Introduction:

In the realm of financial markets, options trading has emerged as a sophisticated and potentially lucrative investment strategy. However, questions linger about the accessibility of this trading avenue for individuals outside the borders of the United States. Are options trading privileges restricted to U.S. citizens, or do international investors share equal opportunities in this financial arena? This article delves into the global landscape of options trading, exploring the complexities and nuances that shape its availability and accessibility across borders.

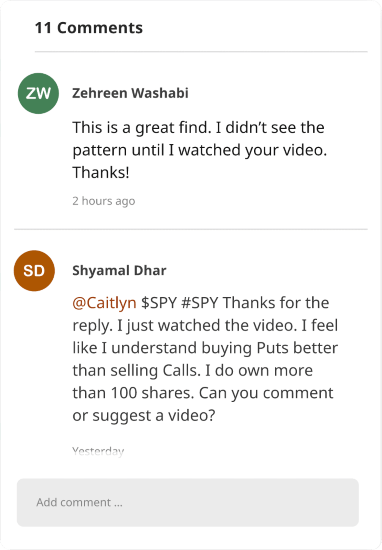

Image: abcapplepieoptiontrades.com

Historical Context:

Traditionally, options trading was primarily accessible to individuals and institutions based in the United States. The U.S. Securities and Exchange Commission (SEC) played a pivotal role in establishing regulations and guidelines for options trading within the country, creating a robust and well-defined market. However, with the advent of globalization and the rise of international financial markets, the landscape of options trading has evolved significantly.

Jurisdictional Variations:

Today, options trading regulations vary widely from country to country. While some nations have adopted regulations similar to those in the U.S., others have their own distinct frameworks. These variations have led to differing levels of accessibility for international investors.

In many countries, options trading is accessible to both domestic and foreign investors, subject to specific requirements and regulations. For instance, the United Kingdom’s Financial Conduct Authority (FCA) allows non-UK residents to participate in options trading under certain conditions, including registration and compliance with local laws.

However, some countries have imposed restrictions on options trading by foreign nationals. China, for example, limits options trading to domestic citizens and qualified foreign institutional investors (QFII). This restriction reflects the country’s efforts to maintain control over its financial system.

Account Types and Trading Restrictions:

The availability of different account types and trading restrictions also influences the accessibility of options trading for international investors. In the United States, options trading is typically conducted through brokerage accounts that adhere to SEC regulations. International investors may encounter limitations in opening such accounts due to residency requirements or compliance issues.

Furthermore, some brokers may impose trading restrictions on non-U.S. clients. These restrictions can include limitations on the types of options available for trading, margin requirements, and trading hours.

Image: citizentrader.com

Benefits and Challenges of Cross-Border Options Trading:

Cross-border options trading offers potential benefits for international investors. It allows them to diversify their investments, hedge against risk, and explore new market opportunities. However, navigating the regulatory complexities and account restrictions can be challenging.

Investors should carefully assess the risks associated with cross-border options trading. These risks include currency fluctuations, exchange rate variations, and potential tax implications. Additionally, investors should conduct thorough research to ensure that they fully understand the regulations and requirements applicable to their jurisdiction.

Are Options Trading Just For U.S Citizens

Conclusion:

The accessibility of options trading for non-U.S. citizens is a complex and ever-evolving landscape. While some countries have opened their doors to international investors, others maintain restrictions or limitations.

International investors interested in options trading should thoroughly research the regulations in their respective jurisdictions and consult with qualified professionals such as brokers or financial advisors. By understanding the intricacies of cross-border options trading, investors can navigate the global markets and explore the potential benefits of this sophisticated financial instrument.