Options Trading Margin Account: Empowering Traders with Leverage and Risk

Image: anbreentommie.blogspot.com

In the realm of investing, options trading holds immense allure for its potential returns and flexibility. For savvy traders, understanding and utilizing an options trading margin account can amplify these benefits while introducing calculated risk.

An options trading margin account offers the advantage of leveraging capital beyond the available cash balance. By depositing a margin or security, traders can control a larger position, potentially magnifying both gains and losses. However, this power carries significant responsibility and demands a thorough understanding of the concepts involved.

Navigating the intricacies of Options Trading

Options are sophisticated financial instruments that confer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price and on a specified date. The price of the option reflects the perceived probability of the underlying asset reaching the strike price, offering traders opportunities for both speculation and risk management.

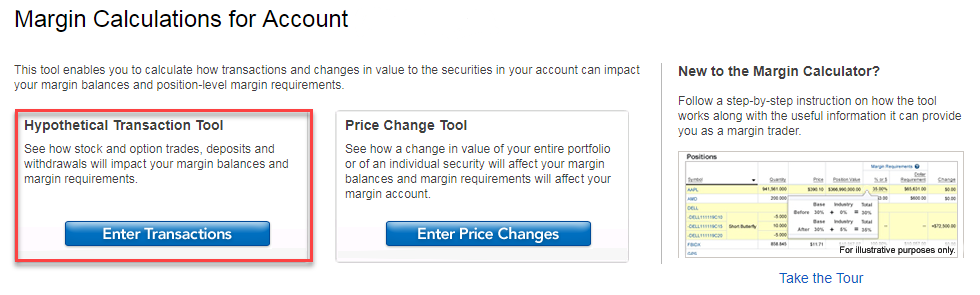

Understanding Margin Accounts

A margin account is a loan granted by a brokerage firm that enables traders to amplify their trading power without tying up all their capital. By depositing a margin, traders can purchase options equivalent to multiple times the amount of the security pledged.

The leverage offered by a margin account magnifies potential profits, but it also amplifies losses. As such, it is crucial to trade cautiously and within limits that align with one’s risk tolerance and financial capabilities.

Leveraging Expert Insights for Success

Internationally renowned options trader Larry McMillan emphasizes the importance of understanding the risks associated with margin trading. McMillan cautions against “leveraging up to the eyeballs,” highlighting the potential for devastating losses during periods of market turbulence.

On the other hand, financial analyst William Cohan highlights the opportunities that margin accounts present for skilled traders who are willing to manage the inherent risks. By utilizing leverage effectively, traders can potentially capitalize on small market fluctuations and generate substantial gains.

Risk Management Strategies for Margin Trading

Effective risk management is paramount in options trading with a margin account. Here are some fundamental strategies to consider:

- Know your risk tolerance: Determine the amount of potential loss you are comfortable with and trade accordingly.

- Set stop-loss orders: Automate the selling or closing of positions when they reach a predetermined loss limit.

- Trade in smaller positions: Start with smaller trades that align with your risk tolerance and incrementally increase position size as you gain confidence and experience.

- Manage your emotions: Avoid letting fear or greed cloud your judgment. Stick to a disciplined trading plan and avoid emotional decision-making.

Conclusion: Empowering Traders with Options Trading Margin Accounts

Options trading with a margin account offers a powerful tool for experienced traders who are comfortable with calculated risk. By understanding the mechanics of margin trading, leveraging expert guidance, and implementing sound risk management strategies, it is possible to harness the potential of options trading to amplify returns while prudently managing risk.

![The Ultimate Guide To Margin Account with Examples [2019 Updated]](http://www.personalfinancefreedom.com/wp-content/uploads/2017/09/Example-MarginAccountsTheBalanceSheet.jpg)

Image: www.personalfinancefreedom.com

Options Trading Margin Account

Image: centerpointsecurities.com