As an avid options trader, I remember the thrill of my first successful trade. The adrenaline rush was unlike anything I had experienced before. However, getting approved for options trading is not a walk in the park. It requires a thorough understanding of the risks involved and a willingness to undergo a rigorous approval process.

Image: www.techyv.com

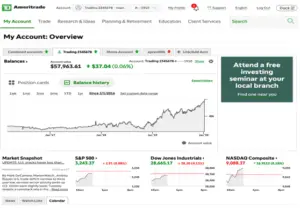

In this comprehensive guide, I will provide you with a step-by-step roadmap on how to get approved for options trading on Ameritrade. I will cover everything from the eligibility criteria to the documentation required, ensuring that you have all the necessary information to navigate the approval process seamlessly.

Understanding the Eligibility Criteria: Are You Qualified?

Before you embark on the approval process, it is crucial to assess your eligibility. Ameritrade has established specific criteria that you must meet to qualify for options trading. These include:

- Age: You must be at least 18 years old.

- Account: You need to have an active Ameritrade account.

- Experience: You must have a minimum of two years of active trading experience in options or a related field.

- Knowledge: You must pass the Options Trading Knowledge Assessment, demonstrating your understanding of options trading concepts and risks.

Documents You Will Need: Preparing for the Approval Process

Once you have confirmed your eligibility, it is time to gather the necessary documentation. Ameritrade requires the following documents to complete the approval process:

- Proof of Identity: A valid government-issued ID (e.g., passport, driver’s license).

- Proof of Address: A utility bill or bank statement showing your current address.

- Proof of Income: Pay stubs or tax returns demonstrating your financial stability.

- Trading Experience: A detailed trading statement from your previous brokerage account, showcasing your options trading activities.

The Approval Process: A Step-by-Step Guide

With your documentation ready, you can initiate the approval process by following these steps:

- Apply Online: Visit the Ameritrade website and complete the online application.

- Provide Documentation: Upload the required documents as specified in the previous section.

- Take the Assessment: Complete the Options Trading Knowledge Assessment to demonstrate your understanding of the subject matter.

- Submit Application: Once you have completed all the steps, submit your application for review.

- Review: Ameritrade will review your application and documentation thoroughly.

- Notification: You will receive an email notification regarding the status of your application. The process typically takes 5-7 business days.

- Provide Comprehensive Documentation: Ensure that you submit all the required documents in a clear and legible format.

- Highlight Your Experience: Emphasize your relevant trading experience and any certifications or licenses you may hold.

- Study for the Assessment: Take the Options Trading Knowledge Assessment seriously. Studying the available resources will help you pass with flying colors.

- Contact Ameritrade: If you have any questions or concerns, reach out to Ameritrade’s customer service for assistance.

![TD Ameritrade Review [2024] - Top Choice For US Traders](https://www.compareforexbrokers.com/wp-content/uploads/2020/09/TD-Ameritrade-Options.png)

Image: www.compareforexbrokers.com

Tips and Expert Advice for a Successful Application

To increase your chances of approval, consider the following tips:

Frequently Asked Questions About Options Trading on Ameritrade

Q: What is the minimum account balance required to trade options on Ameritrade?

A: There is no minimum account balance requirement for options trading on Ameritrade.

Q: Can I trade options without having a margin account?

A: Yes, you can trade options without a margin account. However, you will be limited to cash-secured or covered options.

Q: What is the difference between Level 1 and Level 2 options trading permissions?

A: Level 1 permissions allow you to trade basic options strategies, while Level 2 permissions provide access to more complex strategies.

How To Get Approved For Options Trading Ameritrade

Conclusion: Embark on Your Options Trading Journey

Getting approved for options trading on Ameritrade is an important step in your financial journey. By following the steps outlined in this guide and incorporating the expert advice provided, you can navigate the approval process erfolgreich. Remember, the stock market carries inherent risks, and options trading is no exception. Always trade responsibly, with a clear understanding of the potential rewards and risks involved.

Are you interested in exploring the exciting world of options trading? Share your thoughts and questions in the comments section below, and let’s engage in a lively discussion.