Vega: Harnessing Volatility for Options Trading Profits

Image: www.financialtrading.com

Introduction

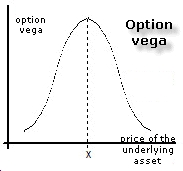

In the exhilarating realm of options trading, understanding the intricacies of Vega unlocks a treasure-trove of opportunities. Vega measures the sensitivity of an option’s price to changes in implied volatility. Embracing this enigmatic parameter empowers traders to craft nuanced strategies that capitalize on market volatility.

Deciphering Vega

Implied volatility, a crucial metric in options pricing, encapsulates the market’s collective perception of future price movements. Vega quantifies the impact of implied volatility shifts on option premiums. Positive Vega indicates that an option’s value will rise as implied volatility increases, while negative Vega signifies the inverse relationship.

Leveraging Vega

Savvy traders exploit Vega to amplify potential profits or hedge against risk. When implied volatility is expected to surge, traders can strategically purchase options with high Vega to capture the upswing in premiums. Conversely, if volatility is predicted to decline, selling options with negative Vega can offset potential losses.

Practical Applications

Consider an investor bullish on Apple’s stock. To capitalize on expected price appreciation, they purchase an Apple call option with positive Vega. As market volatility escalates, the option’s premium skyrockets, multiplying their gains.

Conversely, an investor anticipating a decline in Amazon’s stock price may sell an Amazon put option with negative Vega. If volatility plunges, the option’s value plummets, mitigating the investor’s potential losses.

Expert Insights

“Vega is a double-edged sword,” cautions options veteran John Carter. “While it can amplify gains, it can also magnify losses.” He emphasizes the importance of carefully evaluating implied volatility forecasts before incorporating Vega into trading strategies.

Actionable Tips

- Monitor Implied Volatility: Track implied volatility trends and forecasts to gauge potential price movements.

- Choose Options with Appropriate Vega: Select options with Vega values aligned with your volatility expectations.

- Use Vega as a Complement: Combine Vega with other technical indicators to enhance decision-making.

Conclusion

Vega, a powerful tool in the options trader’s arsenal, empowers individuals to navigate the complexities of volatility and capitalize on its fluctuations. By embracing Vega’s intricacies and combining it with expert insights, traders can unlock the potential for remarkable profits while mitigating risks. Remember, the journey to trading mastery begins with unpacking the mysteries of Vega.

Image: www.strike.money

How To Use Vega For Options Trading

Image: www.youtube.com