Imagine being able to invest and potentially grow your hard-earned savings while simultaneously managing your healthcare expenses. With TD Ameritrade’s Health Savings Account (HSA), you can do just that by tapping into the power of options trading. In this comprehensive guide, we’ll delve into the intricacies of TD Ameritrade options trading with HSAs, empowering you to make informed decisions and potentially enhance your financial well-being.

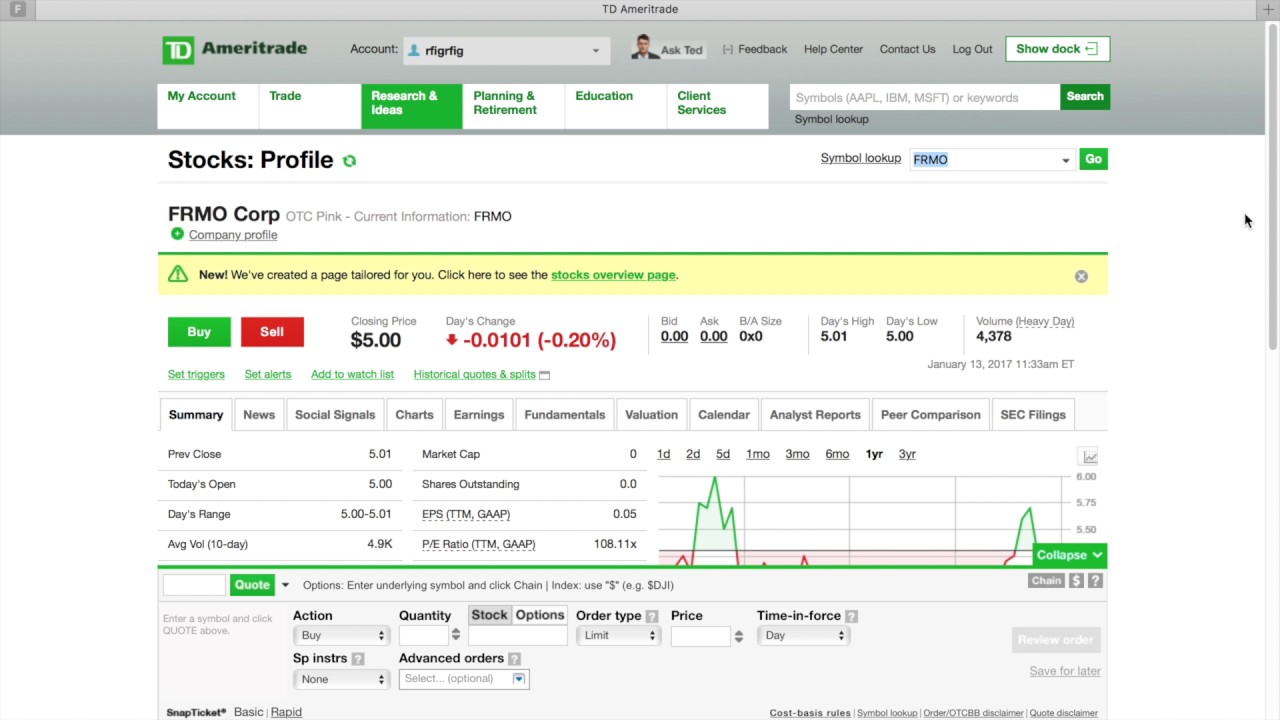

Image: www.ainfosolutions.com

TD Ameritrade Options Trading with HSAs: A Game-Changer

An HSA is a tax-advantaged savings account designed specifically for medical expenses. Its allure lies in its triple tax benefit: contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are tax-free. By integrating TD Ameritrade’s options trading capabilities within your HSA, you gain access to a wealth of opportunities to potentially grow your healthcare savings while maintaining the tax-advantaged nature of the account.

Understanding Options Trading: A Quick Primer

Options are financial contracts that grant you the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset (such as a stock or index fund) at a predetermined price (strike price) on or before a specified date (expiration date). This flexibility allows for strategic investing and risk management, enabling you to tap into market trends and capitalize on potential opportunities.

Benefits of Options Trading with TD Ameritrade’s HSA

- Flexible Investment Strategies: Options offer a wide range of strategies, catering to diverse investment goals. You can speculate on market direction, hedge against potential losses, or generate income through premium collection.

- Potential for Growth: With options, you have the potential to amplify your gains if the underlying asset moves in your favor. This can be particularly beneficial in rising or volatile markets.

- Tax-Advantaged Growth: The tax-deferred nature of HSAs extends to options trading within the account. Any earnings from successful options trades are tax-free until withdrawn for qualified medical expenses.

Image: tradechoices.blogspot.com

Getting Started with TD Ameritrade Options Trading

To embark on your options trading journey with TD Ameritrade’s HSA, follow these steps:

- Open a TD Ameritrade HSA: If you don’t already have one, open an HSA and fund it to the desired amount.

- Activate Options Trading: Contact TD Ameritrade and complete the necessary paperwork to enable options trading within your HSA.

- Educate Yourself: Familiarize yourself with the basics of options trading, including terminology, strategies, and risk management techniques. Consider consulting with a financial advisor for personalized guidance.

Expert Insights and Practical Tips

Mastering options trading requires a combination of knowledge and experience. Here are some insights and tips from experienced traders:

- Start Small: Begin with small trades to minimize potential losses while you gain experience and confidence.

- Understand the Risks: Options trading involves inherent risks. Always research and fully comprehend the potential risks before executing a trade.

- Monitor Your Trades: Regularly review your options positions and make adjustments as market conditions change.

- Seek Professional Advice: If you’re unsure about a particular strategy or investment decision, consider seeking advice from a qualified financial advisor.

Td Ameritrade Options Trading Hsa

Image: ebidobyt.web.fc2.com

Conclusion: Empowered Healthcare Savings and Investment Decisions

TD Ameritrade options trading with HSAs offers a powerful combination of tax-advantaged healthcare savings with the potential for investment growth. By arming yourself with knowledge, understanding the risks, and implementing thoughtful strategies, you can navigate the world of options trading and potentially enhance your financial well-being. Empower yourself to make informed decisions and maximize the benefits of your HSA. Remember, investing in your health and wealth can create a path towards a brighter and more secure financial future.