In the bustling world of finance, the intricate dance of elephant swing trading in the options market beckons both seasoned and aspiring traders. As the financial landscape continues to evolve, it is imperative to seek simpler yet effective strategies to navigate the complexities of options trading. This comprehensive guide will embark on a journey through the intricacies of elephant swing trading, empowering you with a simplified approach to capitalize on market movements and achieve trading success.

Image: forex-station.com

Deconstructing Elephant Swing Trading

Elephant swing trading derives its name from the deliberate and rhythmic movements of an elephant’s swing. It involves identifying and capitalizing on price swings that unfold over extended periods, typically ranging from a few weeks to several months. Unlike scalping or day trading, which revolve around short-term price fluctuations, elephant swing trading adopts a patient and strategic approach, allowing traders to harness the momentum of longer-term trends.

Identifying Elephant Swing Trading Opportunities

The cornerstone of successful elephant swing trading lies in identifying potential “swing areas” within the market. These areas represent zones where a stock’s price has reversed its trend and is consolidating or oscillating within a specific range. Traders patiently observe price action within these zones, waiting for a decisive breakout that signals the start of a new trend.

Various technical indicators, such as moving averages, support and resistance levels, and candlestick patterns, serve as valuable tools in identifying swing areas. By carefully analyzing these indicators in conjunction with price action, traders can gain insights into potential reversals and capitalize on emerging trends.

Mastering Swing Trading Techniques

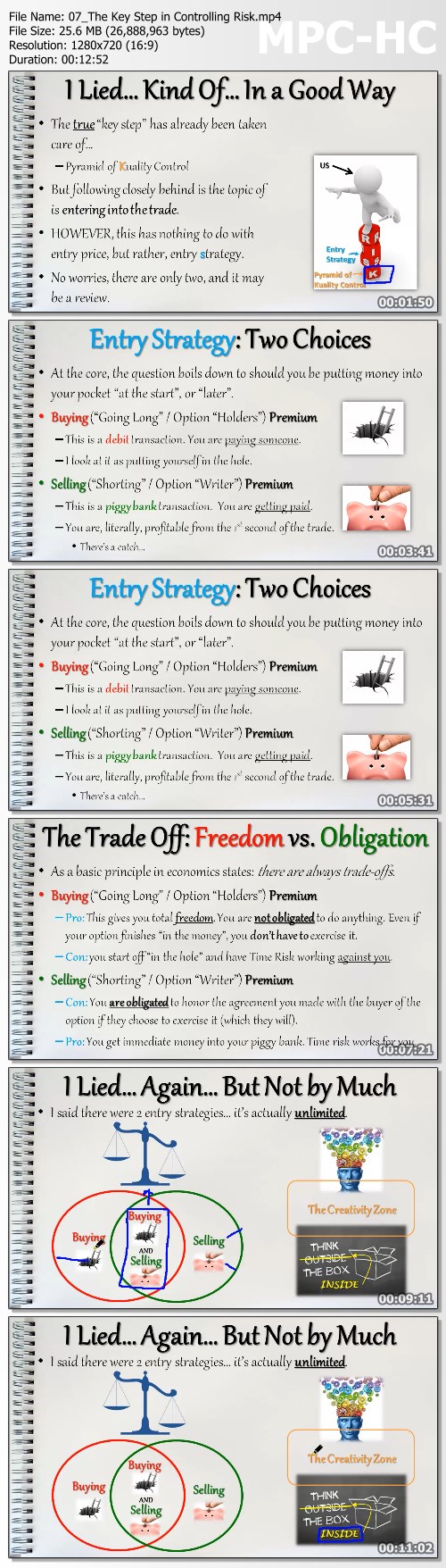

Once a potential swing trade opportunity is identified, the next step involves selecting an appropriate options strategy. The most commonly employed options strategies in elephant swing trading include:

- Long options strategies (calls or call spreads) are ideal for bullish traders who anticipate an upward price movement.

- Short options strategies (puts or put spreads) are tailored for bearish traders who expect a decline in the underlying stock’s price.

![[Download] Simpler Options – Elephant Swing Trading - FAST RELEASE](https://www.fastrls.ir/wp-content/uploads/2019/04/Simpler-Options-Elephant-Swing-Trading-Options-Course-768x1831.jpeg)

Image: www.fastrls.ir

Risk Management and Position Sizing

Risk management is paramount in elephant swing trading, as extended holding periods expose traders to potential adverse price movements. Prudent position sizing is essential to manage risk effectively. Traders should carefully calculate their position size based on their risk tolerance, account size, and the volatility of the underlying stock.

Moreover, stop-loss orders serve as a crucial safeguard against excessive losses. Placing stop-loss orders at strategic price levels allows traders to exit positions automatically if the market moves against their expectations, minimizing potential losses.

Trading Psychology

Elephant swing trading requires a unique blend of patience, discipline, and emotional control. Unlike short-term trading strategies where quick decisions are paramount, elephant swing trading demands patience and the ability to withstand market fluctuations without prematurely exiting positions.

Discipline is essential to adhere to a predefined trading plan and avoid emotional decision-making. Traders should resist the temptation to chase losses or prematurely close profitable positions. Emotional control helps navigate the inevitable ups and downs of the market, preventing impulsive trades and preserving long-term profitability.

Latest Trends and Developments

The advent of technology and the proliferation of online trading platforms have significantly transformed elephant swing trading in recent times. Algorithmic trading and automated trading systems have gained popularity, enabling traders to identify and execute trades based on predefined parameters.

Additionally, the rise of social media platforms and online trading communities has fostered a wealth of knowledge sharing and discussion among elephant swing traders. Traders can now connect, share insights, and learn from the experiences of others, enhancing their understanding of the market and refining their trading strategies.

FAQ on Elephant Swing Trading

Q: How does elephant swing trading differ from other options trading strategies?

A: Elephant swing trading adopts a long-term approach, focusing on price swings that unfold over extended periods. It involves identifying swing areas and capitalizing on trends, contrasting with scalping and day trading strategies that revolve around short-term price fluctuations.

Q: What are some key tips for successful elephant swing trading?

A: Prudent risk management, meticulous position sizing, and unwavering discipline are crucial. Additionally, traders should develop a comprehensive understanding of technical analysis, market trends, and options pricing models.

Simpler Options Elephant Swing Trading

Image: tradingdl.com

Conclusion

Elephant swing trading presents a compelling opportunity for options traders seeking to harness the power of extended price swings. By adopting a patient and strategic approach, coupled with robust risk management techniques and emotional control, traders can increase their chances of long-term success. As you embark on this trading journey, remember that the market is a dynamic and ever-evolving landscape. Continuous learning, adaptability, and a commitment to ongoing improvement are essential elements to thrive in the realm of elephant swing trading.

So, are you ready to embrace the allure of elephant swing trading? Let the gentle sway of this trading technique guide you toward market triumphs.