In the dynamic world of options trading, understanding volatility is crucial. Vega, a Greek letter measure, serves as the volatility barometer, providing valuable insights into how the option’s price aligns with changes in implied volatility (IV). Join us as we delve into the fascinating realm of Vega, exploring its significance and practical applications.

Image: www.motilaloswal.com

What is Vega?

Vega measures the sensitivity of an option’s price to a one-point change in IV. It quantifies the potential gain or loss in option value as IV fluctuates. Positive Vega indicates that the option’s price appreciates when IV increases, while negative Vega suggests a depreciation in option value as IV rises.

Vega: A Double-Edged Sword

Vega’s presence in options trading presents both opportunities and challenges:

-

Opportunities: Traders leveraging Vega can capitalize on IV movements by selecting strategies that align with their volatility expectations. For example, buying options with positive Vega positions traders to benefit from future increases in IV.

-

Challenges: Vega can amplify volatility’s impact, leading to greater risk for traders who underestimate its significance. Options with high Vega are more susceptible to rapid price swings and can lead to substantial losses if volatility fails to materialize as anticipated.

Vega’s Role in Option Strategies

Vega plays a pivotal role in various options strategies:

-

Long Vega: Traders seek to profit from rising IV by purchasing options with high positive Vega, such as call options on stocks expected to exhibit increased volatility in the future.

-

Short Vega: Aiming to safeguard against volatility decreases, traders may opt for options with negative Vega, such as selling put options on stocks anticipated to experience reduced volatility.

-

Neutral Vega: Seeking a balanced approach, traders aim to neutralize Vega impact by purchasing an equal number of options with positive and negative Vega. This strategy helps offset potential losses resulting from unexpected volatility shifts.

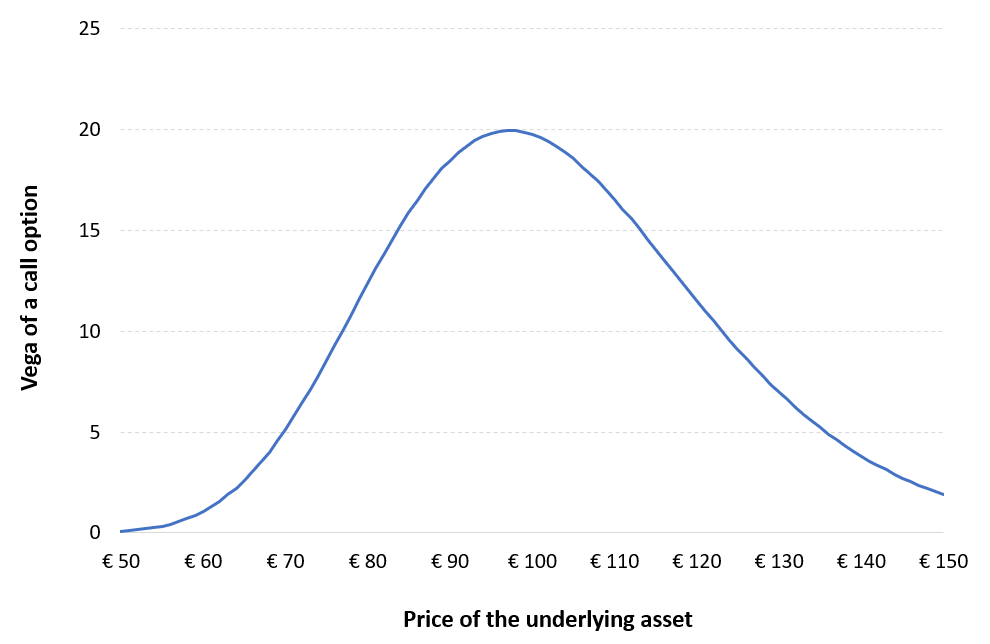

Image: www.financialtrading.com

Vega and Market Conditions

Vega’s significance varies with market conditions:

-

High Volatility Environments: Vega’s influence intensifies during periods of high volatility, as options with significant Vega can experience substantial price fluctuations.

-

Low Volatility Environments: Vega’s impact diminishes in low volatility markets, as option prices display less sensitivity to changes in IV.

Expert Insights on Vega

Industry professionals emphasize the importance of considering Vega in options trading:

“Vega is a crucial factor to monitor for options traders,” says Mark Douglas, a renowned options trading expert. “It provides invaluable insights into how options respond to volatility changes, enabling traders to adjust their strategies accordingly.”

“Traders new to Vega should proceed with caution,” advises Dr. Richard Sincere, a professor of financial management. “Vega can amplify volatility’s effects, leading to unexpected losses if not managed properly.”

Vega In Options Trading

Image: www.simtrade.fr

Conclusion

Vega empowers options traders with a powerful tool to assess volatility’s impact. By understanding Vega’s role and incorporating it into their trading strategies, traders can navigate the complexities of the options market with greater confidence. Remember to exercise prudence when dealing with Vega, as volatility remains a double-edged sword in options trading.