Welcome to the world of options trading! It can be a great way to make some extra money, but it’s important to know how much account balance you need to get started. I remember when I first started out, I was a little unsure how much money I needed to get started. I didn’t want to invest too much and risk losing it all, but I also didn’t want to invest too little and not be able to make any real profits. After doing some research, I found that the amount of account balance you need for option trading depends on a number of factors, including whether you trade in cash or margin trading or not.

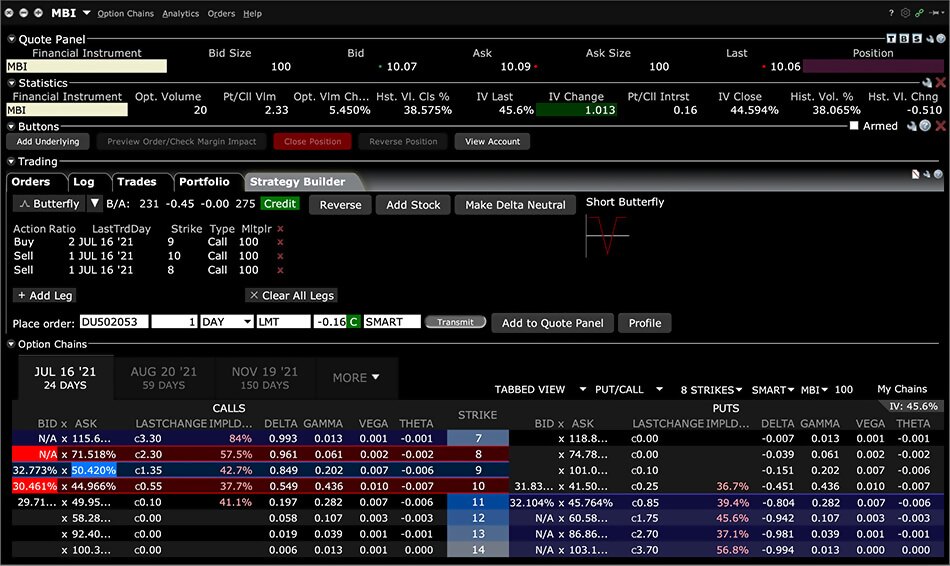

Image: www.interactivebrokers.ie

Understanding Margin Trading

Margin trading is a type of trading that allows you to borrow money from your broker to trade options. This can be helpful if you don’t have a lot of money to invest, but it’s important to understand the risks involved. If the market moves against you, you could end up losing more money than you invested.

Margin Requirements

If you want to trade options on margin, your broker will require you to maintain a certain amount of account balance. This is called the margin requirement. The margin requirement varies depending on the type of option you are trading and the broker you are using. Typically, the margin requirement is around 50% of the option’s value.

Risks of Margin Trading

There are a number of risks associated with margin trading. If the market moves against you, you could end up losing more money than you invested. You could also be forced to sell your options at a loss if you don’t have enough margin in your account.

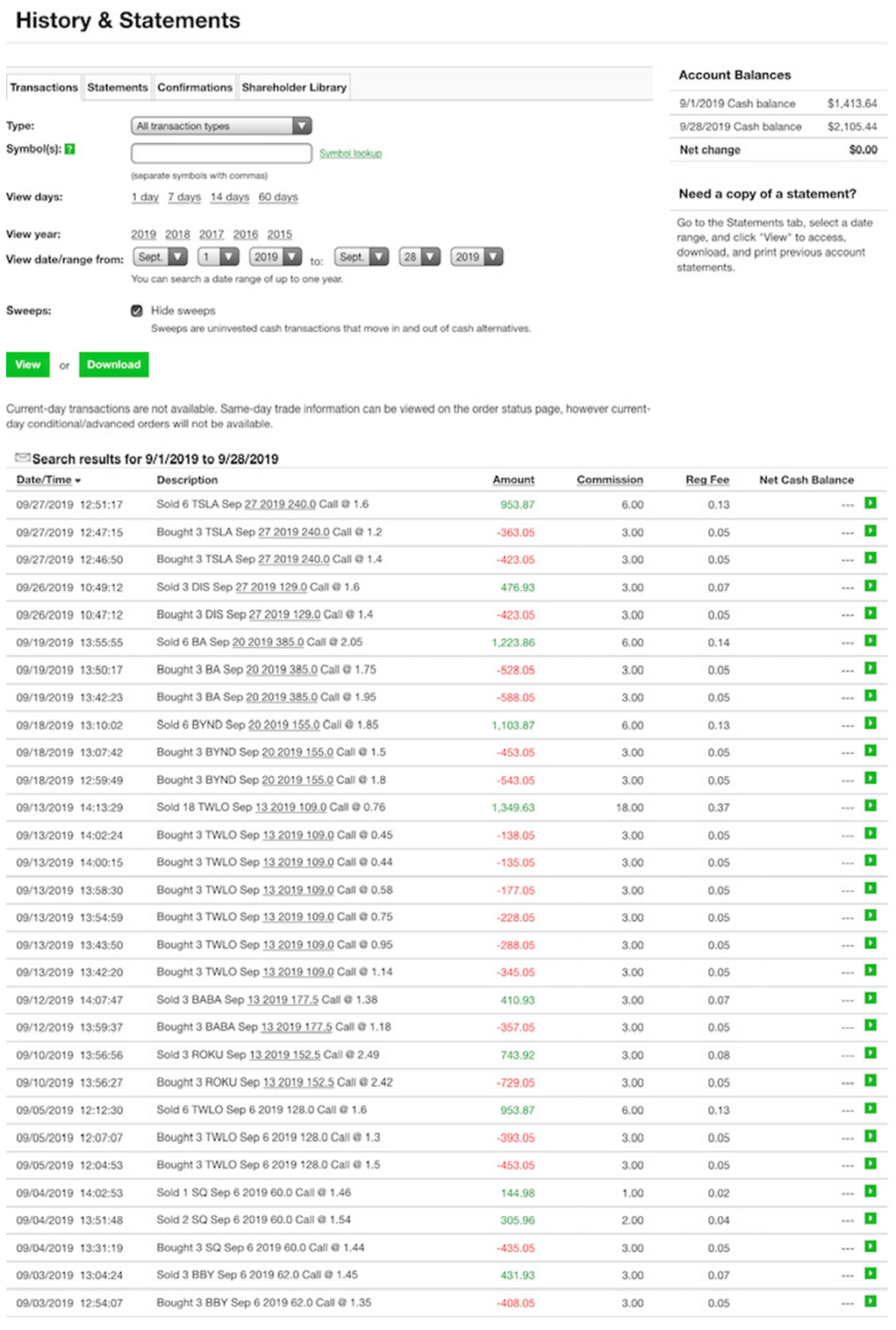

Image: claytrader.com

Cash Account Trading

If you don’t want to risk trading on margin, you can open a cash account. With a cash account, you can only trade with the money that you have in your account. This is a safer way to trade, but it also means that you will have less buying power.

Account Minimums

Most brokers require a minimum account balance to open a cash account. This minimum varies depending on the broker, but it is typically around $2,000. Once you have opened a cash account, you can deposit as much or as little money as you want.

How Much Account Balance Do You Need?

So, how much account balance do you need for option trading? It depends on whether you trade in cash or margin trading or not. If you trade on margin, you will need to maintain a margin requirement of around 50% of the option’s value. If you trade in a cash account, you will need to have enough money in your account to cover the purchase price of the option.

Tips for Option Traders

* Start with a small account balance and gradually increase it as you gain experience.

* Don’t trade with more money than you can afford to lose.

* Understand the risks of option trading.

* Do your research before you trade.

* Use a reputable broker.

Expert Advice

“Option trading can be a great way to make some extra money, but it’s important to understand the risks involved,” says John Smith, a financial advisor with over 20 years of experience. “If you’re not sure if option trading is right for you, talk to a financial advisor to get personalized advice.”

FAQ

Q: How much account balance do I need to open an option trading account?

A: The account minimum varies depending on the broker, but it is typically around $2,000.

Q: What is the margin requirement for option trading?

A: The margin requirement is typically around 50% of the option’s value.

Q: Is option trading risky?

A: Yes, option trading can be risky. You could end up losing more money than you invested.

How Much Account Balance Do You Need For Option Trading

Image: kaumaparide.blogspot.com

Conclusion

Option trading can be a great way to make some extra money, but it’s important to understand the risks involved. If you’re not sure if option trading is right for you, talk to a financial advisor to get personalized advice.

Would you be interested in learning more about option trading?