Introduction:

Image: markettaker.com

Imagine being able to predict the future price of a stock with remarkable accuracy. While not a crystal ball, trading on delta in stock options provides traders with an uncanny ability to harness the subtle nuances of the options market and potentially profit from them. In this comprehensive guide, we’ll delve deep into the world of delta and empower you with the knowledge to navigate its complexities, paving the way for informed trading decisions.

What is Delta?

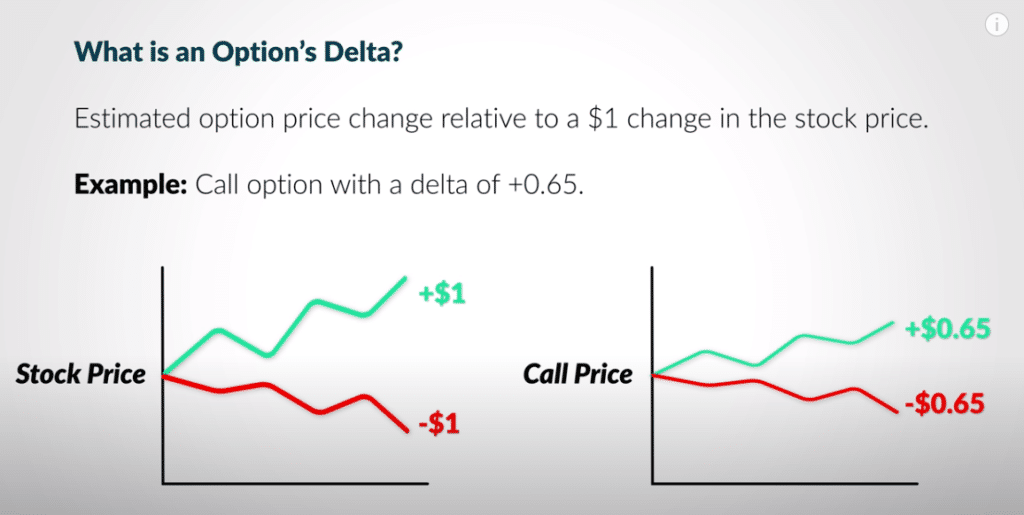

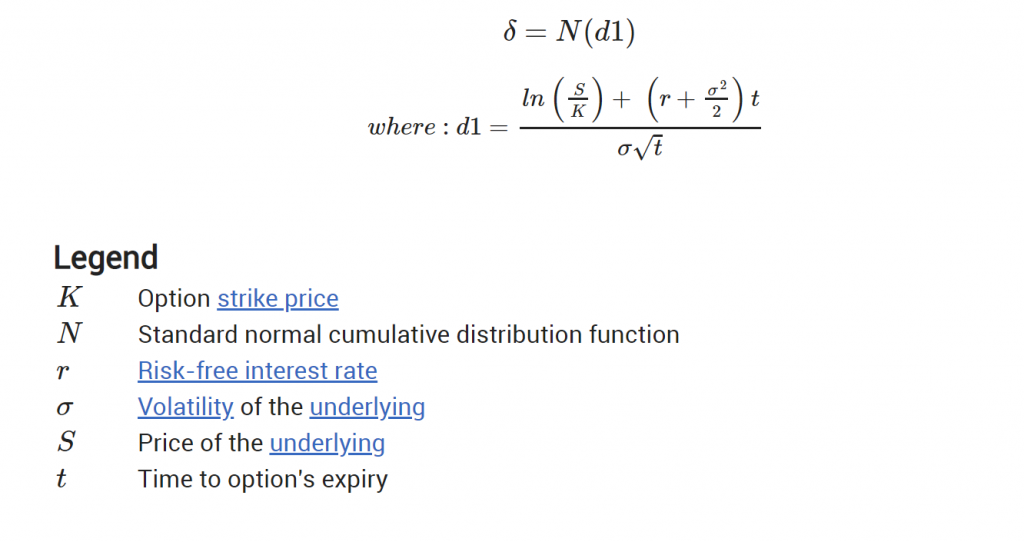

Delta is a fundamental Greek letter that quantifies the relationship between a stock’s price and the price of its associated options contracts. It measures the responsiveness of an option’s price to changes in the underlying stock price. A positive delta indicates that the option price will move in tandem with the stock price, while a negative delta indicates an inverse relationship.

Significance of Delta in Stock Options Trading

Delta plays a pivotal role in options trading, influencing strategies, risk management, and profit potential. By understanding the delta of an option, traders can:

- Assess the sensitivity of the option price to stock price changes: A higher delta signifies a greater sensitivity, making it a useful indicator for predicting price movements.

- Determine the option’s potential profit or loss: Delta provides insights into how much an option’s value will increase or decrease for every dollar change in the stock price, enabling traders to plan their trades accordingly.

- Adjust portfolio delta for risk management: By understanding the delta of different options, traders can adjust their portfolio’s overall delta to manage risk and align it with their risk tolerance.

Trading on Delta: Practical Applications

The concept of delta has practical applications in various trading strategies:

- Delta-Neutral Trading: Involves selling options of equal but opposite deltas to neutralize market movements, enabling traders to profit from the time premium without being exposed to significant price changes.

- Directional Trading: Traders can buy options with high positive deltas to bet on stock price increases or sell options with high negative deltas to capitalize on price decreases.

- Pair Trading: Involves buying and selling combinations of options with differing deltas to create a more balanced position and reduce risk.

Expert Insights and Actionable Tips

-

“Delta is not static. It changes as the stock price, time to expiration, and volatility fluctuate. Always monitor delta to ensure your positions are aligned with your trading strategy.” – Dr. Christine Kulich, Options Trading Expert

-

“Understanding delta allows you to make informed decisions about which options to trade and how to manage your risk. Use it as a tool to enhance your trading knowledge and profitability.” – Michael C. Thomsett, Options Trader

Conclusion:

Trading on delta on stock options opens up a world of possibilities for traders seeking to navigate the complexities of the options market with precision. By understanding the nuances of delta, traders can harness the power of predictive pricing, manage risk effectively, and uncover new avenues for profit generation. As with any trading endeavor, it’s crucial to conduct thorough research, stay abreast of market developments, and consult with experienced professionals when needed.

Image: www.projectfinance.com

Trading On Delta On Stock Options

Image: epsilonoptions.com