Discover the Thrilling World of AAPL Option Trading

In the ever-evolving financial landscape, where swift decisions and meticulous planning collide, options trading has emerged as a compelling tool for savvy investors seeking to maximize their returns. Among the multitude of options available, those derived from the illustrious Apple Inc. (AAPL) stand apart as a lucrative opportunity. This comprehensive guide will delve into the intricacies of AAPL options trading, empowering you with the knowledge and strategies to navigate this dynamic market.

Image: twitter.com

Understanding AAPL Options: The Foundation

Options contracts, in essence, represent agreements between two parties, conferring the right but not the obligation to buy or sell an underlying asset at a specified price and expiration date. In the case of AAPL options, the underlying asset is Apple’s renowned stock. There are two primary types of options: calls and puts. Call options grant the buyer the right to purchase a predetermined number of shares at a specified strike price, while put options bestow the right to sell. The strike price represents the agreed-upon price at which the transaction will occur if the option is exercised. These contracts provide a means to gain exposure to AAPL’s stock performance without directly owning the underlying shares.

Deciphering the Option Chain: A Path to Clarity

The option chain is a tabular representation of all available options contracts for a specific underlying asset, organized by expiration date and strike price. This dynamic matrix provides valuable insights into the market’s sentiment and expected volatility. Each option contract is characterized by its unique symbol, price, and Greek letters that measure its sensitivity to various factors. Understanding how to navigate the option chain is essential for making informed trading decisions.

Strategies for Trading AAPL Options: Maximizing Returns

The versatility of AAPL options empowers traders with a wide array of strategies to capitalize on market movements. Covered calls involve selling call options against shares of AAPL that the trader owns. This strategy generates income from the premium received while limiting potential upside if Apple’s stock price rises beyond the strike price. Conversely, buying calls allows traders to speculate on the potential appreciation of AAPL’s stock, with the potential for substantial gains if the underlying price increases sufficiently. Put options offer opportunities to hedge against downside risk or speculate on price declines. Selling puts obligates the seller to purchase shares of AAPL at the strike price if the option is exercised, while buying puts confers the right to sell shares at the agreed-upon price.

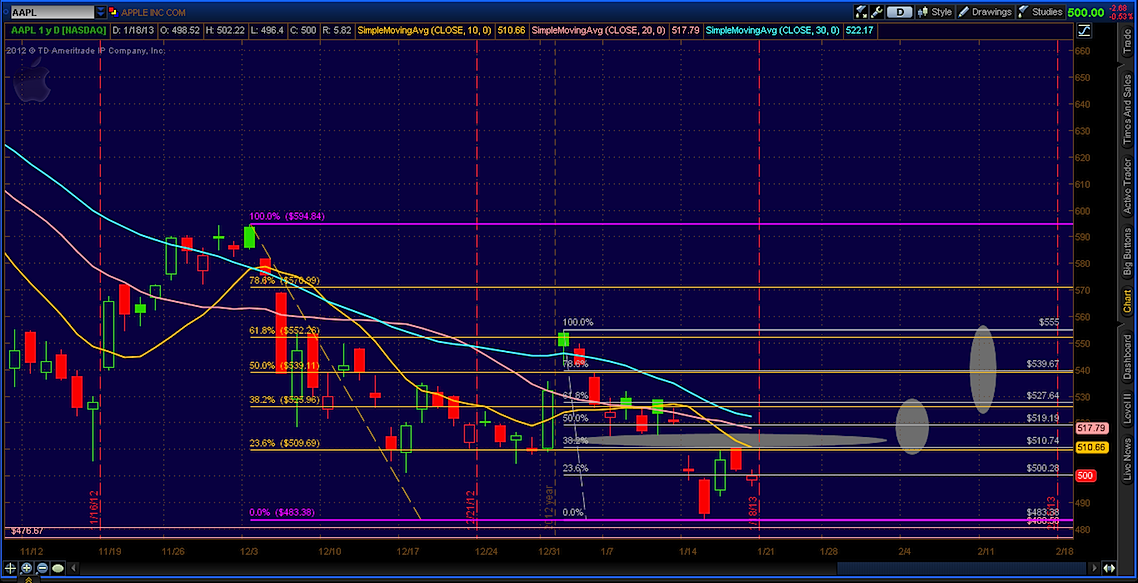

Image: www.seeitmarket.com

Expert Insights: Wisdom from the Titans

“AAPL options trading is a double-edged sword. It can amplify your potential profits, but it also carries the risk of substantial losses,” cautions renowned investor Warren Buffett. “The key lies in understanding your risk tolerance and employing prudent strategies that align with your financial goals.”

“Thorough research and technical analysis are imperative before trading AAPL options,” advises Mark Cuban, renowned entrepreneur and investor. “Don’t chase after quick profits. Develop a well-defined strategy and stick to it.”

Trading Aapl Options

https://youtube.com/watch?v=XTGId_70Bcg

Conclusion: Embracing Calculated Risks for Potential Rewards

Trading AAPL options presents a thrilling opportunity for investors to participate in the dynamic fluctuations of Apple’s stock. By comprehending the fundamentals of options contracts, navigating the option chain, and employing well-conceived strategies, traders can harness the potential for significant returns. However, it’s essential to proceed with caution, meticulously assess risks, and seek guidance from reputable sources before venturing into this captivating yet challenging realm. Remember, the financial markets are a perpetual tapestry of risk and reward, and success often favors those who approach it with both wisdom and audacity.