Introduction

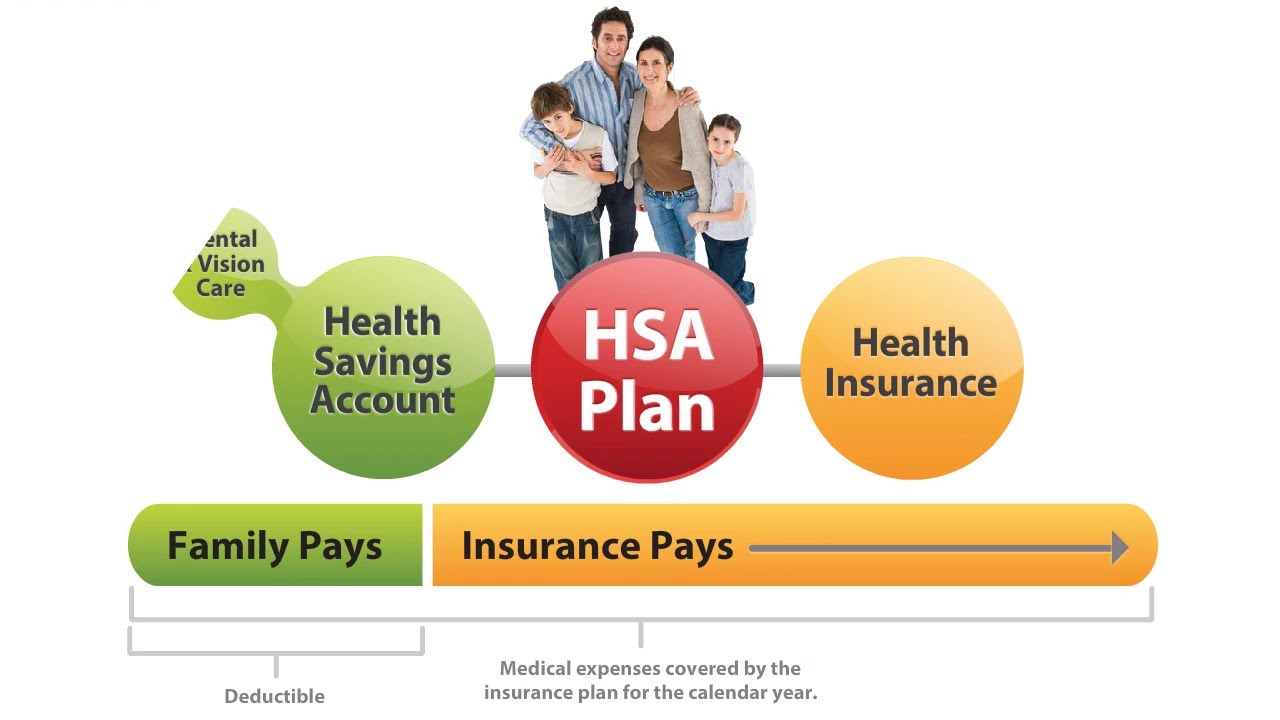

The arrival of my firstborn child exhilarated me. Amidst the joy, the weight of financial responsibility settled upon me. As I began exploring financial planning options, the idea of a health savings account (HSA) captivated my attention. An HSA not only shelters my funds from taxes but also empowers me with lucrative investment opportunities. Intrigued, I embarked on a journey to unravel the world of HSA options trading.

Image: pediatricdentalassociatesal.com

Unlocking the Potential of HSA Options Trading

HSA options trading empowers you to capitalize on the volatility of the financial markets while enjoying the tax deferment of your HSA. By utilizing options, you can employ flexible investment strategies, hedge against potential losses, and optimize your investment portfolio. The versatility of options contracts offers a tailored approach to investing, enabling you to adjust your risk appetite and potential returns.

Option Trading Strategies for HSAs

The realm of HSA options trading presents a myriad of strategies to suit diverse risk profiles and investment goals. Here’s a glimpse into the most commonly employed strategies:

- Covered Calls: An effective strategy for generating income from existing HSA holdings. You sell call options against your shares, earning a premium while retaining underlying shares.

- Cash-Secured Puts: This strategy allows you to invest in new assets with reduced risk. Sell a put option and commit to buying the underlying asset at a specified price if its value declines.

- Protective Puts: By purchasing a protective put, you can safeguard your portfolio against unexpected market downturns. It offers insurance protecting your investments from substantial losses.

Navigating HSA Trading Options

Navigating HSA trading options requires strategic decision-making:

Selecting the Right Platform: Choosing the right broker is crucial. Ensure they offer HSA-compatible options trading platforms aligned with your investment goals.

Advisor Involvement: Consider consulting a qualified financial advisor. They can provide personalized advice, guide you in navigating complex options strategies, and develop a tailored investment plan that aligns with your risk tolerance and investment objectives.

Understanding the Risks: Education is paramount. Thoroughly understand the risks associated with options trading before investing. Remember, options can potentially lead to losses.

Image: www.youtube.com

Recent Trends in HSA Options Trading

The HSA landscape is continuously evolving, with innovative strategies emerging:

Exchange-Traded Funds (ETFs) for HSAs: Introduced recently, HSA-eligible ETFs enable investors to access a diversified portfolio, spreading risk across various assets while maximizing tax savings and investment growth.

HSA Direct Indexing: Allowing for greater customization, HSA direct indexing enables investors to match their HSA investments precisely to their unique preferences. It’s an exciting frontier that grants investors more control over their portfolios.

Tips from the Experts

Here’s expert guidance to enhance your HSA options trading journey:

Start Conservatively: Commence with small investments, gradually increasing your stake as you gain confidence and refine your strategies.

Continuously Educate Yourself: Stay abreast of market trends and the evolving options landscape through research and professional development.

Monitor Your Portfolio Regularly: Vigilant portfolio monitoring is essential to identify any necessary adjustments and track your progress towards your financial goals.

Hsa Account Options Trading

Image: retiregenz.com

FAQ on HSA Options Trading

Q: Can I trade options through any brokerage account?

A: No, you need an HSA-compatible brokerage account to trade options within your HSA.

Q: Are there tax implications when trading options within an HSA?

A: Yes, options trading within an HSA can have tax implications. Consult with a tax professional for personalized advice.

Q: Can I use my HSA to trade options on margin?

A: No, margin trading is not permitted within HSAs. All trades must be executed on a cash basis.

In Conclusion

HSA options trading is a powerful lever for turbocharging your retirement savings. By leveraging the advantages of HSAs and the flexibility of options, you can amplify your returns while mitigating risks. As you embark on this journey, remember to prioritize education, seek expert guidance, and navigate the market with prudent decision-making. Remember, the path of successful HSA options trading is paved with knowledge, strategy, and a touch of audacity. Are you ready to explore the exciting possibilities of HSA account options trading?