When venturing into the world of finance, individuals often encounter restrictions and regulations that govern their investment activities. One such restriction is the prohibition of option trading on certain accounts. Understanding the reasons behind this restriction and its implications is paramount for investors seeking to engage in options trading.

Image: www.stockbrokers.com

Options Trading Basics

Options trading involves contracts that grant the holder the right but not the obligation to buy (in the case of call options) or sell (in the case of put options) an underlying asset at a specified price on or before a specified date. These instruments provide investors with various strategies for speculating on or hedging against price movements of stocks, indices, commodities, and other financial assets.

Reasons for Restriction on Certain Accounts

There are several reasons why option trading may be restricted on certain accounts:

- High Risk: Options trading carries a significant level of risk compared to traditional stock or bond investments. The potential for profit is accompanied by the risk of substantial losses, making it unsuitable for accounts with limited capital or low risk tolerance.

- Complexity: Options trading involves complex strategies and requires a deep understanding of market dynamics, risk management, and financial mathematics. This complexity poses a challenge for investors without the necessary knowledge and experience.

- Account Type Restrictions: Some account types, such as retirement accounts (e.g., IRAs, 401(k)s), have restrictions on the types of investments that can be made, and options trading may be prohibited.

Implications of the Restriction

For individuals who wish to engage in options trading and are subject to the restriction, it may have the following implications:

- Limited Investment Opportunities: The restriction excludes investors from participating in a potentially lucrative investment market, reducing their ability to diversify their portfolios and potentially generate higher returns.

- Investment Goal Confinement: The restriction may hinder investors from achieving specific investment goals that could be accomplished through options trading, such as speculating on short-term price movements or hedging against downside risk.

- Alternative Investment Options: Individuals restricted from options trading should explore alternative investment options that are more suitable for their risk tolerance and investment objectives, such as stocks, bonds, or mutual funds.

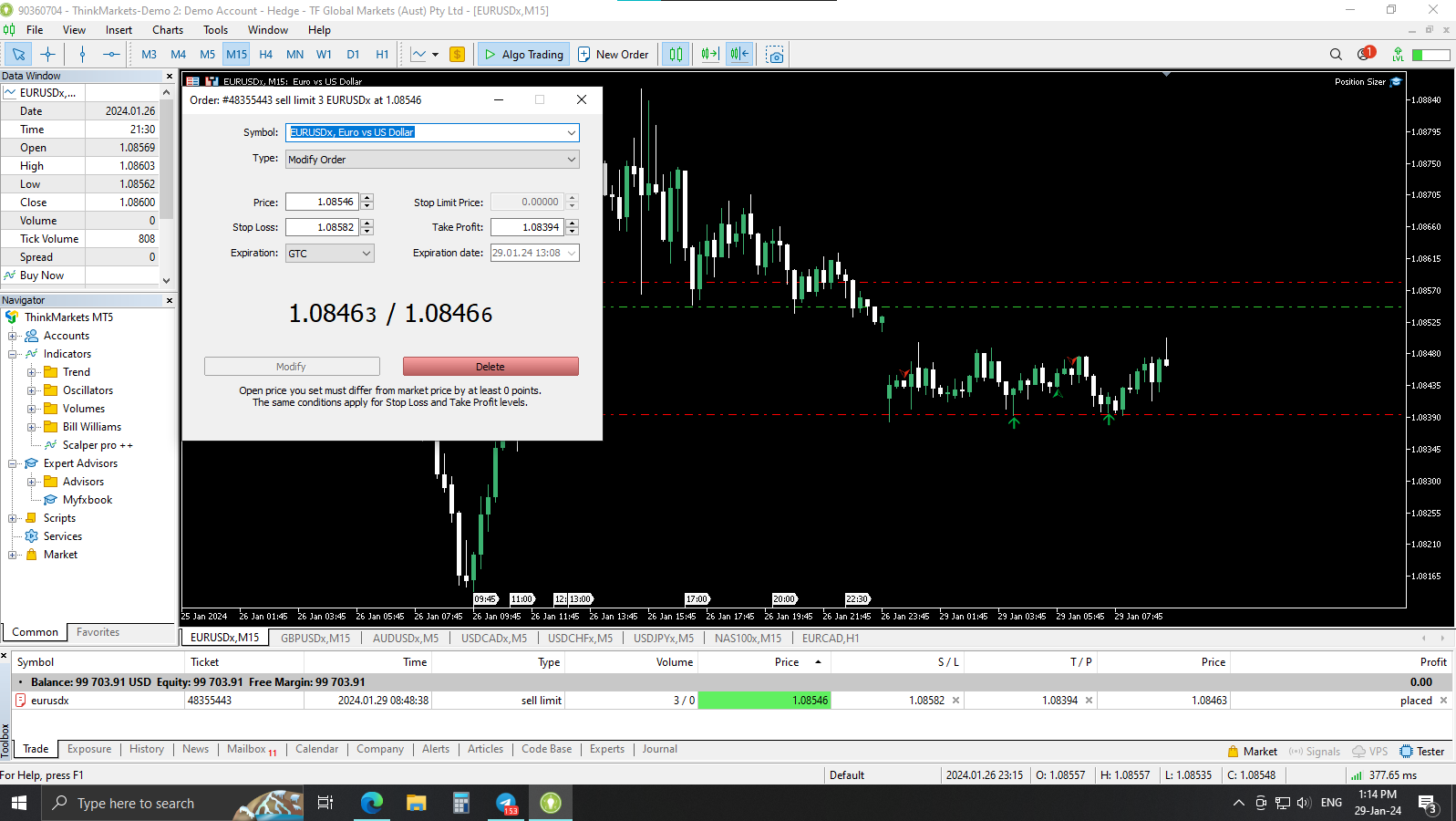

Image: www.mql5.com

Expert Advice on Restricted Accounts

Investors who are restricted from options trading should seek guidance from financial professionals:

- Consult a Financial Advisor: A reputable financial advisor can provide personalized advice on suitable investment options, risk management strategies, and account management in the absence of options trading.

- Educate Themselves: While options trading is restricted, individuals can still educate themselves on the subject matter by reading books, attending webinars, or taking online courses to enhance their financial literacy.

FAQ on Option Trading Restrictions

Q: Can I still invest in options if I have a restricted account?

A: No, option trading is prohibited on restricted accounts due to its high risk, complexity, or account type restrictions.

Q: Are there any alternative investment options available to me?

A: Yes, individuals with restricted accounts can explore stocks, bonds, mutual funds, or other investment options that align with their risk tolerance and investment goals.

Q: What are the consequences of violating the restriction?

A: Violating the option trading restriction may lead to account termination, loss of investment funds, and potential legal consequences.

No Option Trading Is Allowed On This Account

Image: www.questrade.com

Conclusion

Understanding the reasons behind the restriction on option trading on certain accounts is crucial for investors. While the restriction may limit investment opportunities, it serves to protect individuals from excessive risk exposure and ensure responsible financial decision-making. By seeking guidance from financial professionals and exploring alternative investment options, investors can navigate the financial landscape effectively within the confines of their account limitations.