Embracing the Force of Volatility

In the ever-shifting financial landscape, volatility is an inescapable force that can both cripple and empower traders. The Vega option trading strategy harnesses this formidable power, providing investors with a tool to mitigate risk and capitalize on market fluctuations. By understanding the intricate workings of Vega, traders can transform volatility from a perilous threat into a lucrative opportunity.

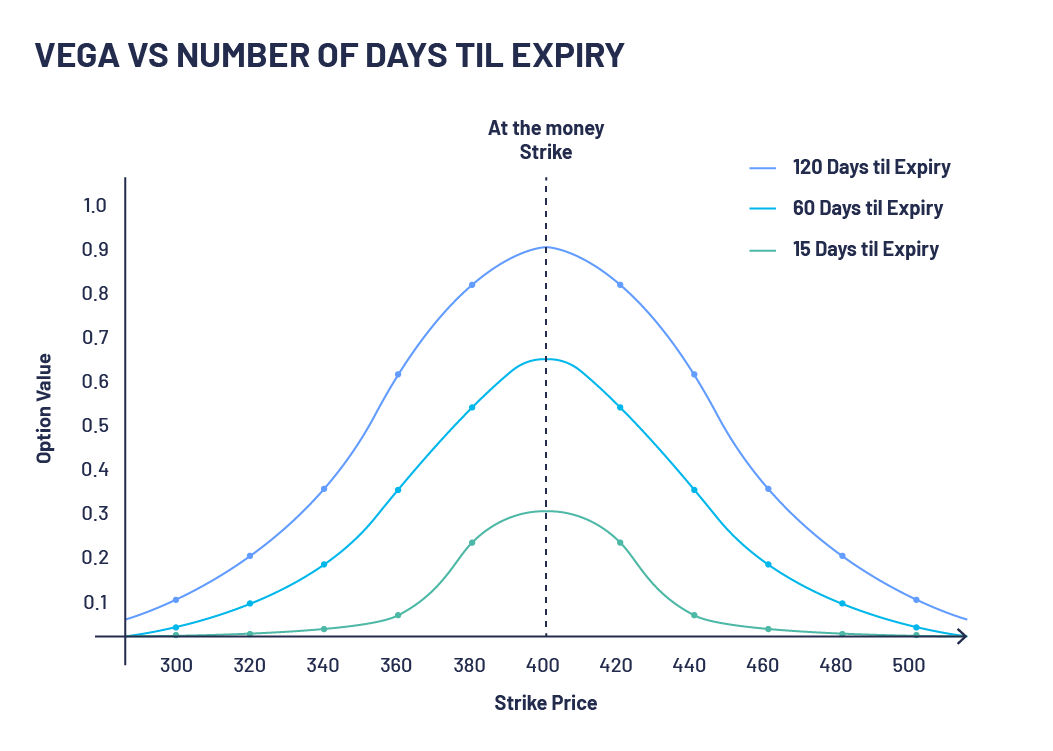

Image: optionsdesk.com

What is Vega?

Vega is a Greek letter that measures the sensitivity of an option’s price to changes in implied volatility. The higher the Vega, the more the option’s price will change for each unit change in implied volatility. Volatility is essentially the market’s perception of the magnitude of future price swings and has a significant impact on option premiums.

Vega’s Role in Option Trading

When implied volatility rises, the prices of options with positive Vega increase, while those with negative Vega decrease. This provides traders with the flexibility to adjust their strategies based on their volatility outlook. For instance, investors bullish on volatility can purchase options with high positive Vega to amplify their potential gains, while those bearish on volatility may seek options with negative Vega to limit their downside exposure.

Trading Strategies Utilizing Vega

Understanding the mechanics of Vega enables traders to craft sophisticated strategies that leverage volatility. Here are a few examples:

-

Vega Risk Position: This strategy involves purchasing or selling options with a high Vega to capitalize or hedge against significant volatility fluctuations. Higher Vega values amplify potential returns, but also magnify risk.

-

Diversification: Traders can mitigate portfolio risk by combining options with varying Vega values. This approach diversifies volatility exposure, reducing the impact of large price swings in any one direction.

-

Volatility Trading: Traders can profit from implied volatility by selling options with high Vega when volatility is anticipated to decline, or purchasing options with positive Vega when a spike in volatility is expected.

Image: www.youtube.com

Expert Insights for Effective Trading

Mastering Vega demands a nuanced understanding and strategic implementation. Here are some expert tips to guide your Vega trading endeavors:

-

Study Volatility History: Analytically examine historical volatility data to forecast future market behavior and refine your Vega trading strategies accordingly.

-

Assess Market Sentiment: Gauge the collective sentiment of market participants through forums, news outlets, and social media platforms to ascertain the prevailing volatility outlook.

-

Manage Risk Prudently: Implement proper risk management techniques, such as position sizing and stop-loss orders, to protect your capital from extreme price swings.

Frequently Asked Questions on Vega

Q: Why is Vega important in option trading?

A: Vega measures the sensitivity of an option’s price to changes in implied volatility, enabling traders to adjust their strategies based on their volatility outlook.

Q: How can traders utilize Vega in practice?

A: Traders can employ Vega trading strategies such as Vega risk positions, diversification, and volatility trading to leverage or hedge against volatility fluctuations.

Q: What are the potential risks associated with Vega trading?

A:Vega amplifies the impact of volatility on option prices, increasing both potential profits and losses. Risk management measures are crucial to mitigate these risks.

Theat Vega Option Trading Strategy

Image: www.youtube.com

Conclusion: Embracing Volatility with Vega

The Vega option trading strategy empowers traders with a sophisticated tool to navigate the complexities of financial markets. By harnessing the force of volatility, investors can transform uncertainty into opportunity. With a comprehensive understanding of Vega, effective strategy implementation, and prudent risk management, traders can unlock the full potential of this versatile strategy.

Are you ready to embrace the dynamic world of Vega option trading and conquer the volatility landscape?