Options Trading: Unveiling the World of Possibilities

For seasoned traders and aspiring investors, TD Ameritrade offers a robust platform for exploring the dynamic landscape of options trading. However, navigating the intricate world of options can be daunting, especially when factoring in the associated fees. In this comprehensive guide, we will delve into the fee structure of TD Ameritrade’s option trading services, providing clarity and equipping you with the knowledge to make informed decisions.

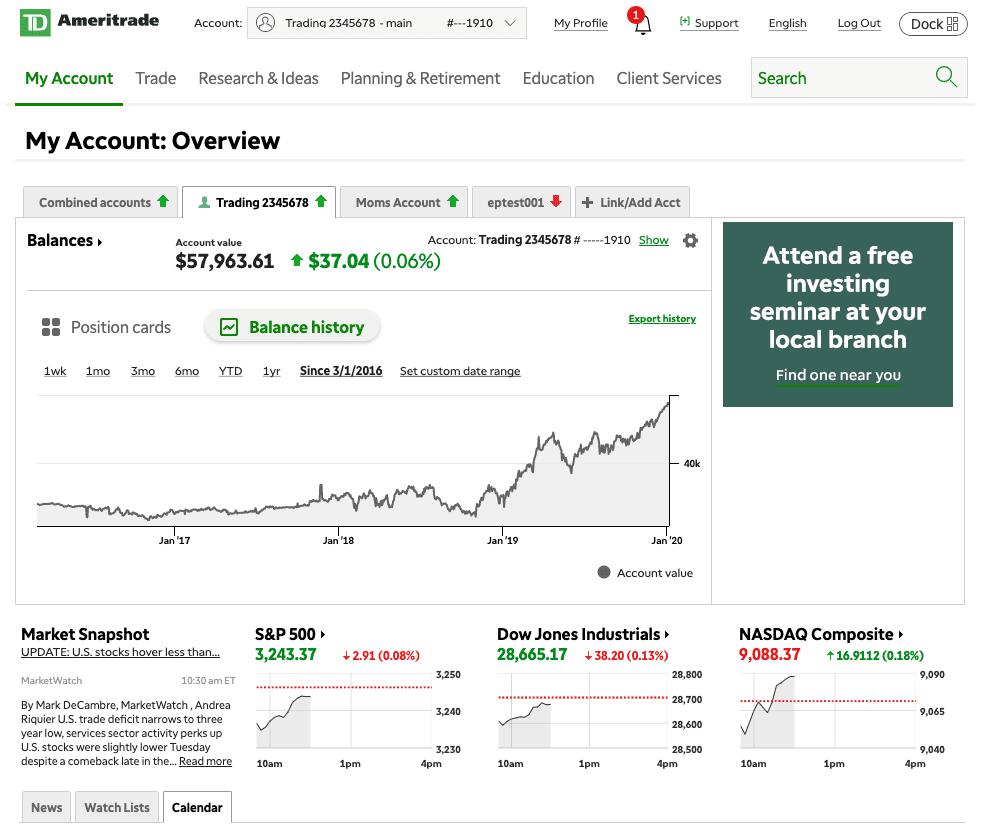

Image: forextradeon.com

Fee Structure: Deciphering the Options

TD Ameritrade’s option trading fees are structured to cover the costs of execution, clearing, and regulatory fees. The base fee for an option trade is a flat $0.65 per contract, regardless of the number of contracts traded. However, the fee structure becomes more nuanced when considering additional factors, such as the option’s type, expiration date, and trading volume.

For standard listed options, which are the most common type traded, the per-contract fee remains at $0.65. Extended-hours trading, which allows for option orders to be placed outside of regular market hours, incurs an additional $0.10 per contract. Non-standard options, such as personalized options or large notional value orders, may attract higher fees based on their complexity and execution requirements.

The Impact of Expiration Date and Volume

The expiration date of an option also influences the fee structure. Options expiring within one day or less, known as “short-term” options, incur an additional $0.10 per contract fee. For options expiring longer than one day, the base fee of $0.65 is retained.

Additionally, high trading volume can result in reduced fees. TD Ameritrade offers volume-based discounts for active traders. When trading 25 or more contracts per month, the per-contract fee is reduced by $0.15, resulting in a lowered fee of $0.50. This tiered pricing rewards high-volume traders and makes TD Ameritrade a competitive choice for those engaging in frequent option transactions.

Industry Insights and Expert Perspectives

To gain a comprehensive understanding of the latest trends and developments in TD Ameritrade’s option trading fees, we turned to industry experts and sought insights from reputable news sources, forums, and social media platforms.

Analysts observe a growing preference for commission-free trading, which has led to intensified competition among online brokerages. TD Ameritrade’s fee structure remains competitive within the industry, especially for high-volume traders who can capitalize on the volume-based discounts. However, it’s worth noting that some newer brokerages have emerged, offering even lower or no-fee options trading.

Image: forexhero.info

Tips and Advice for Informed Decisions

Drawing upon our insights and the perspectives of experienced traders, we present the following tips to help you navigate the TD Ameritrade option trading fee landscape:

Consider your trading volume: If you plan to trade significant volumes of options regularly, TD Ameritrade’s volume discounts can offer substantial savings. Evaluate your activity level to determine if you qualify for reduced fees.

Factor in the expiration date: Short-term options carry an additional fee, so be mindful of this when selecting the expiration date for your trades. If time permits, consider trading options with longer expiration dates to avoid the additional charge.

FAQs on TD Ameritrade Option Trading Fees

To address commonly asked questions, we have compiled this FAQ section:

Q: Is there a minimum account balance required to trade options with TD Ameritrade?

A: No, there is no minimum account balance requirement for options trading at TD Ameritrade.

Q: Does TD Ameritrade offer paper trading for practicing options trading?

A: Yes, TD Ameritrade provides a paper trading platform called Thinkorswim PaperMoney, which allows you to simulate trading without risking real capital.

Q: Are there additional fees for non-standard options trades?

A: Yes, non-standard options trades, such as personalized options or large notional value orders, may incur higher fees. Contact TD Ameritrade for a specific quote based on your trade requirements.

Td Ameritrade Option Trading Fees

Conclusion: Empowering Informed Options Trading

TD Ameritrade’s option trading fees are structured to cover the costs of execution, clearing, and regulatory requirements. By understanding the fee structure, including the impact of option type, expiration date, and trading volume, you can make informed decisions that optimize your trading strategy. Whether you’re a seasoned trader or just starting your options trading journey, TD Ameritrade provides a competitive platform with a range of fees to suit different trading needs.

We encourage you to explore the resources and information presented in this article to gain a comprehensive understanding of TD Ameritrade’s option trading fees. Whether you’re interested in refining your current trading practices or venturing into the world of options trading, this guide provides a solid foundation to assist you on your financial journey.