Introduction

Image: optionstrat.com

Are you a novice in the world of options trading, eager to navigate its complexities and unlock its potential? Look no further! This in-depth guide will shed light on the essential tool – the option trading calculator in Excel – unraveling its capabilities and empowering you to make informed decisions.

Understanding Option Trading Calculators

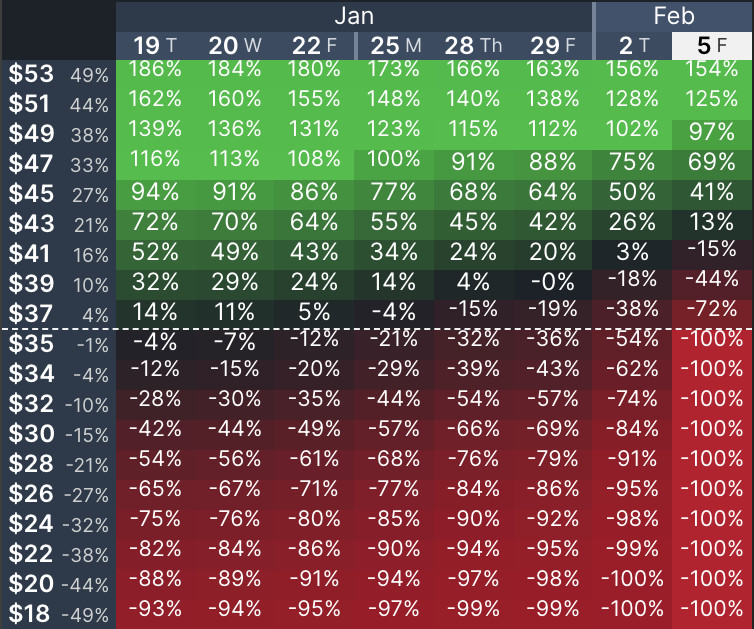

An option trading calculator in Excel is a powerful tool that enables traders to swiftly and conveniently analyze various option strategies. It incorporates algorithmic formulas that factor in vital variables like underlying asset price, strike price, expiration date, and implied volatility to generate real-time data. By inputting these parameters, traders gain insights into potential profit, loss, breakeven points, and risk-reward ratios.

Unlocking the Benefits of Excel Option Trading Calculators

The advantages of incorporating Excel in option trading are multifaceted. Firstly, it offers a comprehensive platform for evaluating multiple strategies effortlessly. Traders can experiment with different parameters, gaining a comprehensive understanding of how each variable impacts option pricing and risk.

Moreover, option trading calculators in Excel provide unparalleled accuracy and speed. Their high-precision calculations eliminate manual errors, saving traders valuable time while maximizing their confidence in the analysis.

Essential Elements of an Excel Option Trading Calculator

A typical Excel option trading calculator comprises several key elements:

- Underlying Asset Price: The current market price of the underlying stock or index being traded.

- Strike Price: The specified price at which the trader can buy or sell the underlying asset when the option contract matures.

- Expiration Date: The date when the option contract expires and becomes void.

- Implied Volatility: A market-derived estimate of how volatile the underlying asset’s price is expected to be over the life of the option.

Image: db-excel.com

Types of Option Trading Calculations

Using an Excel option trading calculator, traders can access a spectrum of valuable calculations:

- Option Premium: The amount a trader must pay or receive to enter an option contract.

- Profit/Loss: The potential profit or loss that can be generated from the option contract.

- Breakeven Point: The underlying asset price at which the trader’s profit equals the premium paid.

- Risk-Reward Ratio: A metric that quantifies the potential reward in relation to the potential loss.

Applications of Excel Option Trading Calculators in Real-World Trading

Option trading calculators in Excel serve as indispensable decision-support tools, offering insights into various trading scenarios:

- Comparative Analysis: Evaluating profitability and risk metrics for different option strategies, such as covered calls, cash-secured puts, and vertical spreads.

- Risk Management: Assessing the potential downside and downside protection of option strategies, ensuring informed decisions that align with an appropriate risk appetite.

- Scenarios Analysis: Simulating different market conditions and their impact on option profitability, empowering traders to anticipate and adapt to changing market dynamics.

Option Trading Calculator Excel

Image: warsoption.com

Conclusion

Embracing the power of Excel option trading calculators empowers traders with the clarity and confidence to navigate the complexities of options trading. By unlocking the potential of this robust tool, traders can make informed decisions, manage risk, and maximize potential收益. Whether you’re a seasoned trader or just starting your journey, an Excel option trading calculator is an invaluable asset, enabling you to unravel the intricacies of options trading and grasp opportunities in the financial markets.