders may require wider limit prices to increase the chances of execution, while smaller orders can have tighter limits.

Expert Insights on Limit Price

“Limit prices are an essential tool for managing risk and refining options trading strategies,” advises Dr. Johnathan Marks, a renowned options expert. “By setting clear price boundaries, traders can prevent emotional decision-making and maximize their chances of successful trades.”

Mark Noble, a seasoned options trader, emphasizes the importance of flexibility: “Limit prices should not be rigid constraints. Regularly monitor market conditions and adjust your limits as needed to optimize trading outcomes.”

Actionable Tips

-

Use limit orders in conjunction with technical analysis to identify optimal price levels for execution.

-

Avoid setting limit prices too close to the current market price, as this may lead to premature execution or failure to execute at all.

-

Practice using limit prices in a simulated trading environment before implementing them in real trading accounts.

Limit Price In Options Trading

Image: pantip.com

Conclusion

Limit price in options trading is a crucial concept that enables traders to execute orders with precision and manage risk. By understanding the types of limit orders, their importance, and how to set them, traders can enhance their control over their trades and improve their potential for successful outcomes in the dynamic options market. Remember, limit prices are a powerful tool, and when used wisely, they can empower options traders to navigate market volatility and achieve their trading goals.