Image: www.youtube.com

Introduction

The world of financial markets is vast and can be daunting for many, but options trading stands as a beacon of opportunity for savvy investors. HDFC Securities, a leading brokerage firm in India, offers a comprehensive platform that empowers both novice and experienced traders to navigate the intricacies of options strategies. In this comprehensive guide, we delve into the fascinating world of options trading with HDFC Securities and unveil the secrets to maximizing your profits.

Options Trading: A Path to Financial Independence

Simply put, options are financial instruments that allow you to speculate on the future price movements of underlying assets like stocks, commodities, and indices. Unlike futures, options provide traders with the flexibility to exercise their contracts (buy or sell the underlying asset) at a predetermined price within a specified time frame. This inherent leverage and flexibility offer traders the potential for substantial returns.

Choosing HDFC Securities: The Brokerage of Choice

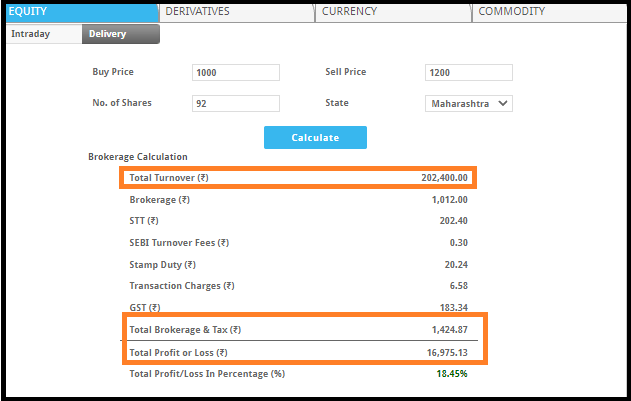

HDFC Securities stands as the ideal partner for your options trading journey. Their robust platform and diverse range of offerings cater to every level of expertise. HDFC Securities’ brokerage fees are transparent and competitive, ensuring you retain more of your hard-earned profits. Additionally, their in-depth market analysis and proprietary trading tools provide you with the edge you need to make informed decisions.

Embarking on Your Options Trading Adventure

To embark on your options trading adventure with HDFC Securities, you must first open an account. The process is straightforward and can be completed online. Once your account is set up, you’ll have access to a wide range of trading tools and educational resources designed to guide you through the intricacies of options strategies.

Trading Strategies for Success

Options trading encompasses a vast array of strategies, each with distinct risk-reward profiles. Some popular strategies include:

- Call options: Betting on a stock’s potential to rise in price.

- Put options: Hoping for a stock’s value to fall.

- Straddles: Combining call and put options to hedge bets on either a stock’s upward or downward movement.

- Strangles: Using out-of-the-money call and put options to capture potential market volatility.

Expert Insights

“Options trading is not a get-rich-quick scheme,” cautions financial expert Samir Modi. “It requires a deep understanding of market dynamics and a disciplined approach to risk management.” Market volatility can lead to substantial gains but also exposes traders to potential losses. Therefore, it is imperative to approach options trading with a well-defined strategy and a willingness to learn from your experiences.

Conclusion

HDFC Securities provides an unparalleled platform for options traders of all levels. Their competitive fees, robust trading tools, and educational resources empower you to pursue financial success. By mastering options strategies and implementing prudent risk management, you can unlock the full potential of this exciting investment arena. Remember, knowledge and discipline are key to maximizing profits and minimizing losses in the dynamic world of options trading.

Image: www.slideshare.net

Brokerage For Options Trading In Hdfc Securities

Image: www.adigitalblogger.com