The allure of options trading lies in its potential for significant returns, but choosing the right trading platform is crucial for success. Navigating the labyrinth of available options can be overwhelming, so let’s delve into the intricacies of selecting a platform that aligns with your trading style and objectives.

Image: woodlands.adventist.org

Platform Essentials: Unveiling the Key Features

When assessing options trading platforms, consider the following essential features:

- Ease of Use: An intuitive user interface facilitates seamless navigation, order placement, and account management.

- Security: Reputable platforms prioritize data encryption, two-factor authentication, and adherence to industry regulations.

- Market Data: Up-to-date and comprehensive market data powers informed decision-making and timely trade execution.

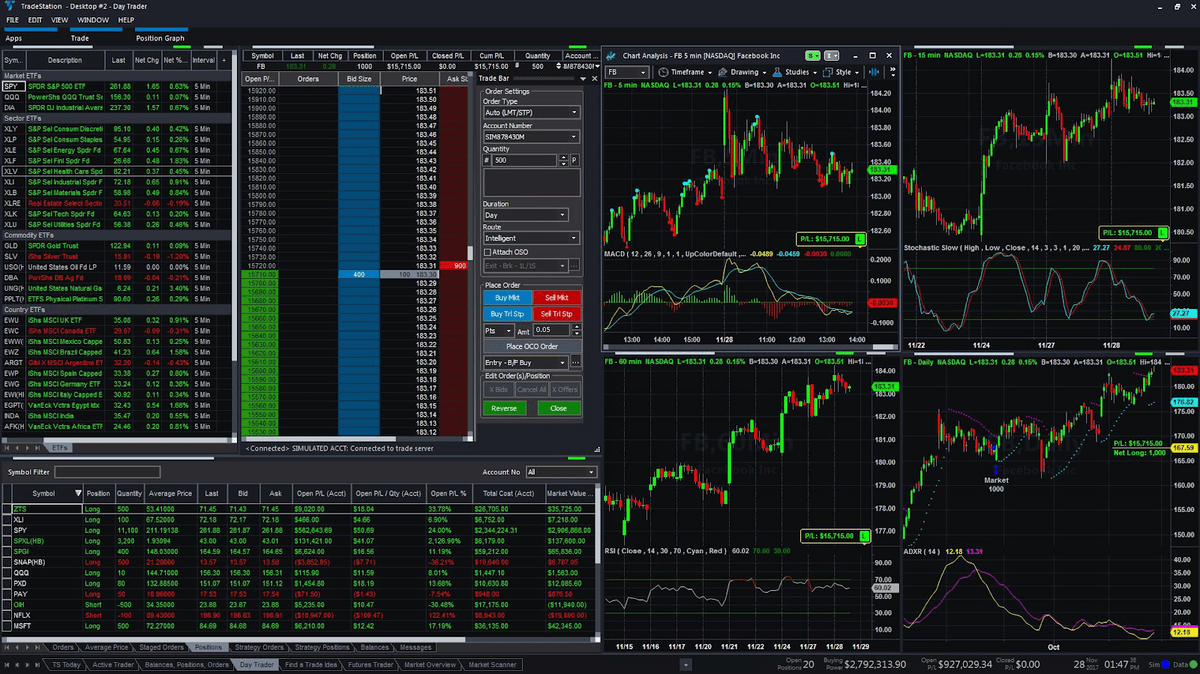

- Tools and Features: Advanced charting capabilities, technical indicators, and risk management tools enhance analysis and trade execution.

- Customer Support: Responsive and knowledgeable customer support is invaluable, especially for novice traders.

Leading Platforms for Options Trading: A Comparative Analysis

To assist your decision-making, let’s examine three leading platforms for options trading, each offering distinct advantages:

Interactive Brokers: A Heavyweight for Seasoned Traders

Interactive Brokers stands as a towering force in the options trading arena, catering to experienced traders and sophisticated investors. Its extensive suite of trading tools, rigorous risk management features, and global market reach make it a top choice for seasoned professionals.

Image: vocal.media

TD Ameritrade: A Balanced Approach for Intermediate Traders

TD Ameritrade strikes a graceful balance between accessibility and functionality. Its intuitive platform suits intermediate traders seeking powerful tools and educational resources. The platform’s PaperMoney feature simulates trading conditions, allowing traders to hone their skills without risking real capital.

Fidelity Investments: A Gateway for Beginners

Fidelity Investments extends a welcoming hand to novice traders through its user-friendly interface, comprehensive educational materials, and dedicated support. Fidelity’s low trading fees and tiered account structure accommodate traders of varying experience levels.

Additional Considerations: Refining Your Search

Beyond these primary considerations, evaluate the following secondary factors to fine-tune your platform selection:

- Commission Structure: Consider the fees charged per trade and compare them against your anticipated trading volume.

- Platform Compatibility: Ensure the platform is compatible with your preferred devices, including desktop, laptop, and mobile.

- Educational Resources: Access to tutorials, webinars, and other learning materials accelerates your trading proficiency.

- Community Engagement: Seek platforms with active user forums and social media groups for knowledge-sharing and support.

- Promotions and Incentives: Take advantage of welcome bonuses, referral programs, and other incentives offered by some platforms.

Which Platform Is Good For Options Trading

Image: keysgame.pl

Conclusion: A Catalyst for Trading Success

Choosing the right options trading platform is not a one-size-fits-all equation. By discerningly evaluating the key features and additional considerations outlined above, you can empower yourself with a platform that resonates with your trading aspirations. Remember that a harmonious alliance between trader and platform is the catalyst for unlocking success in the dynamic world of options trading.