Traversing the volatile waters of stock markets, savvy investors often seek strategies to maximize returns while mitigating risks, and options trading looms as a formidable tool in their arsenal. Options, granting the holder the right but not obligation to buy or sell an underlying asset, empower traders with flexibility and the potential for significant profits. This comprehensive guide delves into the intricacies of options trading, illuminating its advantages, risks, and nuances in the context of the tech behemoth, Apple (AAPL).

Image: fastoptionstrading.blogspot.com

Deciphering Options Trading: A Dual-Edged Sword

Options trading entails the purchase or sale of contracts representing the underlying asset, in this case, AAPL shares. Two primary types of options exist: calls (right to buy) and puts (right to sell). Traders can speculate on the stock’s price movement by acquiring calls (betting on a rise) or puts (anticipating a decline). While options offer the tantalizing possibility of lucrative returns, it’s crucial to acknowledge the inherent risks involved. The value of options is closely intertwined with the underlying stock’s price, and adverse price movements can erode or eliminate the investment’s value.

Understanding the Mechanics of AAPL Options

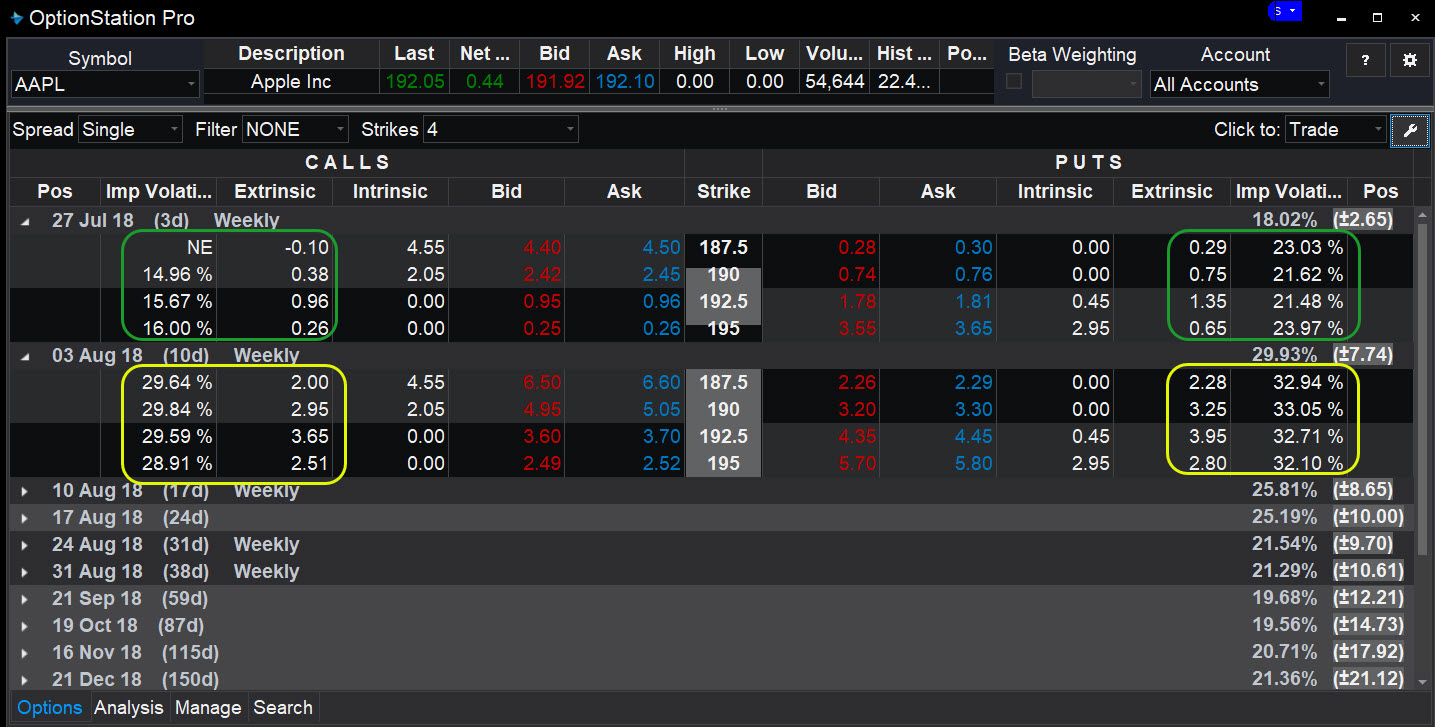

Comprehending AAPL options trading requires familiarity with key concepts. Options contracts are standardized and traded on exchanges, each featuring specific characteristics: strike price, expiration date, and premium. The strike price represents the predetermined price at which the holder can buy or sell the underlying stock if the option is exercised. The expiration date signifies the deadline by which the option must be exercised, and the premium constitutes the price paid to acquire the option contract.

Navigating the Diverse Options Strategies

The realm of options trading encompasses a kaleidoscope of strategies, each tailored to specific market conditions and investor preferences. Covered calls, for instance, involve selling call options while owning the underlying stock, aiming to generate income through premium collection. Cash-covered puts, on the other hand, entail selling put options while holding cash reserves to potentially acquire the stock at a favorable price. Moreover, spreads, involving the simultaneous purchase and sale of options with different strike prices, offer ways to fine-tune risk and reward profiles.

Image: www.tradestation.com

Real-World Examples in the AAPL Arena

To illustrate these concepts concretely, let’s examine some real-world examples in the AAPL options market. Suppose an investor anticipates a surge in AAPL’s stock price in the coming months. They could purchase a call option with a strike price slightly above the current market price and an expiration date aligned with their investment horizon. If the stock’s price rises beyond the strike price before the expiration date, the investor can exercise the option to buy the stock at the advantageous strike price, profiting from the price appreciation.

Conversely, an investor bearish on AAPL’s future prospects might opt for a put option. By selling a put option, the investor receives a premium but obligates themselves to buy the stock at the strike price if the price falls below that level before the expiration date. Should the stock’s price indeed decline, the investor can profit from the difference between the strike price and the lower market price.

Embracing Risk Management for Prudent Trading

While options trading presents alluring opportunities, it’s imperative to embrace robust risk management practices to safeguard capital. Meticulously assessing risk tolerance, setting clear trading limits, and adhering to disciplined execution are fundamental principles in this arena. Moreover, familiarity with concepts like delta, gamma, and theta enhances traders’ comprehension of option price sensitivity to underlying stock movements, volatility, and time decay.

Options Trading Aapl

Image: www.youtube.com

Conclusion: Unlocking the Potential of AAPL Options

Options trading presents a versatile and potentially lucrative avenue for investors seeking to navigate the complexities of stock markets. By understanding the intricacies of AAPL options, traders can craft tailored strategies aligned with their risk tolerance and investment objectives. However, it’s equally crucial to recognize the inherent risks associated with options trading and adopt prudent risk management practices. Embracing these principles empowers investors to harness the full potential of AAPL options trading, enhancing their chances of financial success while mitigating potential pitfalls.