Are you tired of settling for meager returns on your HSA savings? Ready to unlock the potential of strategic investing and turbocharge your financial health? Options trading within your HSA might just be the game-changer you’ve been seeking.

Image: www.rismedia.com

Options trading is a sophisticated yet accessible investing technique that could amplify the returns on your HSA funds. By understanding the fundamentals of options and navigating the regulatory landscape, you can leverage this powerful tool to generate tax-advantaged gains while diversifying your investment portfolio.

HSAs: A Tax Haven for Your Healthcare

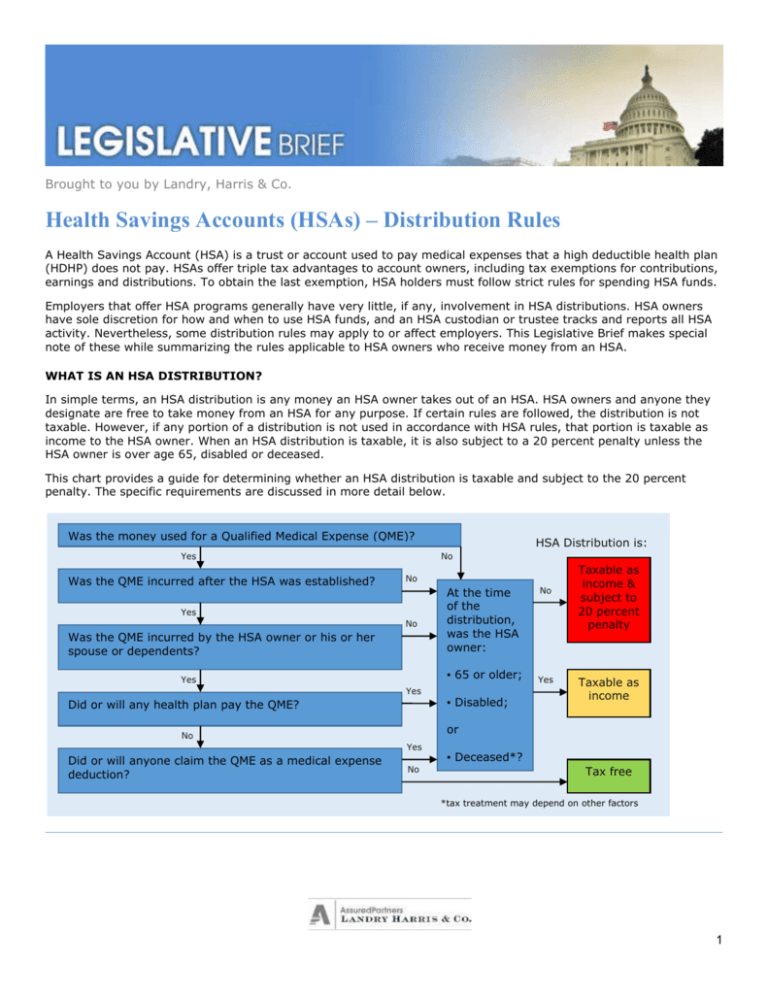

A Health Savings Account (HSA) is a triple-tax-advantaged financial vehicle specifically designed for medical expenses. Contributions, earnings, and withdrawals for qualified medical expenses are all tax-free, making HSAs an attractive tool for healthcare savings and investments.

HSAs offer various investment options, including stocks, bonds, and mutual funds. However, options trading presents unique advantages that can significantly enhance your return potential within this tax-advantaged environment.

Options: A Path to Amplified Returns

Options are financial contracts that give you the right (but not the obligation) to buy (call option) or sell (put option) an underlying asset, such as a stock, at a predetermined price on or before a specific date. They’re like insurance policies for your investments, allowing you to hedge against losses or speculate on potential gains.

Options trading in HSAs is particularly attractive due to the tax-advantaged nature of HSAs. Gains made through options trading within your HSA are tax-free as long as they are used for qualified medical expenses. Even if you choose to use the funds for non-medical purposes, you only pay the standard income tax rate, avoiding the additional 20% penalty imposed on non-qualified withdrawals from traditional HSAs.

Types of Options Strategies

Numerous options strategies can be employed within an HSA, each with its unique risk and reward profile. Some of the most common strategies include:

-

Covered Calls: Selling a call option against an underlying asset you own to generate additional income while limiting your potential upside.

-

Cash-Secured Puts: Selling a put option while holding enough cash to cover the potential purchase price of the underlying asset if assigned.

-

Protective Puts: Buying a put option on an underlying asset you own as a form of insurance against potential losses.

Image: studylib.net

Expert Advice for Success

Navigating the world of options trading requires a blend of knowledge and discipline. Here are a few valuable insights from seasoned options traders:

-

Focus on Education: Thoroughly educate yourself on options trading basics, strategies, and risk management techniques.

-

Start Small: Begin with small, manageable trades to gauge your understanding and tolerance for risk.

-

Avoid High-Risk Strategies: While some strategies can yield significant returns, it’s crucial to avoid those with higher risks of substantial losses.

-

Monitor Your Trades: Continuously monitor your open positions and adjust as necessary based on market conditions and your financial goals.

Options Trading In Hsa

Image: www.researchgate.net

Conclusion

Options trading in HSAs offers a compelling opportunity to unlock the full potential of your tax-advantaged healthcare savings. By leveraging this powerful technique, you can diversify your portfolio, potentially generate substantial returns, and secure your financial future.

Remember to approach options trading with caution, seek professional guidance when needed, and always prioritize your financial well-being. With a well-informed and disciplined approach, you can harness the power of options trading to build a prosperous healthcare savings plan and achieve your financial aspirations.