Vega, a crucial Greek letter in options trading, measures the sensitivity of an option’s price to changes in implied volatility. Understanding how Vega works can empower options traders to make informed decisions and maximize potential profits.

Image: www.truedata.in

Delving into the Role of Vega in Options Trading

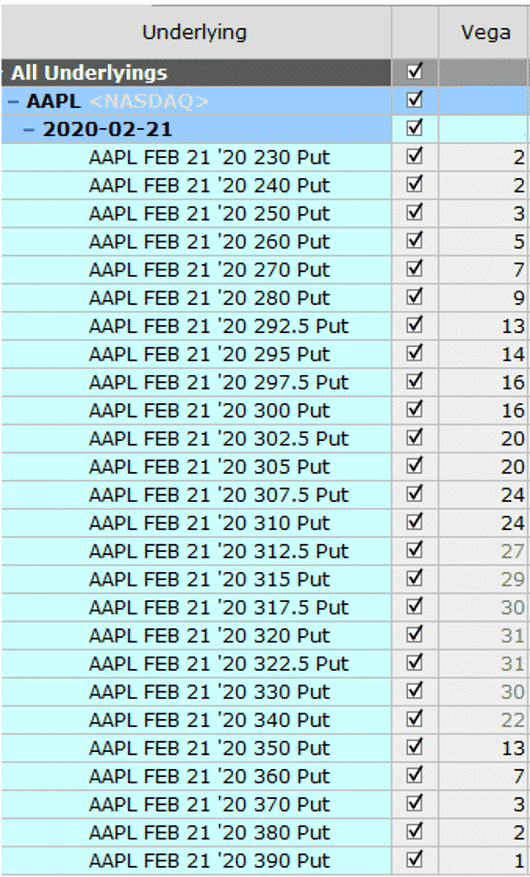

Vega represents the rate at which an option’s price changes for every 1% increase or decrease in implied volatility. Implied volatility, in turn, reflects the market’s expectations of future price movements in the underlying asset. As implied volatility rises, options with positive Vega gain value, while those with negative Vega lose value.

Leveraging Vega in Options Trading Strategies

Traders can utilize Vega to their advantage by incorporating the following strategies:

-

Buying vega-positive options: When traders anticipate an increase in implied volatility, they can buy options with positive Vega to profit from the potential appreciation.

-

Selling vega-negative options: Alternatively, if traders expect a decline in implied volatility, they can sell options with negative Vega to generate potential income.

Mastering Vega for Profitable Options Trading

Acquiring a solid understanding of Vega empowers traders to navigate the options market effectively. By integrating Vega into their trading strategies, traders gain a nuanced perspective on volatility and can optimize their trades accordingly.

-

Monitoring implied volatility: By keeping track of implied volatility and its historical trends, traders can make informed decisions about the timing and direction of their Vega trades.

-

Managing Vega risk: Traders should carefully manage their exposure to Vega by diversifying their portfolio and employing risk management techniques such as stop-loss orders.

-

Applying Vega calculations: To calculate Vega, traders can use the formula (∂OptionPrice/∂IV)*Notional, where ∂OptionPrice is the change in option price, ∂IV is the change in implied volatility, and Notional is the face value of the option contract.

Image: optionstradingiq.com

The Latest Trends and Developments in Vega

In recent years, Vega has gained significant attention due to several factors:

-

Increased market volatility: Heightened volatility has amplified the impact of Vega on options pricing, making it an indispensable tool for traders.

-

Growth of volatility-related strategies: The rise of strategies like volatility targeting and volatility arbitrage has fueled demand for in-depth Vega analysis.

Expert Tips and Advice for Profitable Vega Trading

-

Seek professional guidance: Consult with experienced options traders or financial advisors to deepen your understanding of Vega and its implications.

-

Stay updated with market news: Monitor market developments and economic news that may influence implied volatility, thereby affecting Vega.

-

Practice risk management: Prioritize risk management by using protective stops, monitoring position sizes, and diversifying your Vega exposure.

Frequently Asked Questions about Vega in Options Trading

-

Q: What is the significance of Vega in options trading?

A: Vega measures the sensitivity of an option’s price to changes in implied volatility. -

Q: How can I utilize Vega in my trading strategies?

A: You can buy vega-positive options if you anticipate an increase in implied volatility or sell vega-negative options if you expect a decline. -

Q: What are the potential risks associated with trading Vega?

A:Vega risk can arise from unpredictable volatility changes, so traders should manage their exposure and use risk management techniques.

How To Use Vega In Options Trading

Conclusion

Embracing Vega in options trading empowers traders to make more informed decisions. By leveraging Vega strategies, monitoring implied volatility, and employing risk management techniques, traders can maximize their profit potential and navigate the options market with confidence.

Are you ready to elevate your options trading skills and leverage Vega to enhance your profitability? Explore Vega further and discover the endless possibilities it offers.