Unlock the Power of Leverage and Income Generation

In the ever-evolving world of investing, exploring alternative strategies to augment your retirement savings is crucial. TD Ameritrade’s Option Trading IRA presents an exceptional opportunity for seasoned investors seeking higher returns and income generation.

Image: www.finder.com

Empowering Investors with Option Trading

An option contract grants you the right, but not the obligation, to either buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). This flexibility empowers investors to capitalize on market fluctuations, hedge against risk, and potentially enhance their retirement portfolio’s growth.

Types of Options Strategies for IRA

TD Ameritrade offers a comprehensive suite of option trading strategies suitable for IRA accounts, empowering you to tailor your investment approach to your unique goals. Some popular strategies include:

- Covered Calls: Selling call options against stocks you own to generate income.

- Protective Puts: Buying put options to protect against potential declines in stock prices.

- Iron Condors: Combining call and put options to create a defined risk and potential return.

li>Bullish Call Spreads: Purchasing a call option with a lower strike price and selling another with a higher strike price to profit from rising prices.

Benefits of Option Trading in IRA

By incorporating option trading into your IRA strategy, you can unlock several potential benefits, including:

- Enhanced Returns: Options offer the potential for higher returns compared to traditional investment vehicles like stocks and bonds.

- Income Generation: Selling covered calls generates income on stocks you hold.

- Risk Hedging: Protective puts and other strategies can help mitigate downside risk in your portfolio.

- Tax Advantages: IRA accounts offer tax-deferred or tax-free growth, maximizing your long-term returns.

Image: scuba-dawgs.com

Expert Advice and Guidance

To maximize the benefits of option trading in your IRA, consider seeking guidance from experienced professionals. TD Ameritrade provides access to research, educational resources, and support from knowledgeable trading specialists. By leveraging their expertise, you can refine your trading strategies, enhance your risk management, and optimize your returns.

Frequently Asked Questions

- Q: What is the minimum investment required to start option trading in an IRA?

A: The minimum investment varies depending on the option strategy you choose, but it is generally lower than the margin requirement for trading options in a non-IRA account.

- Q: How do I get started with option trading in my TD Ameritrade IRA?

A: Contact your TD Ameritrade representative or visit their website to complete the necessary application and obtain approval.

- Q: What types of underlying assets are available for option trading in an IRA?

A: TD Ameritrade offers options on a wide range of underlying assets, including stocks, ETFs, and futures.

Td Ameritrade Trading Options Ira

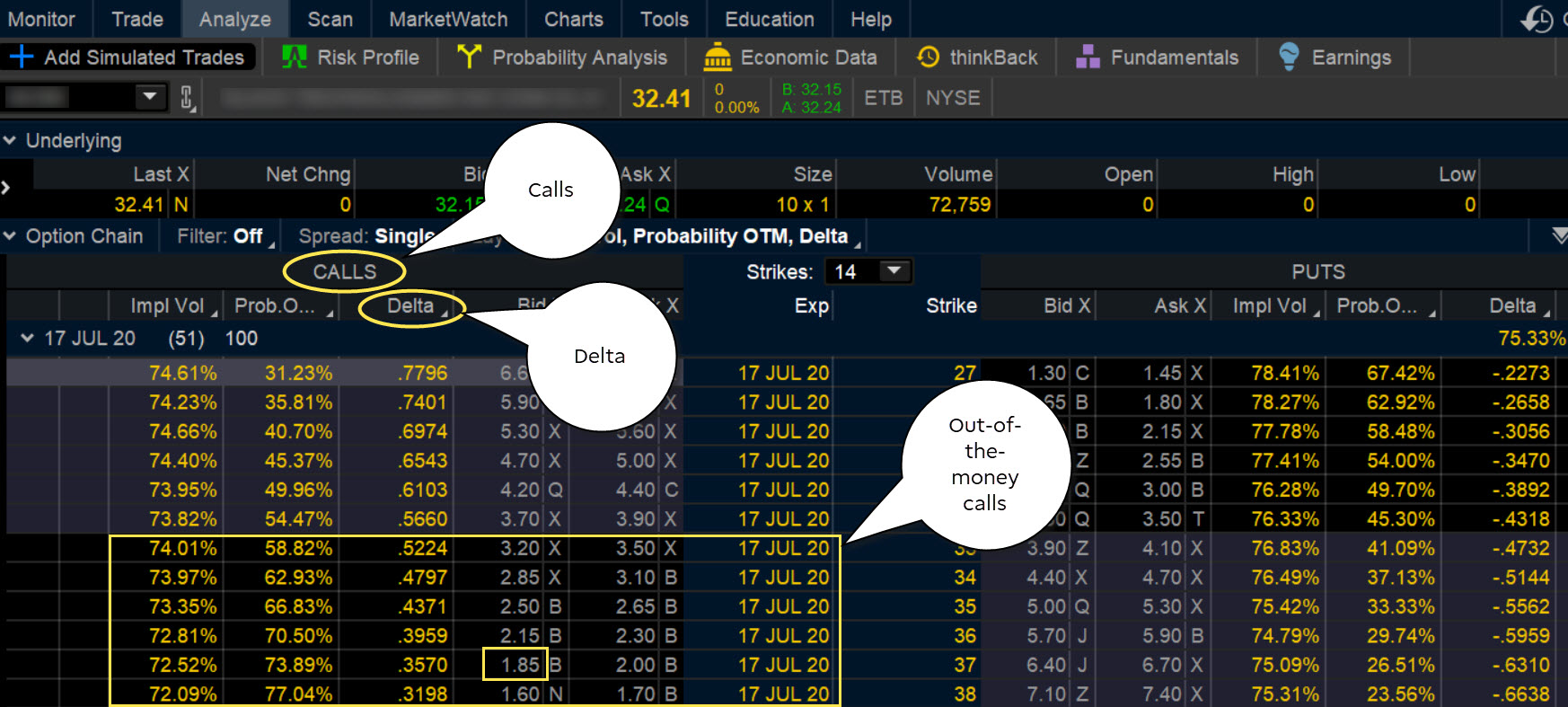

Image: tickertape.tdameritrade.com

Conclusion

Incorporating option trading into your TD Ameritrade IRA can be a powerful strategy to maximize your retirement savings, generate income, and hedge against risk. By understanding the fundamentals of option trading, carefully selecting trading strategies, and seeking expert advice, you can enhance your investment portfolio and work towards a more secure financial future.

Would you like to explore the potential benefits of option trading in your TD Ameritrade IRA account? Contact your financial advisor or visit their website for more information and resources.