What is a Risk Reversal Spread?

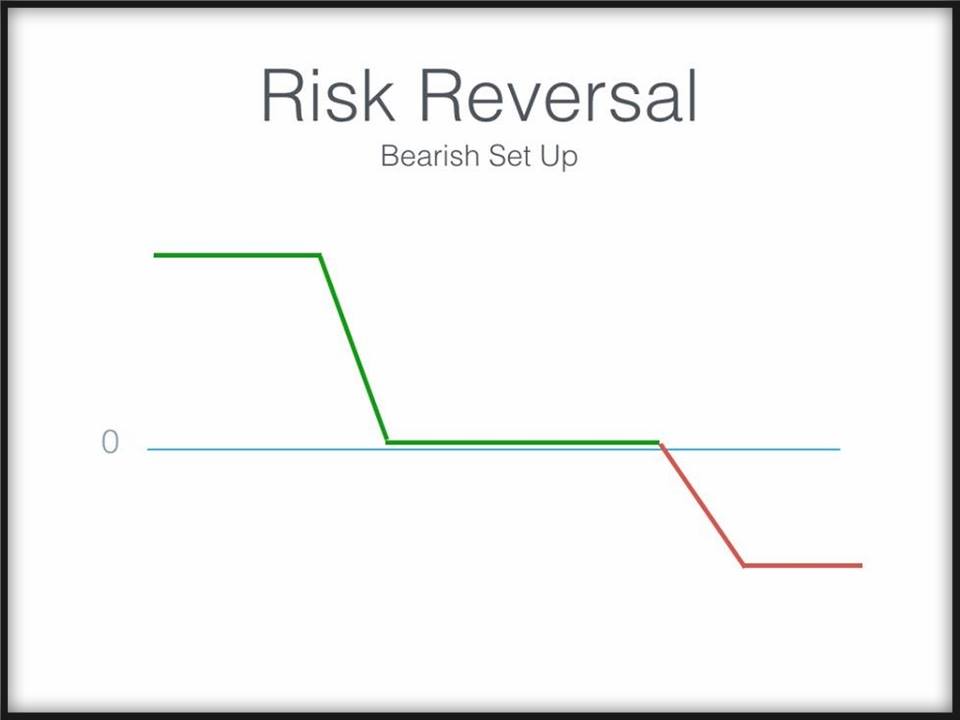

In the realm of options trading, a risk reversal spread, also known as a “synthetic put spread,” is a versatile strategy that allows traders to either enhance their bullish or bearish bias while mitigating their overall risk exposure.

Image: www.randomwalktrading.com

This strategy involves buying a deep ITM call option and simultaneously selling two OTM put options. The call option grants the trader the right to buy the underlying asset at a set price (strike price) on or before a specific date (expiration date). On the other hand, the put options confer the right to sell the underlying asset at predetermined strike prices.

Understanding the Risk and Reward

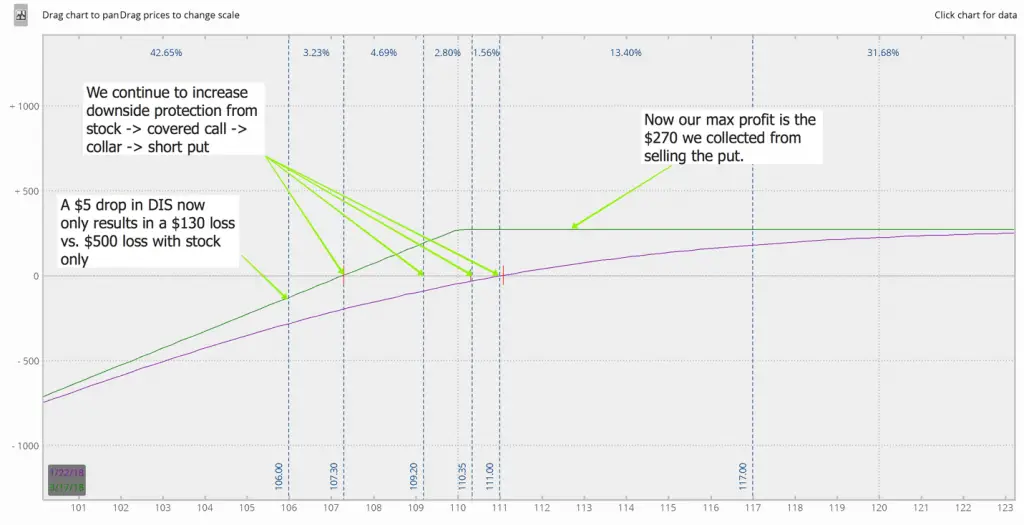

The risk reversal spread offers a combination of risk management and potential return. By implementing this strategy, traders seek to capture the premium received from selling the put options, while the purchased call option serves as a “backup plan” to protect against significant downside price movements.

The profit potential is potentially substantial if the underlying asset’s price moves significantly in the direction of the trader’s prediction. On the other hand, the maximum loss is limited to the net premium paid for the call option minus the premiums received from selling the put options.

Market Conditions for Risk Reversal Spread

This strategy can be a suitable option in specific market conditions. For a bull call risk reversal spread (RRS), it works best when the trader expects moderate to high price increases in the underlying asset. The sold put options provide a favorable premium collection and some downside protection.

Conversely, a bear RRS is ideal when the trader anticipates significant price decline. In this scenario, the trader sells two ITM put options to capitalize on the higher premium received, while purchasing an OTM call option for potential upside gains.

Tips and Expert Advice

To make the most of a risk reversal spread, it is essential to follow proven strategies:

- Choose the appropriate delta values: Select call and put options with appropriate delta values to achieve the desired risk profile.

- Hedge against volatility: Consider incorporating volatility hedging mechanisms to protect against unexpected price swings.

Image: calcfellow.medium.com

FAQs

- Q: What is the primary benefit of a risk reversal spread?

- A: The primary benefit lies in its ability to enhance potential returns while managing downside risk.

- Q: What influences the profit potential of a risk reversal spread?

- A: Profit potential hinges upon the accuracy of the trader’s market prediction, price movement, and time decay.

Complete Option Trading Guide To Risk Reversal Spread

Image: www.newtraderu.com

Conclusion

The risk reversal spread is a powerful technique in the options trading toolkit, allowing traders to adapt their strategies to dynamic market conditions. By embracing the principles outlined in this guide, traders can navigate the market with greater confidence and seize opportunities for potential growth and risk mitigation.

Are you intrigued by the potential of risk reversal spreads? Engage in the discussion below and share your thoughts on this versatile trading strategy!