Unveiling the Essence of Spread Trading

Spread trading in options involves simultaneously purchasing and selling options contracts of the same underlying asset, but with different strike prices and/or expiration dates. This strategy allows traders to capitalize on price movements without the need for directional prediction. By understanding the spread concept and its nuances, traders can gain an edge in managing risk and generating returns in the complex world of options trading.

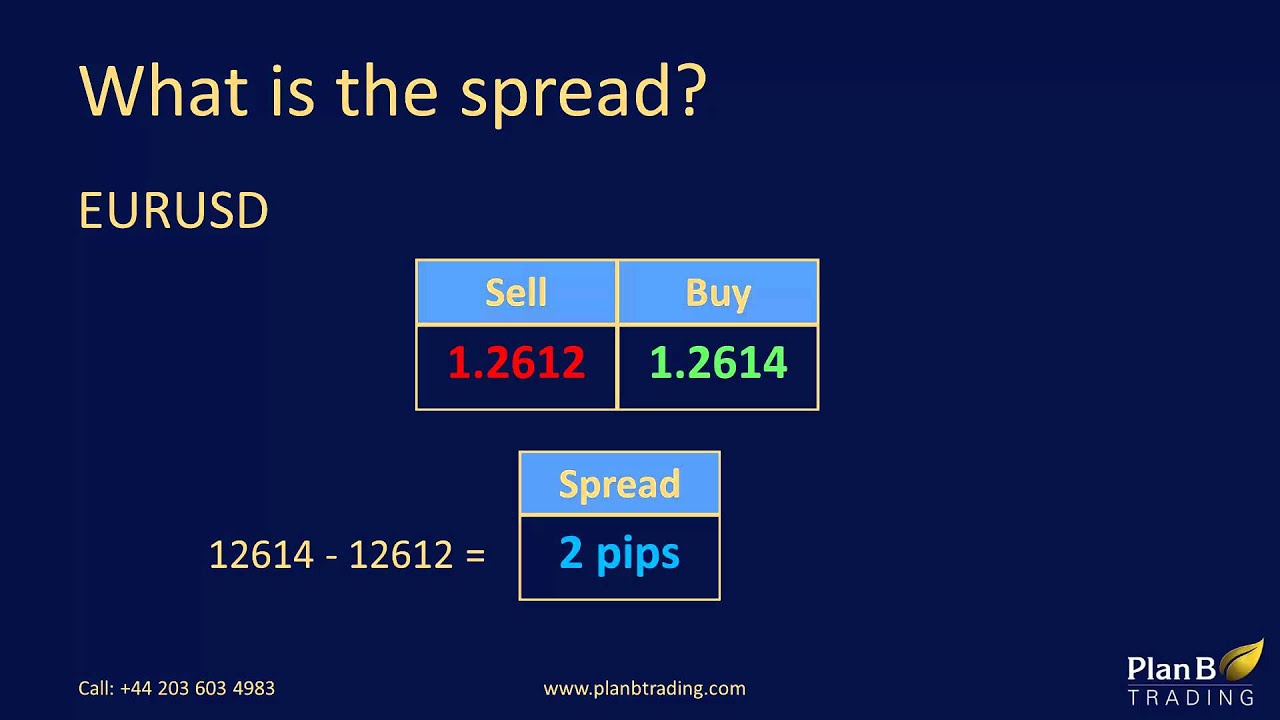

Image: www.youtube.com

Decoding Spread Types

The two primary spread types are vertical spreads and horizontal spreads. In a vertical spread, options with different strike prices but the same expiration date are combined. In a horizontal spread, options with the same strike price but different expiration dates are employed. Understanding these spreads’ dynamics empowers traders to tailor their strategies based on market conditions and risk tolerance.

Anatomy of a Spread Trade: Crafting a Profitable Strategy

Spread trading offers a versatile approach to options trading by minimizing risk and improving return potential.

Leveraging Price Movements

By simultaneously purchasing and selling options contracts, spread traders lock in a specific price range within which they expect the underlying asset to fluctuate. If the underlying asset’s price stays within this range, the trader can capture the difference between the premiums paid for the purchased and sold options, reaping a potential profit.

Image: www.youtube.com

Hedging and Managing Risk

Spread trading often serves as a hedging tool, reducing the downside risk associated with directional options strategies. By offsetting positions with opposing profit and loss profiles, traders can mitigate potential losses while still retaining the upside potential inherent in options trading.

Tips and Expert Advice from a Seasoned Trader

-

Embrace Diversification: Incorporating spread trading into your options arsenal broadens your risk-reward spectrum, reducing dependency on singular directional bets.

-

Master Strike Selection: Carefully choose the strike prices of your spreads, considering the underlying asset’s volatility and historical price action.

-

Monitor Market Developments: Stay abreast of economic news, market trends, and industry-specific events that could impact the underlying asset’s price.

-

Consider Expiration Dates: Strategically select expiration dates for your spreads based on your market outlook and risk appetite.

-

Manage Risk Prudently: Always maintain a disciplined risk management approach, employing stop-loss orders and position-sizing strategies to safeguard your capital.

Exploring the World of Spreads: A Comprehensive Guide

Butterfly Spread: This three-legged spread involves buying an ATM option and selling two OTM options (one above and one below the ATM strike price).

Calendar Spread: Traders execute a calendar spread by buying a near-term option and selling a farther-term option with the same strike price.

Condor Spread: A condor spread is a four-legged strategy involving buying an ITM option, selling a near-term OTM option, buying an ATM option, and selling a far-term OTM option.

Iron Condor Spread: An iron condor spread is a variation of the condor spread, utilizing four options with the same expiration date.

FAQ on Spread Trading: Empowering Informed Decisions

-

Q: What is the purpose of spread trading?

A: Spread trading aims to capture price movements within a defined range, limiting risk while potentially generating returns.

-

Q: How do I calculate the profit potential of a spread trade?

A: Subtract the premium paid for the sold option(s) from the premium received for the purchased option(s).

- Q: What factors should I consider when selecting options for a spread trade?

A: Consider strike prices, expiration dates, underlying asset volatility, and market conditions.

- Q: Is spread trading suitable for beginners?

A: Spread trading can be complex and requires a deep understanding of options trading. Beginners may consider practicing with paper trading before employing real capital.

Spread In Options Trading

Conclusion: Harnessing the Power of Spreads

Spread trading offers a multifaceted approach to options trading, providing traders with a powerful tool to manage risk, enhance returns, and navigate market uncertainties. By delving into the world of spreads, traders can unlock the potential of options trading and gain a competitive edge in this ever-evolving financial landscape.

Are you ready to embrace the spread strategy and explore the lucrative possibilities of options trading? Begin your journey today by learning from experienced industry professionals and implementing proven spread trading techniques.