Introduction

Have you ever wondered how to make a quick buck in the financial markets? Day trading options may be the answer you’ve been looking for. It’s a thrilling and fast-paced game that can yield substantial profits—but also significant losses. In this guide, we’ll delve into the world of day trading options, explaining everything you need to know to get started. From the basics to advanced strategies, we’ve got you covered.

Image: www.walmart.com

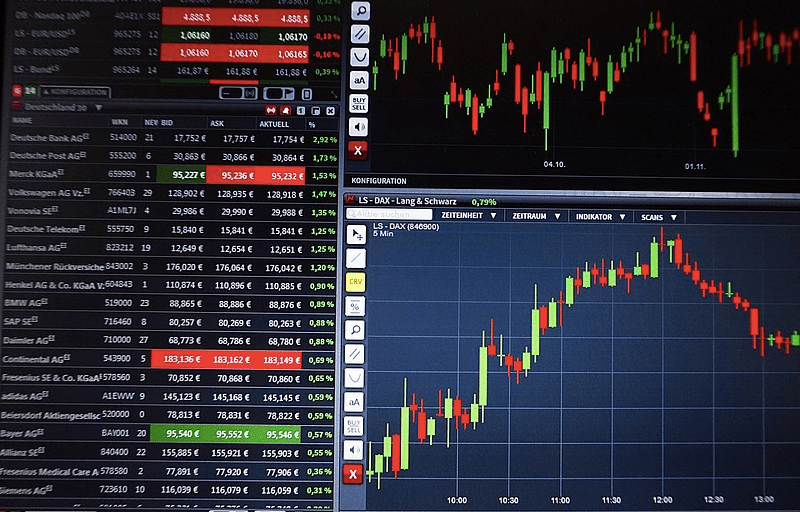

What is Day Trading Options?

Day trading options is a strategy that involves buying and selling options contracts within the same trading day. Unlike stocks, which represent ownership in a company, options contracts give traders the right to buy or sell an underlying asset at a specific price on a particular date. Day traders exploit the volatility of options prices to profit from short-term price fluctuations.

How Do Options Work?

An option contract terdiri of two components: the premium and the strike price. The premium is the price you pay to purchase the contract, and the strike price is the price at which you can buy or sell the underlying asset. There are two main types of options: calls and puts. A call option gives you the right to buy the asset, while a put option gives you the right to sell it.

Getting Started with Day Trading Options

Diving into day trading options requires preparation. Here are a few essential steps to get you started:

-

Image: www.youtube.comEducate Yourself:

Master the basics of options trading through books, online courses, or webinars. Understanding the intricacies of options markets is crucial for success.

-

Choose a Broker:

Select a reputable broker who offers low commissions and a user-friendly trading platform tailored to options traders.

-

Open an Account:

Create a trading account and fund it with sufficient capital. Remember that day trading options can involve significant risks, so only invest what you’re prepared to lose.

-

Develop a Strategy:

Finalize a trading strategy that outlines your entry and exit points, risk management parameters, and profit targets. Stick to your strategy during market fluctuations.

Day Trading Strategies for Beginners

Here are a few popular day trading strategies to consider:

-

Scalping:

Scalping involves holding positions for mere seconds or minutes to capitalize on small price movements.

-

Range Trading:

Range trading seeks to identify and trade within a specific price range based on support and resistance levels.

-

Breakout Trading:

Breakout trading involves trading on the breakout of a trend or consolidation pattern.

-

News Trading:

News trading involves monitoring market news and trading on price reactions to important economic or political events.

Expert Insights and Actionable Tips

To enhance your day trading prowess, listen to the advice of experienced traders:

-

Manage Risk Effectively:

Determine your risk tolerance and manage your positions diligently to avoid substantial losses.

-

Start Small:

Begin with small trades until you gain confidence and experience.

-

Use Technical Analysis:

Technical analysis involves studying price charts and patterns to predict future price movements.

-

Stay Updated on Market News:

Keep yourself informed of current events and economic indicators that can impact market sentiment.

-

Practice with Virtual Trading:

Gain experience and test your strategies without risking real capital through virtual trading platforms.

Learn About Day Trading Options

Image: www.daytrading.com

Conclusion

Day trading options is an exciting yet demanding endeavor. By embracing the right knowledge, skills, and strategies, you can potentially make a lucrative living from the financial markets. Remember to proceed with caution, manage risks effectively, and stay dedicated to continuous learning. The journey to becoming a successful day trader is not without its challenges, but the rewards can be substantial for those who persevere. Embrace the thrill of the chase, but always prioritize financial prudence and a deep understanding of the dynamic world of options trading.