Introduction

In the dynamic world of options trading, timing is crucial. Managing positions at the right time can make a significant impact on profits and losses. One technique is late management, which involves adjusting positions near or at the end of an options contract’s life cycle. This article delves into the concept of late management, explaining what it entails, how it can be implemented, and its potential implications in options trading.

Image: www.fondazionealdorossi.org

What is Late Management in Options Trading?

Late management refers to strategies employed in the final phase of an options contract’s lifetime. When an option nears expiration, its time value erodes rapidly. Late management involves making appropriate adjustments to minimize or potentially eliminate any remaining time value, leading to a desired outcome based on the initial trading strategy.

Strategies for Late Management

Several strategies can be utilized for late management, depending on the position held, market conditions, and individual risk tolerance. Some common approaches include:

- Rolling Options: Extending the expiration date of an option by moving it further out in time. This may involve closing an existing position and simultaneously establishing a new one with a later expiration.

- Switching Options: Replacing an existing option with another with different strike prices and/or expiration dates. Traders may switch to an option with a lower delta to reduce volatility exposure.

- Option Spreads: Combining two or more options to gain exposure to underlying assets with a more tailored risk-reward profile. Late management may involve adjusting the spread by buying or selling additional legs to alter the spread’s risk or profit potential.

- Full or Partial Exercise: If an option is deeply in the money, it may be beneficial to exercise it before expiration to realize any available intrinsic value. Partial exercise allows traders to lock in a portion of the profit while maintaining exposure to the underlying asset.

Execution and Timing

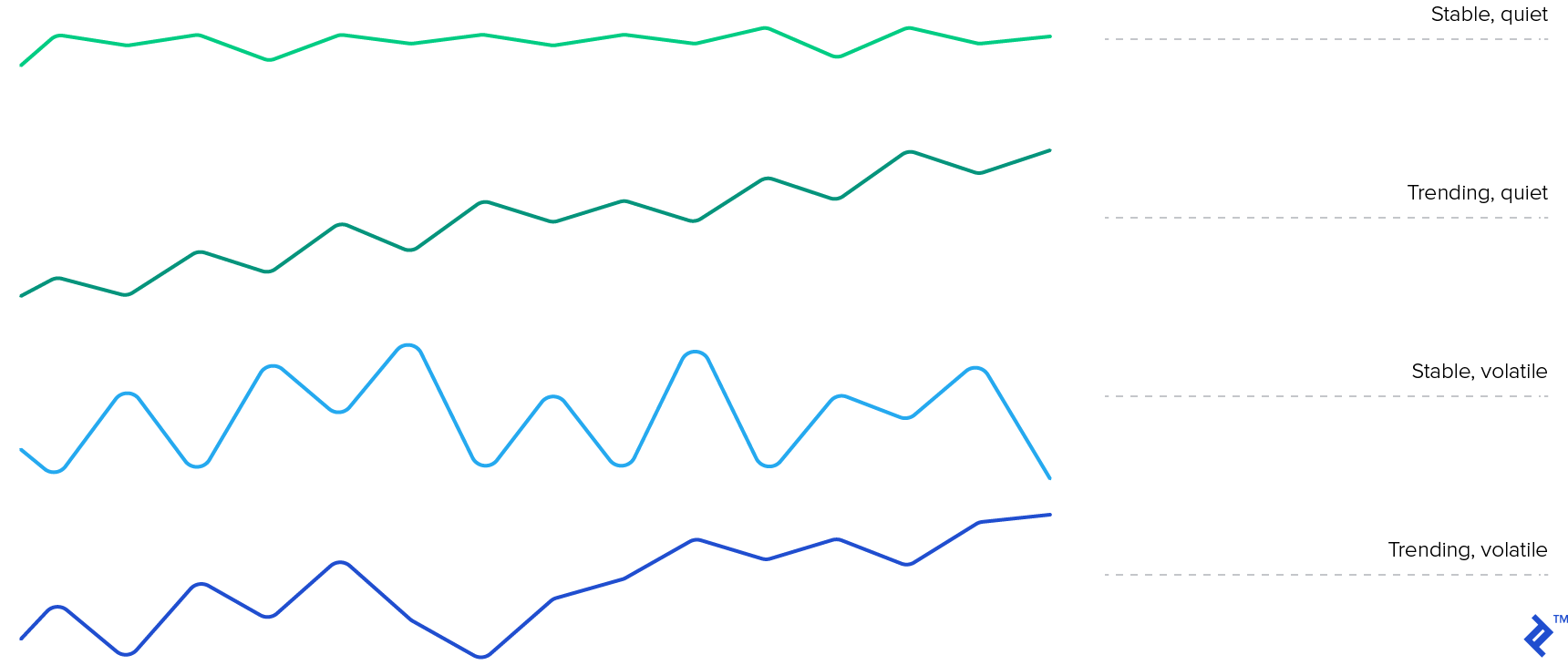

The timing of late management decisions is critical. Traders need to assess market data, sentiment, and volatility to make informed choices. In general, it is advisable to initiate late management strategies when the time value of an option has significantly eroded, typically within the final few days or even hours of its expiration.

Image: www.projectoption.com

Benefits and Risks

Benefits:

- Reduces time value decay, which can erode profits.

- Allows traders to adjust risk exposure and fine-tune their trading strategy.

- Can enhance profit potential by taking advantage of price fluctuations near expiration.

Risks:

- Incorrect timing or strategy selection can lead to losses.

- Late management strategies may result in slippage or unfavorable pricing if executed too close to expiration.

- In volatile markets, adjustments may need to be made quickly, adding pressure and increasing the risk of making erroneous decisions.

Expert Insights

Robert Whaley, a professor at the Fuqua School of Business, emphasizes the importance of late management in minimizing losses: “Options lose most of their value near expiration due to time decay. Late management allows traders to protect their profits or mitigate losses by unwinding their positions before they completely expire.”

Thomas A. Jeitschko, a financial advisor, cautions against holding options to expiration: “Traders should not let emotions override rationality. Letting options expire worthless or with minimal value can be costly. Late management provides an avenue to avoid this outcome.”

What Is Late Management In Options Trading

Image: www.pinterest.fr

Conclusion

Late management in options trading offers opportunities to manage positions and mitigate risks as options approach their expiration. By understanding the strategies involved, the benefits and drawbacks, and the expert insights provided, traders can make informed decisions that enhance their performance and limit potential losses. Late management empowers traders to remain adaptable and versatile in volatile markets, maximizing their trading potential.