Introduction

In the realm of options trading, where risk and reward intertwine, exchange-traded spread options (XSPs) stand out as a sophisticated yet potentially lucrative strategy. XSPs allow traders to simultaneously buy and sell options of the same underlying asset but with different strike prices and expiration dates. This unique approach creates opportunities for strategic risk management and enhanced return potential.

Image: financefeeds.com

The allure of XSPs lies in their ability to provide a blend of flexibility and defined risk. Unlike traditional options, which involve a single buy or sell transaction, XSPs create a spread position with a predetermined risk-reward profile. This structured approach reduces the uncertainty associated with open-ended options and makes XSPs suitable for investors with varying risk tolerances and investment goals.

Understanding XSPs

At its core, an XSP involves the simultaneous purchase of a lower-priced option and the sale of a higher-priced option on the same underlying asset. The strike prices of the two options determine the width of the spread, which is the difference between the two strike prices. The expiration dates for the options can vary, providing flexibility in managing the spread’s duration.

There are two main categories of XSPs: bull spreads and bear spreads. Bull spreads are typically executed when the trader anticipates an increase in the underlying asset’s price, while bear spreads benefit from a decline in price. By carefully selecting the strike prices and expiration dates of the options, traders can tailor their XSPs to suit their market outlook and risk appetite.

Types of Bull Spreads

Bullish XSPs aim to profit from upward price movements. The most common type of bull spread is the call spread, which involves buying a lower-priced call option and selling a higher-priced call option with the same expiration date. The profit potential for a call spread is limited to the premium difference between the two options, minus the transaction fees.

Other bull spread strategies include the diagonal bull spread and the calendar bull spread. Diagonal bull spreads combine call options with different expiration dates, while calendar bull spreads use call options with different strike prices but the same expiration date. These variations allow for greater flexibility in managing risk and capturing market opportunities.

Trading XSPs

The key to successful XSP trading lies in understanding the principles of risk and reward. Before executing any trade, traders should carefully consider their investment goals, risk tolerance, and market outlook. Proper analysis of technical indicators, chart patterns, and market trends can provide valuable insights into potential trading opportunities.

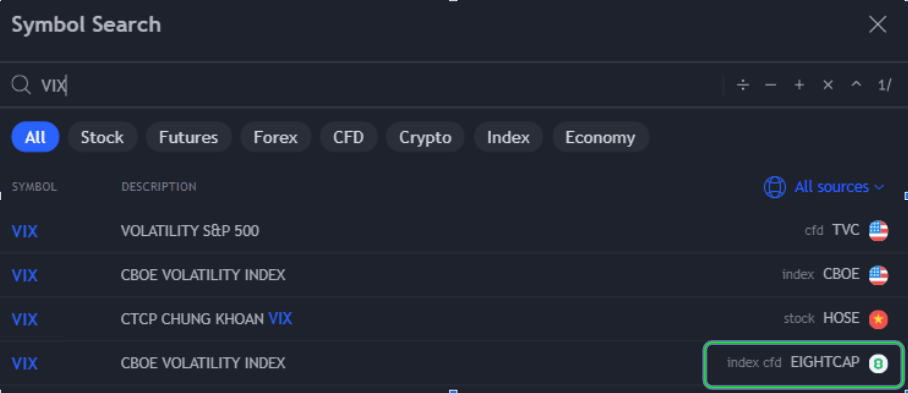

Traders can access XSPs through online brokerages that offer options trading platforms. When placing an XSP order, traders specify the underlying asset, the type of spread (bull or bear), the strike prices of the options, the expiration dates, and the number of contracts they wish to trade.

It’s important to note that XSPs are not without risk. Losses can occur if the market moves against the trader’s position. Therefore, prudent risk management techniques, such as setting stop-loss orders, are essential to safeguard capital.

Image: www.vocsong.com

Xsp Option Trading

Image: www.youtube.com

Conclusion

XSP options trading offers a sophisticated approach to leveraging the potential of options trading while managing risk. By understanding the principles and mechanics of XSPs, investors can unlock new opportunities for return enhancement. If executed with sound analysis and prudent risk management, XSPs can be a valuable addition to any options trading strategy.

We encourage investors to conduct thorough research, consult with financial advisors if necessary, and approach XSP trading with informed decision-making to maximize their chances of success. Embrace the challenges and rewards of XSP trading, and embark on a journey of strategic wealth creation.