Options trading involves the buying and selling of options contracts, financial instruments that derive their value from the underlying asset they represent. Among the various Greek letters used to describe the characteristics of options, Vega measures the sensitivity of an option’s price to changes in implied volatility. Understanding Vega is crucial for options traders seeking to mitigate risk and maximize returns in their trading strategies.

![Vega in Options Trading? [The Volatility Greek Explained]](https://investingfuse.com/wp-content/uploads/2022/07/vega.png)

Image: investingfuse.com

Vega Unveiled: The Impact of Volatility

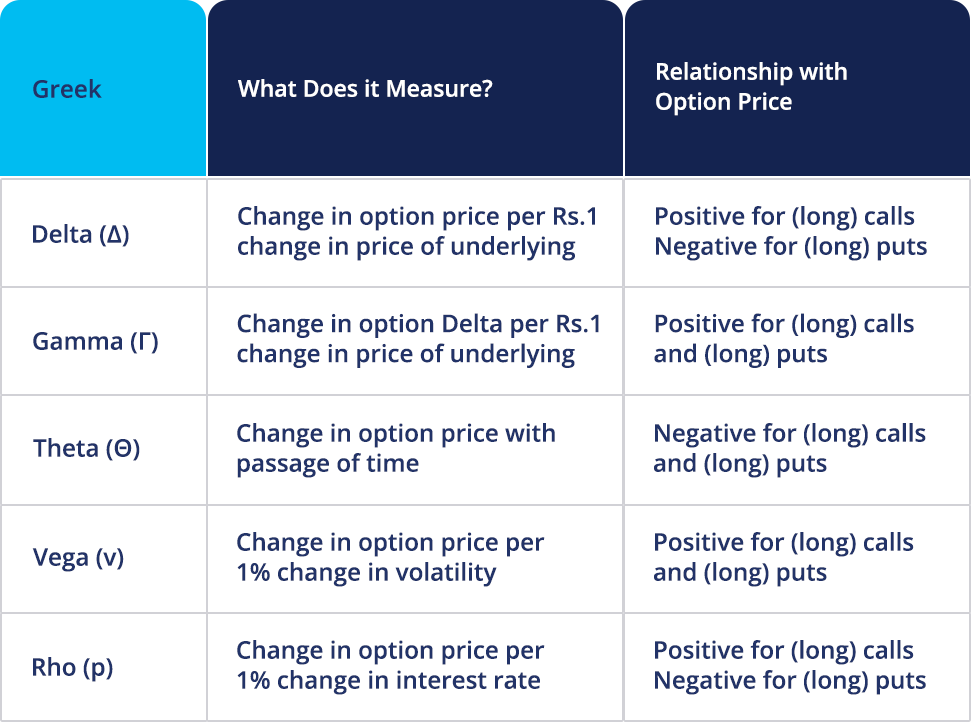

Vega quantifies the change in the price of an option for a 1% increase in implied volatility. Implied volatility, in turn, represents the market’s perception of the future volatility of the underlying asset. Generally speaking, options with longer expirations and higher volatility will exhibit higher Vega.

Consider an example to grasp Vega’s effect. Suppose we have a call option with a strike price of $100 and an expiration date three months out. If the implied volatility rises from 20% to 21%, the call option’s price will increase, assuming all other factors remain constant. This is because the market is now pricing in a higher probability of the underlying asset experiencing significant price movements in the future, making the option more valuable.

Vega’s Role in Options Trading

Understanding Vega is vital for several reasons in options trading:

-

Pricing Options: Vega helps determine the fair value of an option contract, considering its sensitivity to volatility. Traders can use Vega to refine their pricing models and make informed decisions about option premiums.

-

Hedging Strategies: By calculating Vega, traders can construct hedging strategies to manage risk exposure to changes in implied volatility. Options with positive Vega can be used to offset the impact of negative Vega positions in a portfolio.

-

Trading Volatility: Speculative traders can use Vega to trade on implied volatility itself. Buying options with high Vega positions when implied volatility is expected to rise can yield significant returns.

Vega’s Volatility: Unpredictability at Play

While Vega provides insights into the sensitivity to volatility, it’s essential to recognize that implied volatility is inherently unpredictable. Market sentiments, news events, and macroeconomic factors can lead to sudden shifts in implied volatility, affecting option prices and potentially resulting in losses for traders.

Traders should approach Vega with a cautious mindset, acknowledging that it doesn’t guarantee future performance. It’s one piece of the puzzle when analyzing options and should be used in conjunction with other Greek letters and market intelligence for well-rounded decision-making.

Image: www.paytmmoney.com

Options Trading Vega Explained

Image: www.youtube.com

Conclusion: Vega’s Significance Unveiled

Vega plays a pivotal role in the understanding and trading of options. It measures an option’s price sensitivity to changes in implied volatility, allowing traders to assess risk, modify pricing models, and create hedging strategies. While Vega provides valuable insights, traders should approach it with caution, recognizing the unpredictable nature of volatility. By mastering the art of Vega, options traders can navigate the complexities of the market and potentially increase their chances of success in the dynamic world of options trading.