Introduction

If you’re intrigued by the potential of options trading but intimidated by its complexities, you’re not alone. Options trading does carry its intricacies, but navigating its nuances doesn’t have to be a daunting endeavor. By adopting a strategic and educational approach, you can master this powerful financial tool with ease.

Image: www.pinterest.cl

Understanding Options: A Foundation for Success

Options, in essence, are contracts that grant the holder the right, not the obligation, to buy or sell an underlying asset at a predetermined price on or before a set expiration date. This flexibility makes options an enticing tool for both hedging and speculative trading strategies.

However, two key concepts are paramount to understanding options: calls and puts. Calls provide the buyer with the right to purchase the underlying asset, while puts endow the buyer with the right to sell it. Each option contract represents 100 shares of the underlying asset, and the right to exercise this option comes at a premium.

Learning Options Trading: Embark on a Knowledge Quest

The path to options trading mastery starts with education. Immerse yourself in books, online articles, and courses dedicated to the subject. Reading books like “Options as a Strategic Investment” by Lawrence G. McMillan and “The Options Playbook” by Brian Overby can provide you with a solid theoretical foundation.

Online resources abound to supplement your reading. Investopedia, The Options Industry Council (OIC), and Coursera offer a wealth of educational material, from beginner-friendly guides to advanced strategies.

Practice Makes Perfect: Harness the Power of Simulation

Once you have grasped the fundamentals, it’s time to put your knowledge to the test. Paper trading and options trading simulators offer a safe environment to hone your skills without risking real capital. Platforms like Thinkorswim and TradeStation offer realistic simulations that allow you to experience the market firsthand.

Use these simulators to test different strategies, analyze charts, and develop a sound trading plan before venturing into live trading. Remember, the key is consistency; allocate ample time to practice and refine your approach.

![6 Easy Steps To Learn Options Trading Free [For Beginners]](https://subhmantra.com/wp-content/uploads/2021/05/0001-1764850151_20210524_012306_0000.png)

Image: subhmantra.com

Understanding Market Forces: A Key to Unlocking Profits

The options market is inextricably linked to the underlying asset and broader market movements. To succeed in options trading, it’s imperative to have a firm grasp of technical analysis. Study chart patterns, indicators, and price action to identify potential trading opportunities.

Furthermore, staying abreast of economic data, earnings reports, and global events can provide valuable insights into market sentiment and future price movements.

Options Strategies: An Arsenal for Every Occasion

The beauty of options trading lies in its versatility. There’s a myriad of strategies to choose from, each tailored to specific market conditions and risk appetites. Covered calls, protective puts, and bull call spreads are just a few examples.

Start by mastering a few basic strategies. As you gain confidence and experience, you can gradually expand your repertoire. Remember, the goal is to create a diversified portfolio that balances risk and reward.

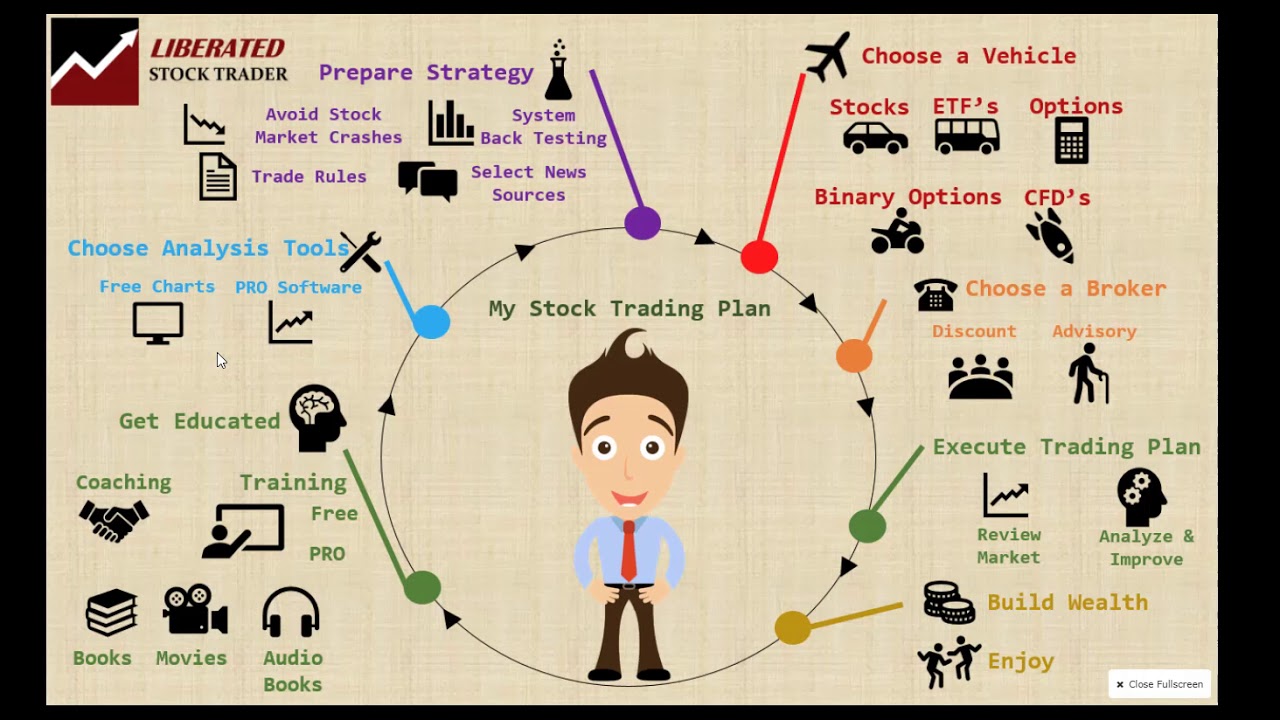

Easiest Way To Learn Options Trading

Image: www.youtube.com

Risk Management: Protecting Your Trading Capital

Options trading involves inherent risks, but by employing sound risk management practices, you can mitigate potential losses and preserve your capital. Set clear stop-loss levels to limit losses, and always trade with a portion of your capital that you’re comfortable losing.

Moreover, avoid overtrading and chase