Introduction

In the ever-evolving landscape of financial markets, digital options trading has emerged as a transformative tool for investors seeking advanced trading strategies and enhanced profit potential. This guide will delve into the intricacies of digital options, exploring their history, key concepts, and practical applications.

Image: blog.iqoption.com

Digital options, also known as binary options, are a type of financial derivative that offers a unique approach to trading by providing investors with a fixed payout or loss upon a binary outcome. Unlike traditional options, which grant the buyer the right but not the obligation to buy or sell an underlying asset at a specified price, digital options pay out a predetermined return based solely on whether the underlying asset’s price reaches or exceeds a predetermined strike price at expiration.

Real-World Applications of Digital Options Trading

The versatility of digital options makes them applicable in various trading scenarios. Traders may employ digital options to:

- Speculate on asset price movements: Digital options provide investors with a straightforward way to speculate on future market movements without the complexities of traditional options. By predicting whether an asset’s price will rise or fall within a specific timeframe, investors can potentially generate substantial returns.

- Hedge against risk: Digital options can be used as a hedging strategy to protect against potential losses in existing investment portfolios. By selecting the appropriate strike price and expiration date, investors can create a structured hedge that limits downside exposure.

- Generate income through premia: Digital options trading also offers opportunities for income generation. By selling premium, investors can profit from the time decay of options contracts, which provides a structured stream of returns regardless of the underlying asset’s price movement.

The Mechanics of Digital Options

Digital options consist of four key components:

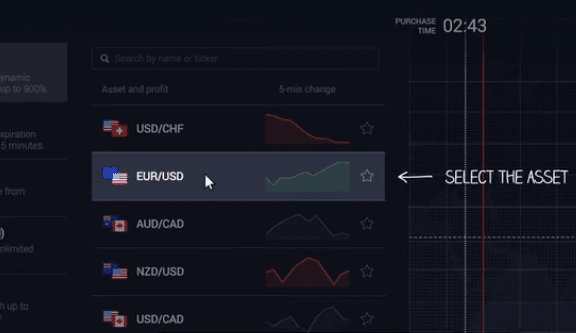

- Underlying Asset: The asset whose price performance determines the outcome of the option, such as stocks, commodities, or currencies.

- Strike Price: The specified price level that the underlying asset must reach or exceed to trigger a predefined payout.

- Expiration Date: The date and time on which the option contract expires, and the payout is determined.

- Payout Structure: The fixed amount or percentage that investors receive if the option expires in their favor.

Advantages and Risks of Digital Options Trading

Digital options offer several advantages for investors:

- Limited risk exposure: Unlike traditional equity investments, which can fluctuate widely in value, digital options limit potential losses to the premium paid, providing investors with defined risk parameters.

- Potential for high returns: Digital options offer the opportunity for high returns on investment due to their fixed payout structure.

- Simplicity and flexibility: Trading digital options is relatively straightforward compared to other options strategies, and investors have flexibility in customizing the terms of their contracts based on their risk tolerance and investment goals.

However, it is crucial to be aware of the risks associated with digital options trading:

- Binary outcome: The binary nature of digital options means that investors either receive the full payout or lose their investment, leaving no room for partial gains or losses.

- Time decay: The value of digital options decreases as the expiration date approaches, which can result in losses if the option fails to expire profitably.

- Regulatory oversight: Digital options trading is not regulated in all jurisdictions, leaving investors vulnerable to fraudulent or unethical practices.

Image: blog.iqoption.com

Digital Options Trading Pdf

Image: iq-study.com

Strategies and Considerations for Digital Options Trading

To maximize the potential for profitable digital options trading, investors should employ careful strategy and risk management techniques:

- Select Assets with Volatility: Digital options perform best with underlying assets that exhibit significant price fluctuations, as this enhances the probability of reaching the strike price within the expiration period.

- Choose Strike Prices with Care: The selection of an appropriate strike price is crucial to achieve a favorable outcome. Investors should consider technical analysis, market conditions, and the expected price movement of the underlying asset.

- Manage Risk with Time Horizons: The time decay of digital options makes careful consideration of expiration dates essential. Short-term options may provide high returns but carry increased risk, while longer-term options have lower premiums but may suffer from reduced profit potential.

- **Use Dem