Introduction

Image: toughnickel.com

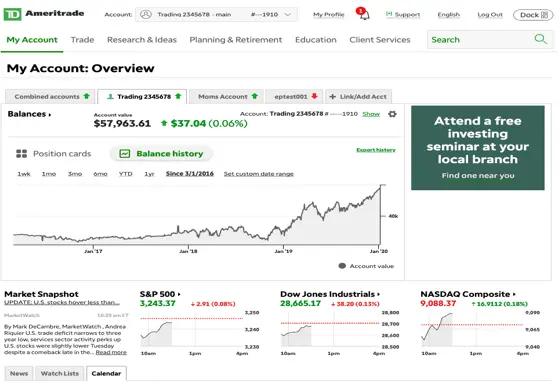

The world of investing has witnessed a paradigm shift with the introduction of options trading within Individual Retirement Accounts (IRAs). TD Ameritrade, a leading brokerage firm, has stepped up to provide its clients with the opportunity to harness this powerful tool to enhance their retirement savings. Options trading has the potential to significantly boost returns and mitigate risks, making it an attractive proposition for savvy investors looking to maximize their retirement nest egg.

TD Ameritrade’s commitment to education and support empowers its clients with the knowledge and confidence to navigate the complexities of options trading. The firm’s comprehensive educational resources, dedicated customer support, and user-friendly platforms ensure that investors have all the tools they need to succeed.

Unveiling the Basics of Options Trading

Options contracts grant investors the right to buy (call option) or sell (put option) an underlying asset, such as a stock or an index, at a specific price on or before a set date. This flexibility allows investors to tailor their investment strategies to align with their risk tolerance and financial goals.

Advantages of Options Trading Within IRAs

Tax-advantaged growth: The tax-deferred nature of IRAs provides a significant advantage for options trading gains. Investors can defer paying taxes on profits until they withdraw funds during retirement, potentially reducing their tax burden and allowing their investments to compound at a higher rate.

Flexibility and risk management: Options offer investors a high degree of flexibility in managing their investments. By combining different option strategies, investors can hedge their positions, limit their downside risk, and position their portfolios for potential upside gains.

Income generation: Options can serve as a source of income through premium collection. Investors can sell (write) options and receive a premium in return, which can supplement their retirement income.

Getting Started with Options Trading at TD Ameritrade

TD Ameritrade recognizes that options trading can be a sophisticated endeavor, which is why they provide a range of educational materials, including webinars, videos, and online courses. These resources help investors gain a solid understanding of options strategies, risk management, and market dynamics.

The firm’s proprietary thinkorswim platform offers a cutting-edge trading experience tailored to the needs of active traders. The platform’s user-friendly interface, advanced charting tools, and robust analytical capabilities provide investors with the necessary resources to make informed trading decisions.

Real-World Applications of Options Trading in IRAs

-

Income generation: An IRA investor with a moderate risk tolerance may sell covered calls on a portion of their stock portfolio. This strategy involves selling a call option against a stock they own, granting someone else the right to buy it at a specific price. If the stock price remains below the set strike price, the investor retains the stock and collects the option premium, generating additional income.

-

Hedging: Investors seeking to mitigate the downside risk of their IRA portfolios may opt to buy protective put options. Put options give the investor the right to sell an underlying asset at a predetermined price, effectively setting a floor for their portfolio value.

Conclusion

Options trading within IRAs offers TD Ameritrade investors a transformative opportunity to enhance their retirement savings. By leveraging the firm’s educational resources, user-friendly platforms, and dedicated support, investors can embrace the power of options and navigate the financial markets with greater confidence and potential reward. Remember, responsible investing and thorough research are key to successful options trading, ensuring alignment with individual financial goals and risk tolerance.

Image: www.techyv.com

Options Trading Ira Td Ameritrade