Introduction

Image: www.iqoptionmag.com

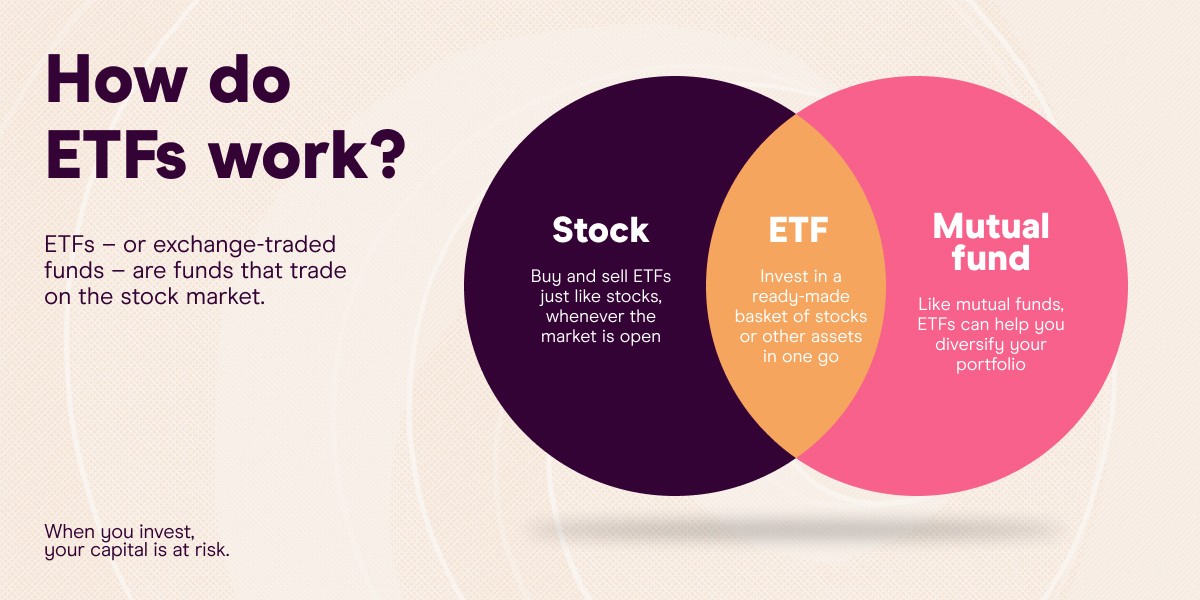

In the ever-evolving world of finance, exchange-traded funds (ETFs) and options provide investors with a powerful combination for strategic wealth management. ETF option trading, the intersection of these two financial instruments, offers a compelling opportunity to enhance returns and hedge risks effectively. If you’re an investor seeking to unravel the complexities of ETF option trading, this comprehensive guide will illuminate the path to success.

What is ETF Option Trading?

ETFs are baskets of securities that track a specific index or market segment. Options, on the other hand, are derivatives that grant the buyer (or seller) the right, but not the obligation, to buy (or sell) an underlying asset at a specified price on or before a特定的日期. When you combine ETFs with options, you gain the flexibility to make calculated bets on the performance of the underlying index or market, opening up avenues for both potential gains and strategic risk management.

How does ETF Option Trading Work?

ETF options, similar to stock options, come in two primary flavors: calls and puts. Call options provide the buyer with the right to buy the underlying ETF at a predetermined strike price by a specified expiration date. Conversely, put options convey the right to sell the ETF at the strike price. When purchasing an ETF option, you pay a premium to the seller, which represents the price for the option contract.

The value of an ETF option contract is influenced by several factors:

- The price of the underlying ETF

- The strike price

- The time remaining until expiration

- Market volatility, or implied volatility

- Interest rates

Benefits and Strategies

ETF option trading offers investors a wealth of benefits, including:

- Leverage: Options offer the potential to amplify returns with a relatively small investment, acting as a powerful lever.

- Income Generation: Selling options can generate income while managing risk.

- Hedging Strategies: Options provide valuable tools for hedging portfolios against potential market downturns.

- Speculation and Income Movement: Options facilitate targeted speculation on ETF price movements or income streams.

- Flexibility and Customization: The wide range of ETFs and option strategies allows investors to tailor trading strategies to their risk tolerance and investment objectives.

Various option trading strategies can be employed, ranging from simple to complex, such as:

- Covered Call: Selling call options against an existing ETF position to generate premium income.

- Bull Call Spread: Purchasing a call option with a lower strike price and simultaneously selling a call option with a higher strike price to benefit from bullish price movements.

- Protective Put: Purchasing a put option to hedge against potential ETF price declines.

Expert Insights and Practical Tips

To navigate the world of ETF option trading effectively, consider adopting the following expert insights and practical tips:

- Understand the risks involved: Options trading carries inherent risks; ensure you fully grasp them before investing.

- Begin with small trades: Start with modest trades to gain practical experience and minimize potential losses.

- Seek professional advice: Consult with a financial advisor experienced in option trading to guide your strategy.

- Educate yourself continuously: Stay abreast of market trends and trading techniques by attending webinars, reading books, and engaging in online forums.

- Monitor your positions closely: Track your trades regularly, making adjustments as market conditions evolve.

Conclusion

ETF option trading can be a transformative financial tool for investors who seek to enhance returns and manage risk. By understanding the fundamentals, employing effective strategies, and embracing expert insights, investors can harness the power of ETF options to create a path to profitable investing. Remember, strategic decision-making and continuous learning are the keys to unlocking success in this dynamic and rewarding domain.

Image: www.linkedin.com

Etf Option Trading

![How To Read An Etf Option Trading Chart - [Updated] July 2023](https://andronishoneymoon.com/wp-content/uploads/2022/12/how-to-read-an-etf-option-trading-chart.jpg)

Image: andronishoneymoon.com