An Introduction to Option Spreads

Trading option spreads can be a lucrative way to earn a living from the financial markets. In this article, we will provide a comprehensive guide to trading option spreads, covering everything from the basics to advanced strategies.

Image: www.babypips.com

What are Option Spreads?

An option spread is a strategy that involves buying and selling options at different strike prices and/or expirations. By combining these options in different combinations, traders can create a wide range of positions with different risk and return profiles.

Why Trade Option Spreads?

There are several reasons why traders opt to trade option spreads. These reasons include:

- _Leverage: Option spreads allow traders to gain significant market exposure with limited capital.

- _Risk Management: By structuring spreads, traders can mitigate the risk associated with individual options positions.

- _Flexibility: Spreads offer traders a wide range of flexibility in terms of risk, return, and position adjustment.

Mastering Option Spread Trading

Understanding Option Spread Basics

Before jumping into option spread trading, it’s crucial to have a solid understanding of the basics. This includes:

- Understanding Option Contract Types: Call and Put options give traders the right, but not the obligation, to buy or sell the underlying asset at a specific price on or before a specific date.

- Strike Price and Expiration Date: The strike price of an option represents the price at which the option can be exercised. Expiry dates determine the timeline for exercising an option.

- Option Premiums: Option premiums represent the cost associated with buying or selling an option. Premiums vary based on several factors such as market conditions and time to expiration.

Common Option Spread Strategies

There are numerous option spread strategies available, each with its own risk and return profile. Some common strategies include:

- Bull Call Spread: A bullish strategy suitable for neutral to upward markets, involving buying a call option at a lower strike price while simultaneously selling a call option at a higher strike price.

- Bear Put Spread: A bearish strategy appropriate for neutral to downward markets, comprising buying a put option at a higher strike price and selling a put option at a lower strike price.

- Straddle: A neutral strategy that benefits from high volatility, involving buying a call and a put option with the same strike price and expiration date.

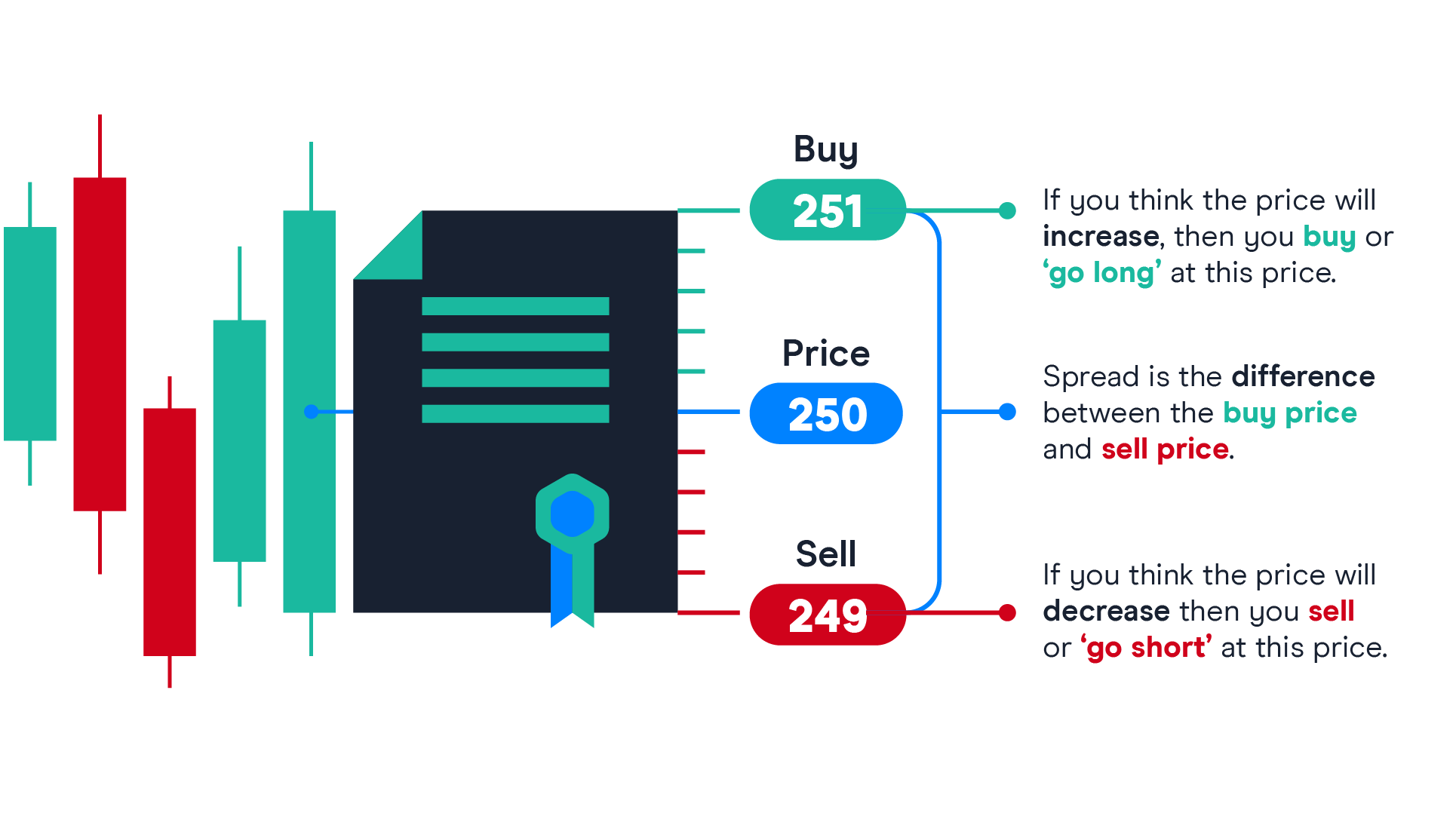

Image: www.cmcmarkets.com

Advanced Option Spread Techniques

For experienced traders seeking to elevate their spread trading strategies, more advanced techniques can be employed. These techniques include:

- Iron Condor Spread: A neutral strategy that involves selling an out-of-the-money call and put option at different strike prices while simultaneously buying an out-of-the-money call and put option at even higher strike prices.

- Butterfly Spread: A bullish or bearish strategy that involves buying an at-the-money option while selling two out-of-the-money options at different strike prices on the same side.

- Condor Spread: A neutral strategy similar to an iron condor but involves selling an at-the-money call and put option while buying two out-of-the-money options at different strike prices on each side.

FAQs on Option Spread Trading

Q: How much capital is required to trade option spreads?

As with all financial trading, the required capital depends on the size and complexity of the spread. It’s generally advisable to start small and gradually increase positions as experience grows.

Q: What is the key to successful option spread trading?

Successful spread trading hinges on precise market timing, comprehensive risk management, and a thorough understanding of market dynamics.

Trading Option Spreads For A Living

Image: www.pinterest.com.mx

Call to Action

If you’re ready to take the leap into the world of option spread trading, this article has provided you with a solid foundation. Enhance your knowledge by continuing to research, experimenting with different strategies, and seeking professional guidance when needed. Remember, trading involves risks, so approach it with prudence.

Are you interested in learning more about option spread strategies and how to implement them in your trading journey? Feel free to comment below and let’s engage in a discussion about this rewarding trading technique.