Introduction

In the ever-evolving world of financial trading, options courses provide an avenue to unlock high-profit potential while minimizing stress levels. Whether you’re a seasoned trader or just starting, understanding the nuances of options trading can empower you to navigate market volatility with confidence.

Image: www.chegg.com

Beginners’ Guide to Options Trading

Options are financial contracts that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specified date. This flexibility allows you to structure strategies that align with your risk tolerance and profit objectives.

Defining Key Concepts

- Calls: Contracts that give the buyer the right to buy the underlying asset.

- Puts: Contracts that grant the buyer the right to sell the underlying asset.

- Expiration Date: The date on which the contract expires and becomes worthless.

- Underlying Asset: The security or commodity that the option is based on.

Profitable Options Trading Strategies

Mastering options trading strategies requires a combination of technical analysis and risk management. Here are some proven methods:

- Covered Call: Selling a call option against an underlying asset that you own.

- Cash-Secured Put: Selling a put option while depositing cash as collateral.

- Collar Strategy: Using a combination of calls and puts to limit both profit and loss potential.

- Iron Condor: Selling a call and a put option at different strike prices, both above and below the underlying asset’s current price.

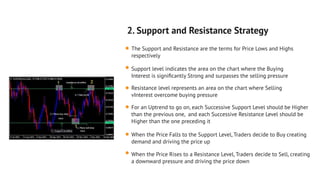

Image: www.slideshare.net

Tips for Low-Stress Trading

Minimizing stress while trading options is crucial for preserving your mental and financial well-being. Here are some expert tips:

- Define Your Risk Tolerance: Understand your financial limitations and only trade with what you can afford to lose.

- Manage Your Emotions: Keep your emotions in check and avoid impulsive decisions.

- Utilize Stop-Loss Orders: Set automatic triggers that sell your options at a specific price, limiting your potential losses.

- Avoid Overtrading: Plan your trades carefully and avoid exceeding your risk tolerance.

Frequently Asked Questions (FAQ)

- Q: What are the risks involved in options trading?

A: Options trading involves inherent risk, including the potential loss of capital, volatility in underlying asset prices, and time decay. - Q: How can I reduce my risk in options trading?

A: Implement risk management techniques such as diversifying your portfolio, setting stop-loss orders, and understanding your risk tolerance. - Q: Is options trading suitable for beginners?

A: While options trading can be complex, there are beginner-friendly strategies that can be started with proper education and risk management.

The Options Course High Profit And Low Stress Trading Methods

Conclusion

Embracing the high-profit, low-stress potential of options course trading empowers you to navigate financial markets with greater confidence. By understanding the concepts, mastering profitable strategies, and implementing stress-reducing techniques, you can unlock the earning potential of options while safeguarding your financial well-being.

Are you intrigued by the world of options trading and eager to explore the possibilities? Join us on our journey to financial freedom and discover the secrets to successful options course trading.