Introduction

In the realm of investing, trading stock options presents both a thrilling opportunity and a daunting challenge. These versatile instruments offer the potential for significant returns but also entail inherent risks. To navigate this complex terrain successfully, it’s imperative to have a well-structured trading plan that serves as your guiding compass. This comprehensive guide will delve into the essential elements of an effective trading plan for stock options, empowering you with the knowledge and tools to make informed decisions and maximize your chances of success.

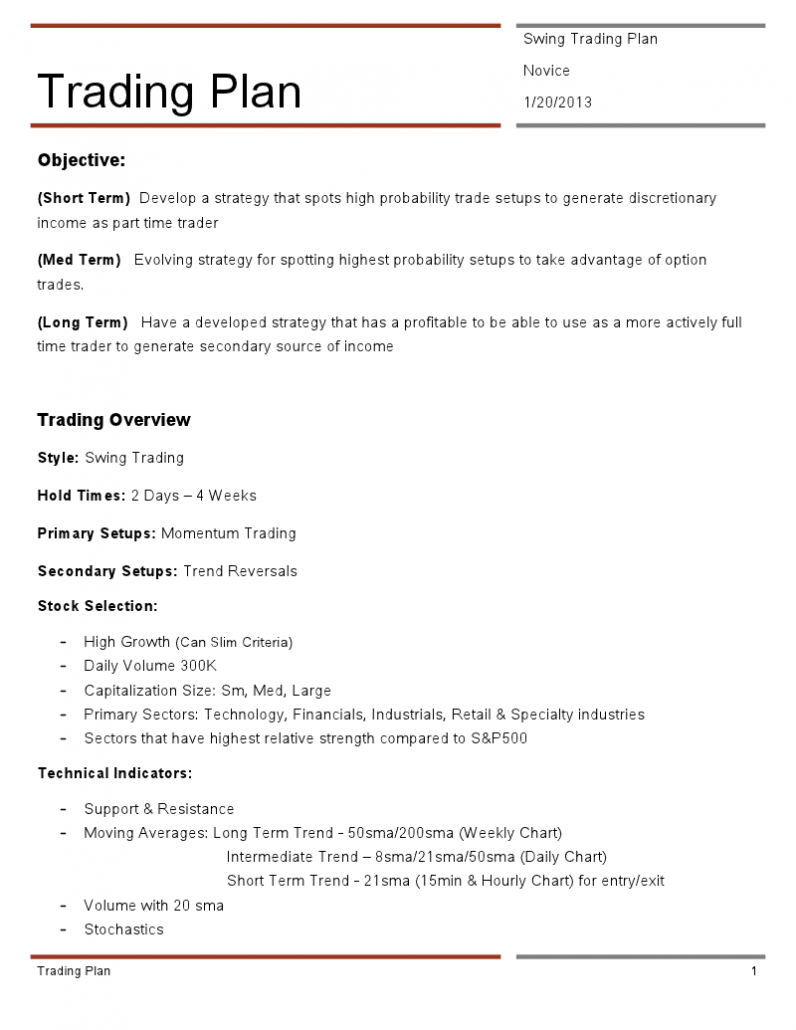

Image: thetradersroom.net

The Cornerstones of a Trading Plan for Stock Options

Effective trading plans for stock options rest upon four fundamental pillars:

-

Goal Setting: Define your financial objectives, whether it’s generating income, increasing capital, or hedging against market volatility.

-

Risk Tolerance: Evaluate your financial situation and risk appetite to determine the appropriate level of leverage and trading volume that aligns with your comfort zone.

-

Market Analysis: Conduct thorough market research to identify potential trading opportunities based on technical indicators, economic trends, and company fundamentals.

-

Trading Strategy: Establish specific entry and exit points for trades, incorporating risk management measures such as stop-loss orders and position sizing.

Step-by-Step Guide to Crafting Your Trading Plan

Step 1: Determine Your Trading Goals

Clearly define what you aim to achieve through stock options trading. Are you seeking steady income, exponential growth, or a hedge against market downturns? Establishing specific goals will provide a clear roadmap for your trading endeavors.

Step 2: Assess Your Risk Tolerance

Understand your financial limitations and emotional tolerance for potential losses. Avoid overleveraging yourself by trading within your means. Determine a risk-to-reward ratio that aligns with your appetite for risk.

Step 3: Conduct Market Analysis

Invest time in studying market trends and researching potential investment opportunities. Utilize technical analysis tools such as charts and indicators to identify potential entry and exit points. Don’t overlook fundamental analysis, which examines a company’s financial health, industry dynamics, and overall economic conditions.

Step 4: Develop a Trading Strategy

Choose a trading strategy that suits your risk tolerance, goals, and market analysis. This strategy should outline specific entry and exit points, as well as risk management techniques. Consider whether you’ll employ scalping, day trading, or a longer-term approach.

Step 5: Monitor and Adjust

Once your trading plan is in motion, continuously monitor market conditions and your trades’ performance. Make adjustments as needed based on changing market dynamics or lessons learned from your experiences. Flexibility and adaptability are essential in the ever-evolving world of stock options trading.

Expert Insights and Actionable Tips

Tip 1: Start Small

Begin with a modest amount of capital to minimize the potential for significant losses. As you gain experience and confidence, you can gradually increase your trading size.

Tip 2: Hedge Your Risks

Employ risk management strategies such as stop-loss orders and position sizing to protect your capital. Never put all your eggs in one basket – diversify your portfolio to spread the risk across multiple trades.

Tip 3: Seek Professional Advice (Optional)

Consider seeking guidance from a reputable financial advisor or broker. They can provide personalized advice based on your individual circumstances and assist you in navigating the complexities of stock options trading.

Image: hamiltonplastering.com

Trading Plan For Stock Options

Image: binaeropsjonskontonorge.logdown.com

Conclusion

Crafting an effective trading plan for stock options is a vital step towards achieving success in this dynamic market. By following the steps outlined in this guide, you can develop a personalized plan that aligns with your financial goals, risk tolerance, and market analysis. Remember to approach trading with discipline, patience, and a commitment to continuous learning. Embrace the challenges and opportunities that this realm presents, and let your trading plan be your guiding light towards profitable endeavors.