Maximize Your Healthcare Savings with Informed Investing

Imagine a world where your Health Savings Account (HSA) could do more than just cover medical expenses—a realm where it transforms into a vessel for financial growth through strategic option trading. In this article, we’ll delve into the captivating world of HSA options trading, empowering you with insights, strategies, and expert guidance to harness its potential.

Image: www.am22tech.com

A Health Savings Account, under the protective umbrella of Internal Revenue Code Section 223, offers tax-advantaged savings for qualified healthcare expenses. But did you know that within the realm of HSAs lies a hidden treasure—the ability to participate in option trading?

Option Trading: A Strategic Maneuver

Options, financial instruments laden with flexibility, grant investors the prerogative to either purchase or sell an underlying asset at a pre-established price on a predetermined date. While options contracts possess the potential to magnify gains, it’s crucial to approach them with judiciousness, as they come with inherent risks.

In the arena of HSA options trading, the IRS extends its benevolent hand, exempting gains from taxation as long as the proceeds remain within the consecrated confines of your HSA. This tax shelter, coupled with the judicious utilization of options strategies, paves the path towards substantial healthcare savings and, potentially, financial prosperity.

Navigating the Labyrinth of Options Trading

To embark upon the journey of HSA options trading, a thorough understanding of its nuances is paramount. A call option bestows upon its holder the right to purchase an underlying asset at an agreed-upon price, while a put option grants the holder the privilege to sell. The premium paid for the option represents the cost of this contractual agreement.

Seasoned investors often employ a diverse array of options strategies, each tailored to specific market conditions. For instance, a covered call strategy involves selling call options against the backdrop of owning the underlying asset, with the aim of generating additional income. Alternatively, a protective put strategy entails purchasing put options to hedge against potential downturns in the market.

Expert Advice for Prudent HSA Option Trading

To navigate the treacherous waters of HSA options trading with grace and aplomb, heeding the sagacious counsel of experts is not merely advisable—it is the epitome of wisdom.

Foremost, they emphasize the paramount importance of meticulous research. Thoroughly investigate the underlying asset, analyze market trends, and comprehend the potential risks and rewards associated with options trading before venturing forth.

Next, they advocate for the judicious allocation of funds. Never allocate more capital to options trading than you can afford to lose. Options trading, while pregnant with potential, is not without its perils, and the possibility of substantial losses looms. Prudent investors will limit their exposure to risk in a manner commensurate with their financial circumstances.

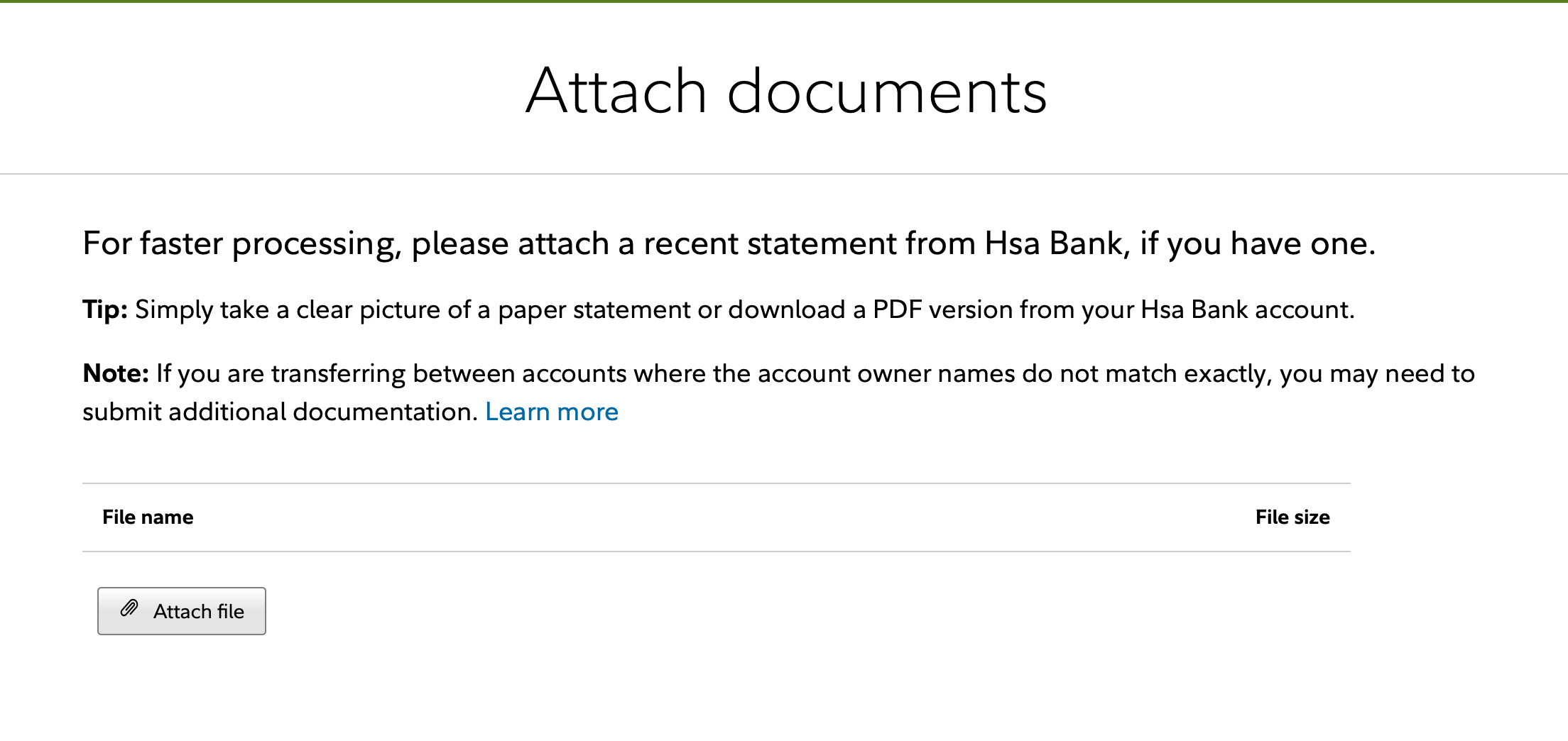

Image: www.globalfinancesdaily.com

Frequently Asked Questions: Unraveling the Enigma

Before embarking upon this audacious expedition, it is imperative to address some frequently posed queries that can illuminate the path forward.

-

Are all options trading strategies suitable for HSA accounts?

The IRS imposes certain restrictions on HSA contributions, withdrawals, and investments. Not all options strategies align with these guidelines. It is imperative to seek professional counsel to ensure compliance. -

Can I trade options directly within my HSA?

HSA custodians typically do not offer direct options trading facilities. You will need to open an external brokerage account linked to your HSA to execute these sophisticated transactions. -

What are the tax implications of HSA options trading?

Gains from HSA options trading are tax-free as long as the proceeds remain within the account. However, if you withdraw funds for non-qualified medical expenses, you may incur income tax and a 20% penalty.

Trading Options In Hsa Account

Image: www.marottaonmoney.com

Conclusion: Embracing the Power of HSA Options Trading

HSA options trading, judiciously executed, can transform your Health Savings Account into a burgeoning reservoir of financial well-being. By harnessing the potential of options strategies, you can optimize healthcare savings, amplify investment returns, and secure your financial future. Embrace the transformative power of HSA options trading, and embark upon a journey toward financial empowerment.

Are you ready to delve into the dynamic world of HSA options trading? Embark on this exhilarating adventure, armed with knowledge and strategic prowess, and witness the exponential growth of your healthcare savings. As always, remember to consult with a qualified financial advisor before making any investment decisions.