Every now and then, a groundbreaking discovery revolutionizes the world of finance. One such game-changer in the realm of trading is the concept of options. Among the diverse types of options, put and call options stand out as essential tools for risk management and profit generation. Yet, their intricacies can often leave investors scratching their heads. In this article, we’ll embark on a comprehensive journey to decode the enigma of put and call options, empowering you to leverage their power in your trading endeavors.

Image: www.tradethetechnicals.com

Navigating the World of Put and Call Options: A Historical Perspective

Options have a rich history, dating back to the 19th century when they emerged as a tool to mitigate risk in agricultural commodity trading. The Chicago Board of Trade standardized options contracts in the 1970s, paving the way for the burgeoning options market we know today. Since then, options have proliferated across various asset classes, including stocks, indices, currencies, and commodities, serving a crucial role in modern-day financial markets.

Understanding Put and Call Options: A Practical Perspective

At their core, put and call options are derivative contracts that grant the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specified date (expiration date). By exercising the option, the holder can lock in a profit or mitigate potential losses. For this right, the option buyer pays a premium to the option seller.

Demystifying the Mechanics of Call Options

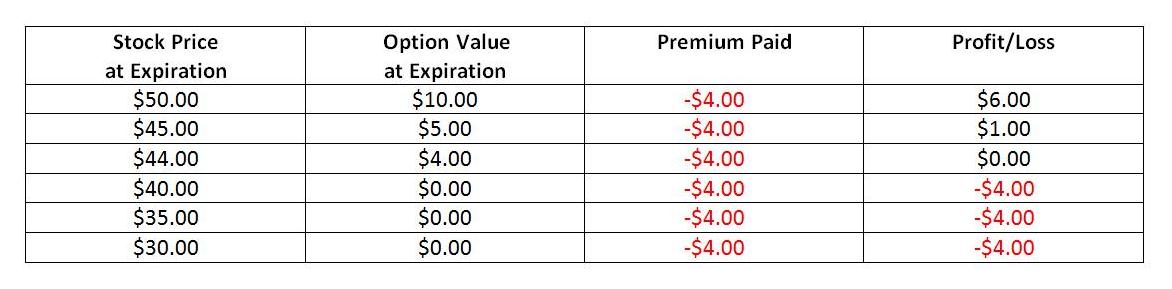

Call options are akin to having a contractual right to buy an underlying asset at a predetermined strike price. When the market price of the asset surpasses the strike price, the call option becomes valuable, as the holder can exercise it to purchase the asset at a lower price than the prevailing market value. The profit potential of a call option is limitless, albeit capped by the underlying asset’s potential price appreciation.

Image: www.onlinefinancialmarkets.com

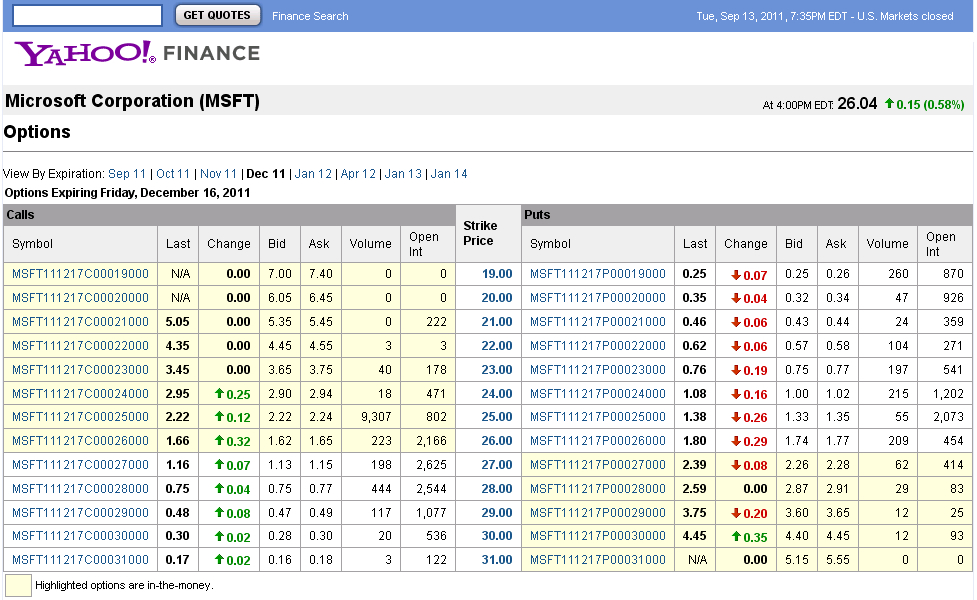

Delving into the Dynamics of Put Options

Put options, on the other hand, empower holders with the right to sell an underlying asset at a predetermined strike price. They become lucrative when the market price of the asset falls below the strike price, enabling the holder to sell the asset at a higher price than the prevailing market value. Put options offer investors a safety net against potential losses or a means to profit from declining asset prices.

Unveiling the Strategies Behind Option Trading

Options trading can encompass a wide array of strategies, each tailored to specific market scenarios and risk appetites. From basic strategies like buying and selling individual options to more complex multi-leg strategies, the possibilities are vast. By carefully considering market conditions, risk tolerance, and profit objectives, investors can craft options strategies that align with their overall investment goals.

Seeking Expert Insights into Option Trading

Navigating the intricacies of option trading can be a daunting task, but guidance from seasoned experts can illuminate the path. Warren Buffett, a legendary investor, famously espoused the virtues of options as a means to hedge against risk and enhance returns. Other notable figures, such as George Soros and Nassim Taleb, have shared their perspectives on the strategic use of options to capitalize on market fluctuations.

Empowering Investors: A Call to Action

Understanding put and call options empowers investors to actively manage their risk exposure while pursuing profit opportunities. By equipping themselves with knowledge and adopting a disciplined approach, investors can harness the power of options to enhance their overall investment strategies. The financial markets are an ever-evolving landscape, and options provide a versatile tool to navigate its complexities.

How To Understand Trading Put And Call Options

Image: www.binarytradingforbeginners.com

Conclusion: Unlocking the Potential of Option Trading

Put and call options are essential components of modern-day financial markets, offering investors the flexibility to manage risk and potentially generate substantial returns. By demystifying their mechanisms and providing practical insights, this article aims to empower readers with the knowledge and confidence to incorporate options into their investment strategies. Remember, informed decision-making is paramount in the world of finance, and thorough research and understanding are key to unlocking the full potential of put and call options.