In the realm of financial markets, where fortunes are won and lost in the blink of an eye, Apple Inc. (AAPL) stands as a beacon of innovation and growth. Its iconic products and services have captivated consumers worldwide, making it one of the most valuable companies on the planet. For savvy investors, Apple options present a unique opportunity to harness the power of this tech giant’s financial prowess. This comprehensive guide will equip you with the knowledge and strategies to confidently navigate the thrilling world of day trading AAPL options, empowering you to make informed decisions and potentially reap significant gains.

Image: tujogim.web.fc2.com

Understanding Apple Options and Day Trading

Options trading involves the buying and selling of contracts that give the buyer the right, but not the obligation, to buy (in the case of call options) or sell (in the case of put options) an underlying asset at a predetermined price (known as the strike price) on or before a specific date (known as the expiration date). Day trading refers to a trading strategy where traders enter and exit positions within a single trading day, with the aim of profiting from short-term price movements.

The Allure of AAPL Options

Apple options stand out as an attractive choice for day traders due to several compelling reasons:

-

High Liquidity: Apple is one of the most heavily traded stocks in the world, ensuring ample liquidity in its options market, which translates to tight spreads and lower transaction costs.

-

Volatility: The inherent volatility of AAPL stock, driven by product releases, earnings reports, and market sentiment, provides day traders with ample opportunities to capitalize on price fluctuations.

-

Market Dominance: Apple’s dominant position in the tech industry and its loyal customer base offer a degree of stability not often found in other stocks, reducing the risk of sudden or drastic price swings.

Essential Strategies for Day Trading AAPL Options

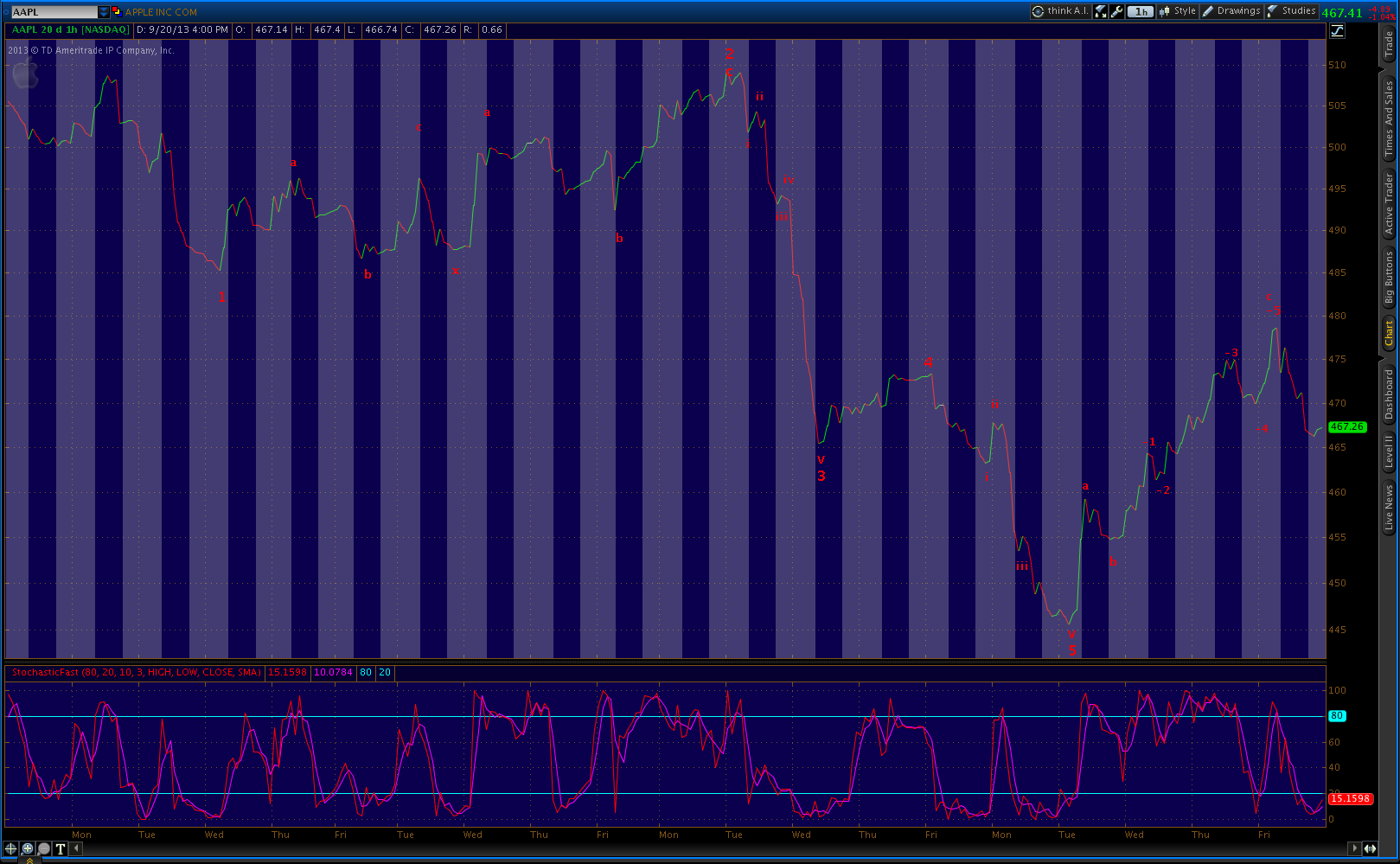

Trend Following: Identifying and capitalizing on prevailing market trends is a cornerstone of successful day trading. By analyzing historical price charts and using technical indicators, traders can determine the overall direction of the stock and enter positions that align with the trend.

Range Trading: For stocks like AAPL that tend to trade within well-defined ranges, traders can employ range trading strategies. This involves buying at or near the lower end of the range and selling at or near the upper end, capturing profits from repeated price swings within a predictable pattern.

Breakout Trading: Breakout trading involves identifying significant price breakouts from support or resistance levels. Once a breakout occurs, traders can buy or sell options that capitalize on the subsequent momentum.

Image: evolvedtrader.com

Mastering the Art of Option Selection

Choosing the right options for your day trading strategy is crucial to maximizing your potential returns. Consider the following factors when selecting AAPL options:

-

Strike Price: The strike price should be carefully selected based on the expected price movement and your risk tolerance. In-the-money options offer a higher probability of success but come at a higher premium.

-

Expiration Date: The expiration date determines the time frame within which your options contract is valid. Choose an expiration date that aligns with your trading strategy and market outlook.

-

Premium: The premium, which represents the cost of purchasing an option, should be weighed against the potential gains. A higher premium implies a higher potential return but also a higher risk.

Managing Risk and Maximizing Returns

Risk management is paramount to sustainable success in day trading AAPL options. Employ the following strategies to mitigate risk and enhance returns:

-

Stop-Loss Orders: Placing stop-loss orders limits your potential losses by automatically selling your options if the price moves against you beyond a predetermined threshold.

-

Position Sizing: Determine the appropriate number of contracts to trade based on your account size and risk tolerance. Avoid overleveraging your account, as this can lead to catastrophic losses.

-

Diversification: Diversify your option portfolio by trading options with different strike prices and expiration dates. This reduces the impact of any single trade on your overall profitability.

Day Trading Aapl Options

Image: www.youtube.com

Embracing the Thrill of Day Trading AAPL Options

Delving into the world of day trading AAPL options can be exhilarating, but it is essential to approach this endeavor with a clear understanding of the risks and rewards involved. By equipping yourself with knowledge, developing sound trading strategies, and practicing risk management techniques, you can navigate the complexities of this dynamic market and potentially unlock significant financial rewards. Remember, trading is not a spectator sport – it’s an active pursuit that requires ongoing learning, self-discipline, and a passion for financial markets.