In the realm of financial trading, the ability to spread your risk and enhance your profit potential is a highly sought-after skill. One such strategy that allows traders to do precisely that is known as a spread option.

Image: ragingbull.com

A spread option involves trading two or more options contracts simultaneously, where one of these options is purchased while the other is sold. This creates a market position that allows traders to benefit from price movements while managing their risk exposure.

Understanding the Basics of a Spread Option

Option Basics:

Options contracts give traders the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price (strike price) on or before a certain date (expiration date).

Spread Options:

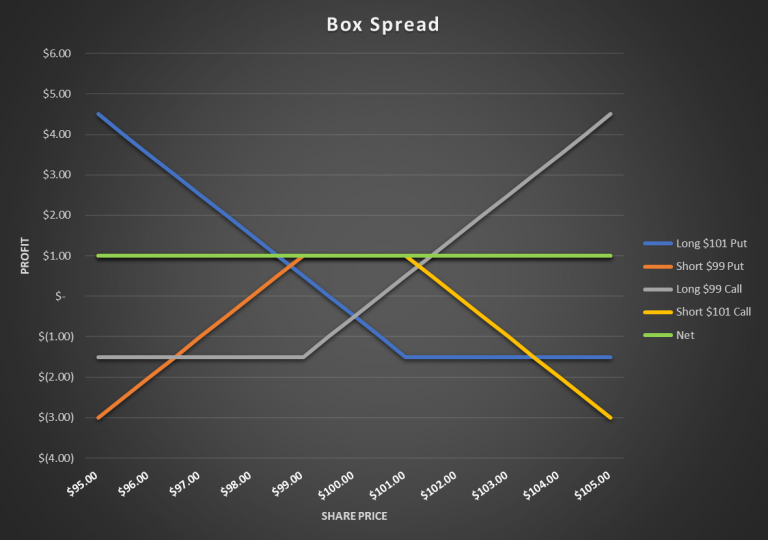

In a spread option strategy, one option is purchased while another option is sold, both with different strike prices and/or expiration dates. This creates a ‘spread’ between the two premiums paid for these options.

The profit potential of a spread option depends on the price movement of the underlying asset. Traders can profit from the price differential between the two options, even if the asset’s price does not move as anticipated.

Image: tradeoptionswithme.com

Types of Spread Options

There are several types of spread options available, each with its unique characteristics and risk/reward profile. Some common types include:

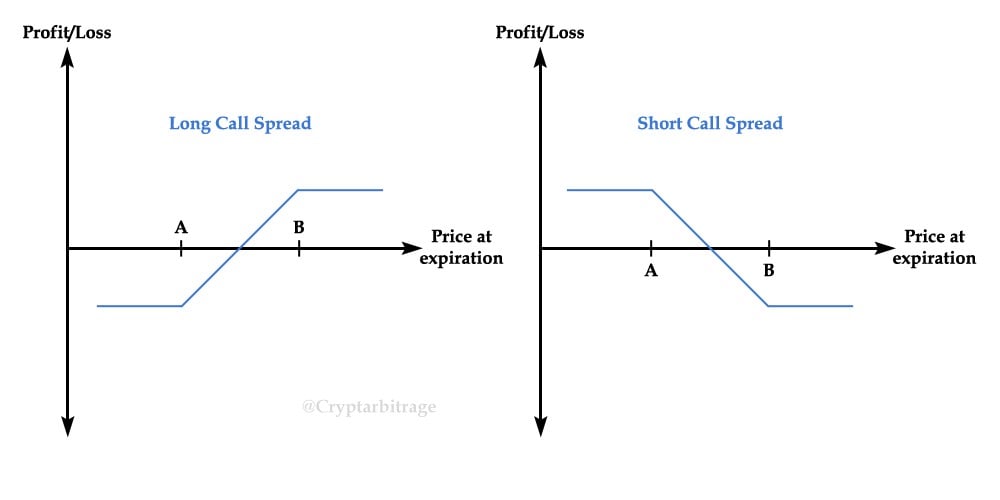

- Bull Call Spread: Buying a lower-strike call option and selling a higher-strike call option to profit from an anticipated increase in asset price.

- Bear Call Spread: Selling a lower-strike call option and buying a higher-strike call option to profit from an anticipated decline in asset price.

- Bull Put Spread: Buying a higher-strike put option and selling a lower-strike put option to profit from an anticipated decline in asset price.

- Bear Put Spread: Selling a higher-strike put option and buying a lower-strike put option to profit from an anticipated increase in asset price.

Advantages and Disadvantages of Spread Options

Advantages:

- Reduced risk: Compared to buying a single option, spread options have a lower risk as they involve buying and selling simultaneously.

- Defined risk/reward: The potential profit and loss are known upfront, allowing traders to manage their risk more effectively.

- Profit from volatility: Spread options can profit from both rising and falling asset prices, depending on the strategy employed.

Disadvantages:

- Limited profit potential: Compared to buying a single option, spread options have a lower profit potential due to the net premium paid.

- Complexity: Spread options can be complex to understand and implement, especially for beginner traders.

- Commissions and fees: Trading spread options incurs trading commissions and fees, which can erode profits.

Tips for Trading Spread Options

Trading spread options requires a thorough understanding of options, risk management techniques, and market dynamics. Here are a few tips to help you navigate this complex strategy:

- Start small: Begin trading small positions to gain experience and confidence before risking substantial capital.

- Manage risk: Determine your risk tolerance and allocate資金 accordingly. Monitor your positions closely and adjust as needed.

- Use proper tools: Utilize online trading platforms or brokers that support spread option trading and provide real-time data.

- Seek education: Continuously expand your knowledge of options and spread option strategies through books, online resources, and webinars.

FAQs on Spread Options

- What is the difference between a vertical spread and a horizontal spread?

- In a vertical spread, the options have different strike prices and the same expiration date. In a horizontal spread, the options have different expiration dates and the same strike price.

- How do I calculate the profit and loss of a spread option?

- The profit or loss is calculated as the difference between the premium received from selling the option and the premium paid to buy the other option.

- What are the risks involved in spread option trading?

- The primary risks include the potential for losses if the asset price does not move as anticipated and the time decay of options.

What Is A Spread Option In Trading

Image: insights.deribit.com

Conclusion

Spread options provide traders with a versatile and potentially profitable strategy for managing risk and enhancing returns in the financial markets. By understanding the mechanics, advantages, and disadvantages of this technique, traders can make informed decisions and implement spread options in their portfolios.

Whether you are an experienced trader or just starting to explore options, I encourage you to delve deeper into the world of spread options. With proper research and risk management, this strategy can be a valuable addition to your trading arsenal.