In the captivating world of options trading, a mysterious force controls the ebb and flow of every transaction: Delta. Like a secret agent in the financial markets, Delta operates discreetly yet profoundly, dictating how options prices fluctuate with the underlying asset. If you aspire to make informed decisions in the options arena, deciphering Delta’s enigmatic role is not merely advisable but absolutely essential.

Image: www.projectfinance.com

Delta: An Unwavering Guide Amidst Market Turbulence

Imagine yourself navigating a turbulent sea of financial uncertainty, where stock prices swing like unpredictable waves. As an options trader, you have the power to harness the tides to your advantage. Delta serves as your compass, indicating the direction and magnitude of an option’s price movement relative to the underlying asset. It’s a beacon of clarity amidst the chaos, guiding you towards profitable trades and safeguarding against unforeseen risks.

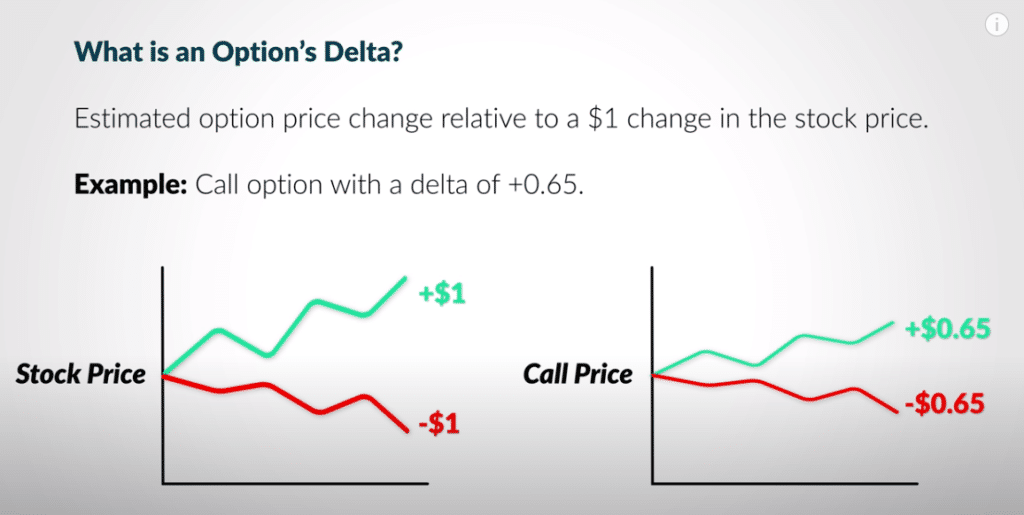

Fundamentally, Delta represents the sensitivity of an option’s price to changes in the underlying asset’s price. A Delta of 0.5 signifies that for every $1 increase in the stock’s price, the option’s price will increase by $0.50. Conversely, a Delta of -0.5 indicates that for every $1 decrease in the stock’s price, the option’s price will decline by $0.50.

Understanding the Spectrum of Delta Values

Delta exists on a spectrum ranging from -1 to 1. Options with a Delta close to 1 are known as “deep in the money” options, meaning their likelihood of expiring in the money is high. These options exhibit a strong positive correlation with the underlying asset’s price movements.

Conversely, options with a Delta near 0 are referred to as “at the money” options. Their probability of expiring in the money hangs in the balance, hovering around the prevailing market price. These options exhibit a more neutral relationship with the underlying asset’s price movements.

Finally, options with a Delta close to -1 are labeled “deep out of the money” options. Their odds of expiring in the money are slim, and they exhibit a strong negative correlation with the underlying asset’s price movements.

Delta’s Significance in Options Trading Strategies

Delta plays a pivotal role in formulating and executing options trading strategies. Traders can tailor their strategies based on their desired level of risk and potential return by carefully selecting options with specific Delta values.

For instance, if a trader anticipates a substantial increase in the underlying asset’s price, they might opt for options with a high Delta (close to 1). This approach magnifies their profit potential but also amplifies their risk exposure.

Alternatively, a trader expecting a more modest price movement might choose options with a lower Delta (closer to 0). This strategy limits both their potential gains and losses, offering a more conservative approach.

Image: haikhuu.com

How To Understand Delta In Options Trading

Image: fx.caribes.net

Unlocking Delta’s Secrets for Trading Success

To harness the power of Delta effectively in your options trading endeavors, consider the following expert insights:

-

Delta is not a static value; it fluctuates dynamically as the underlying asset’s price changes and time passes.

-

The Delta of an option can provide valuable insights into the market’s sentiment towards the underlying asset.

-

By understanding Delta’s relationship with other Greek letters (measures of option risk), traders can make more informed decisions about their options trading strategies.

In conclusion, Delta is a fundamental concept in options trading, serving as a beacon of guidance in the often-turbulent waters of the financial markets. By comprehending its intricacies and incorporating it into your trading strategies, you can increase your chances of navigating the treacherous seas of options trading with confidence and achieving your financial goals.