Do you need a margin account? That’s a question that every options trader eventually faces. It’s vital to understand the basics of margin accounts before opening one up.

Image: www.brokersview.com

A margin account is a type of brokerage account that allows you to borrow money from your broker to trade securities.

What Are the Benefits of Using a Margin Account?

There are potential benefits and risks to using a margin account.

Benefits

- Increased buying power: Margin gives you the leverage to control more shares of a stock than you could with a cash account.

- Short selling: Margin accounts allow you to sell borrowed shares of stock, betting that their price will decrease.

Risks

- Losses can exceed your initial investment: If the market moves against you, you may have to pay back more money than you initially invested.

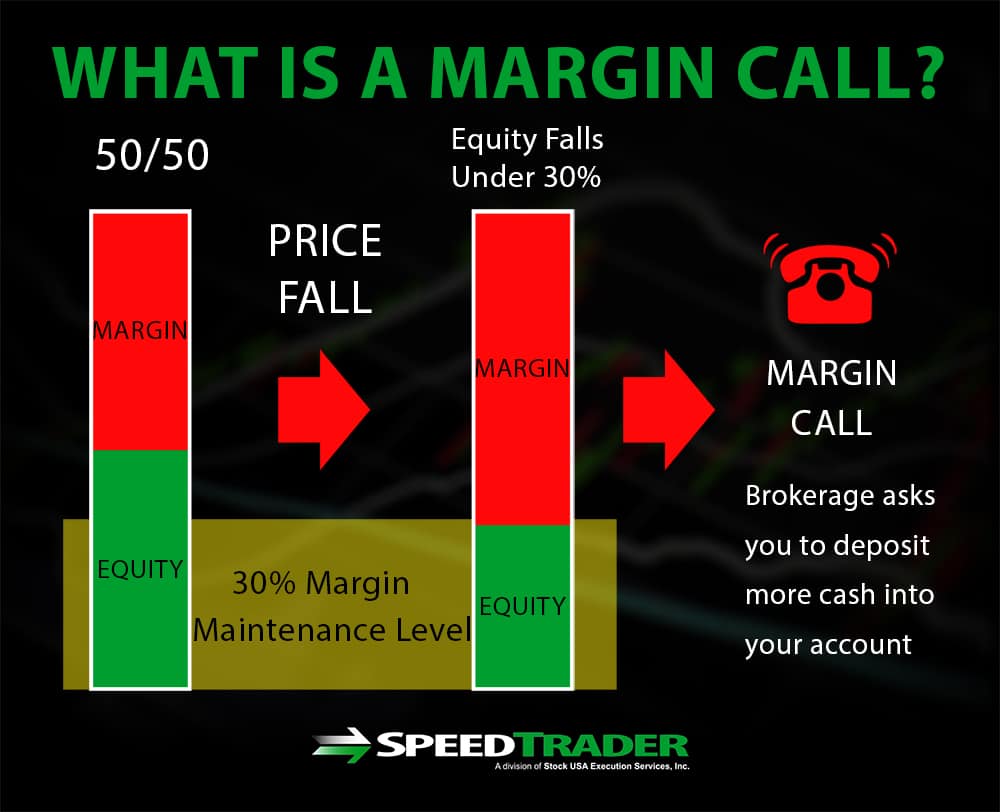

- Margin calls: If your account equity falls below a certain level, your broker may issue a margin call, requiring you to deposit more funds or sell some of your positions.

- Interest charges: Margin accounts typically charge interest on the money you borrow.

Image: speedtrader.com

Do I Need a Margin Account to Trade Options?

In general, you do not need a margin account to trade options.

There are certain types of option trades that require a margin account. For example, you need to have a margin account to sell naked options (i.e., writing options without having the corresponding underlying security in your account). Naked options are considered a level four option trading strategy that is not suitable for beginners.

When Should I Consider Opening a Margin Account?

As a general rule, you should only open a margin account when you are comfortable with the risks involved.

Some of the reasons why you may consider opening a margin account:

- You have experience trading options and are comfortable with the risks involved.

- You have a well-diversified portfolio and can afford to lose money.

- You have consistent income and can make regular margin payments.

Conclusion

So, do you need a margin account to trade options? The answer depends on your individual circumstances and risk tolerance. If you’re new to options trading, it’s best to start with a cash account until you gain more experience.

Are you interested in learning more about margin trading?

Do You Need A Margin Account For Option Trading

Image: www.youtube.com

FAQ

Q: What is the minimum balance required to open a margin account?

A: The minimum balance required to open a margin account varies from broker to broker. Some brokers may offer margin accounts with no minimum balance. However, you will need to maintain a certain amount of equity in your account to avoid a margin call.

Q: What is the interest rate on margin loans?

A: The interest rate on margin loans typically varies from broker to broker. It is usually higher than the interest rate on a personal loan.

Q: Can I use a margin account to trade stocks, options, and other securities?

A: Yes, you can use a margin account to trade stocks, options, and other securities.