Introduction:

Image: www.adigitalblogger.com

In the captivating world of financial markets, option trading stands out as a game of potential and risk, where strategic decisions can lead to transformative gains. HDFC Sec, India’s leading financial services institution, offers a secure and reliable platform for investors to delve into this exhilarating arena. This comprehensive guide will empower you with the knowledge and insights you need to conquer the complexities of option trading with HDFC Sec, unlocking opportunities for significant wealth creation.

Understanding Option Trading

Options are derivative financial instruments that grant investors the right, but not the obligation, to buy (call) or sell (put) underlying assets at a specified price (strike price) on or before a certain date (expiration date). This unique characteristic allows traders to speculate on future price movements of stocks, commodities, currencies, and more, with limited risk and potential for substantial returns.

HDFC Sec: Your Trusted Ally in Option Trading

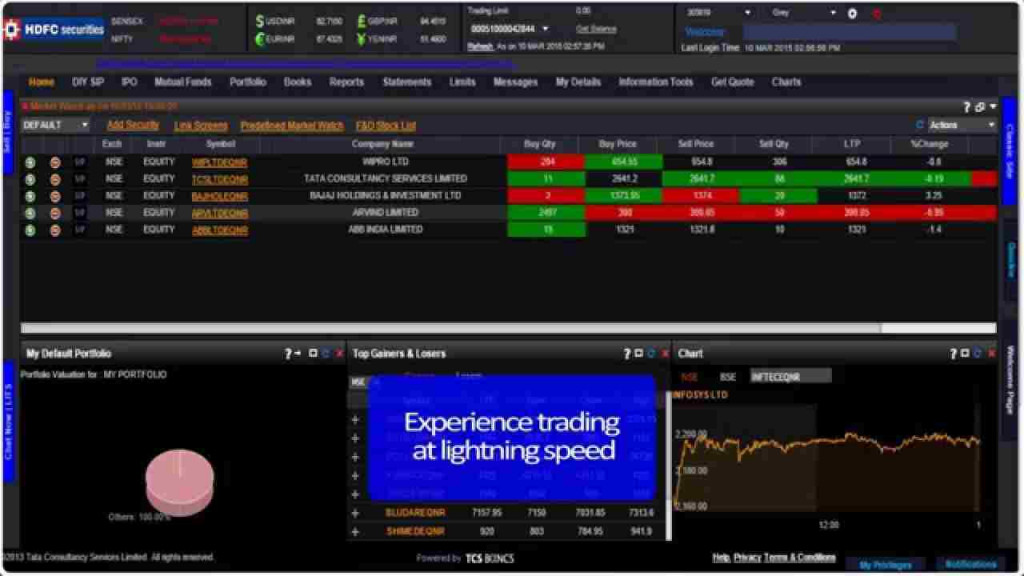

HDFC Sec, with its vast experience and robust infrastructure, has established itself as a trusted brokerage house for option traders. Their user-friendly trading platform, wide range of products, and exceptional customer support provide an unparalleled environment for seamless option trading experiences.

Navigating the Option Chain

Options are traded in contracts with different strike prices and expiration dates. The “option chain” displays these contracts and their premiums, reflecting the market’s assessment of future price movements. Understanding the option chain is crucial for selecting the right options to suit your trading objectives.

Essential Order Types

There are various order types in option trading, each tailored to specific trading strategies. Market orders execute trades at the best available market price, while limit orders allow you to set a specific price at which you want to buy or sell an option. Stop orders trigger trades automatically when the underlying asset reaches a predefined price level, helping you manage risk.

Risk Management Techniques

Option trading involves inherent risk, which can be mitigated with sound risk management practices. Hedging involves combining different options strategies to offset potential losses. Stop-loss orders can limit downside风险, while position sizing ensures you don’t expose too much capital to any single trade.

Tips for Successful Option Trading with HDFC Sec

-

Educate yourself: Familiarize yourself with options terminology, strategies, and market dynamics.

-

Start with a paper trading account: Practice your trading strategies without risking real capital.

-

Choose liquid options: Opt for options with high trading volumes to ensure fair pricing and liquidity.

-

Set realistic profit targets: Don’t overestimate your potential profits and avoid chasing unrealistic returns.

-

Manage emotions: Stay disciplined and avoid making impulsive trading decisions driven by fear or greed.

Conclusion:

Option trading with HDFC Sec offers a wealth of opportunities for investors of all experience levels. By embracing the knowledge and strategies outlined in this guide, you can harness the power of this unique financial instrument to enhance your portfolio performance. Remember, successful option trading requires a blend of knowledge, skill, and discipline. With HDFC Sec as your trusted ally, you’re well-equipped to navigate the intricacies of options trading and unlock the gateway to financial growth.

Image: demataccountopen.com

Option Trading Hdfc Sec

Image: www.youtube.com