Introduction

In the labyrinthine world of financial markets, derivatives emerge as sophisticated instruments that amplify investment strategies and mitigate risks. Among these, options hold a unique allure, granting traders the flexibility to navigate market uncertainties while harnessing their potential gains. Citigroup, a global financial titan, commands a formidable presence in the options market, offering a diverse suite of products and services tailored to discerning investors. Delving into the realm of Citigroup options trading unveils a universe of opportunities and complexities, empowering individuals and institutions to unlock the financial prowess that lies within.

Image: www.forbes.com

Defining Citigroup Options Trading

Options, an integral component of Citigroup’s trading landscape, bestow upon traders the contractual right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price, known as the strike price, before a predetermined deadline, known as the expiration date. These versatile instruments provide unparalleled versatility, enabling traders to calibrate their investment strategies to specific market outlooks, ranging from bullish to bearish.

Mechanics of Citigroup Options Trading

The mechanics of Citigroup options trading hinge upon a nuanced understanding of their pricing. The value of an option comprises two distinct components: intrinsic value and time value. Intrinsic value arises when the market price of the underlying asset exceeds the strike price for call options or falls below the strike price for put options. Time value, on the other hand, reflects the remaining time until the expiration date, gradually diminishing as time progresses.

Beyond their pricing dynamics, Citigroup options trading demands proficiency in order execution. Citigroup’s trading platforms, spanning a spectrum of advanced technologies and user-friendly interfaces, empower traders with unparalleled access to market data and real-time order management.

Strategies and Applications of Citigroup Options Trading

The strategic applications of Citigroup options trading are as diverse as the investors who employ them. From hedging portfolios to speculating on market fluctuations, options offer a versatile toolkit for nuanced financial maneuvers.

Hedging Strategies: Options can effectively mitigate risks associated with adverse market movements. A trader holding a long position in a stock can purchase a put option to establish a downside buffer, safeguarding against potential losses.

Speculative Trading: Options provide a fertile ground for profit generation, enabling traders to speculate on future market behavior. A trader anticipating a surge in the price of an asset can acquire a call option, profiting handsomely if their prediction materializes.

Income Generation: Options can supplement income streams through premium selling. By selling options, traders collect upfront premiums, generating an income regardless of the subsequent direction of the underlying asset.

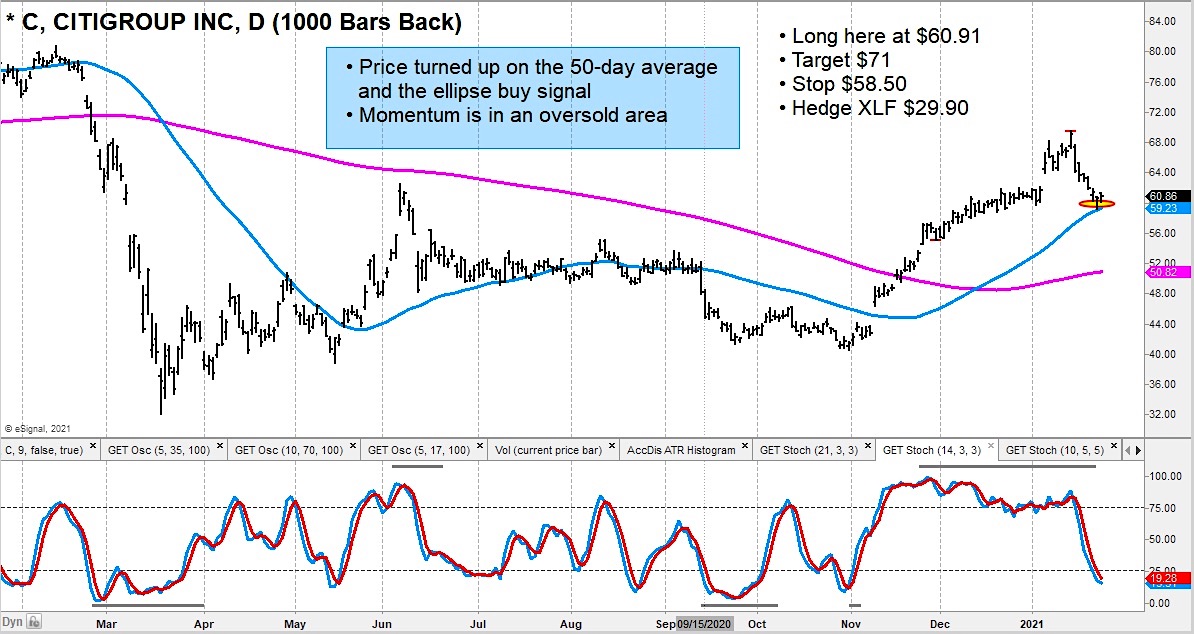

Image: www.seeitmarket.com

Sophisticated Tools for Complex Markets

Citigroup options trading is not without its complexity, demanding a keen understanding of market dynamics and risk management principles. Traders must possess a comprehensive grasp of factors influencing option pricing, including volatility, interest rates, and market sentiment.

Risk Management: Options trading inherently carries inherent risks, necessitating robust risk management strategies. Careful evaluation of the potential rewards and risks is imperative before executing any trade.

Volatility: Volatility, a measure of the magnitude of price fluctuations, plays a crucial role in determining option prices. Higher volatility translates to greater option premiums and vice versa.

Interest Rates: Interest rates exert a significant influence on option pricing, particularly for longer-term options. Changes in interest rates can affect the time value of options and the overall cost of trading.

Market Sentiment: Market sentiment, often characterized by bullish or bearish outlooks, can exert a substantial impact on option demand and pricing. Traders must be mindful of the prevailing market sentiment and its potential impact on their strategies.

Citigroup Options Trading

:max_bytes(150000):strip_icc()/1-2d77578c563246f09361dc30690fdebd.jpg)

Image: www.investopedia.com

Conclusion

Citigroup options trading presents a compelling avenue for discerning investors seeking to navigate the complexities of financial markets. Through strategic deployment and diligent risk management, traders can harness the power of options to mitigate risks, speculate on market movements, and generate income. Citigroup’s comprehensive suite of options offerings and robust trading platforms provide a foundation for seamless execution and unparalleled market access. Embarking on the path of Citigroup options trading opens doors to a world of financial opportunity, empowering traders to elevate their investment acumen and unlock the full potential of complex markets.