Introduction

In the realm of finance, where fortunes are made and lost at the whims of the market, there exists a unique trading strategy that harnesses the power of time decay to generate consistent returns known as option theta trading. As a seasoned trader, I have witnessed firsthand the transformative potential of this strategy, navigating market volatility with precision and generating steady profits over the years.

Image: www.researchgate.net

The allure of option theta trading lies in its ability to profit from the passing of time, regardless of the underlying asset’s price action. This is achieved by selling options contracts, known as “selling premium,” which grants the buyer the right, but not the obligation, to buy or sell an asset at a specific price on or before a predetermined date. As the clock ticks down towards expiration, the value of these options contracts inevitably dwindles, creating an inherent advantage for the seller.

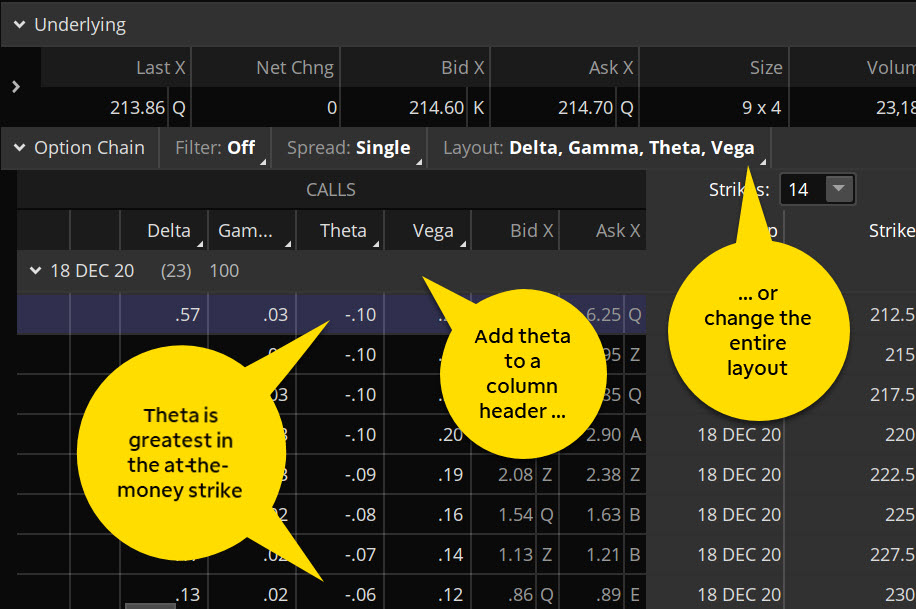

Understanding Option Theta

Theta, a Greek letter denoting time decay, represents the loss in an option’s value as the time to expiration decreases. This is because the option’s price includes a premium for the potential future change in the underlying asset’s price. As time passes, this premium evaporates, leaving only the intrinsic value, which is the difference between the underlying asset’s price and the strike price.

Key Advantages of Option Theta Trading

- Consistent Returns: Theta trading offers a steady stream of income, irrespective of market direction, making it an attractive strategy for risk-averse investors.

- Lower Investment Requirements: Unlike stock or futures trading, theta trading can be executed with relatively low capital, making it accessible to a wider range of traders.

- Hedging Strategies: Theta can be used to hedge against portfolio risk, protecting investments from adverse market movements.

Expert Tips for Option Theta Trading Success

Mastering option theta trading requires a combination of technical understanding and market savvy. Here are a few tips to enhance your trading journey:

- Target High Implied Volatility Assets: Options with higher implied volatility (IV) exhibit greater time decay, increasing your profit potential.

- Employ Short-Term Contracts: Options with shorter time to expiration experience more pronounced theta decay, allowing for quicker returns.

- Run-Up to Earnings: Options that are approaching earnings announcements can experience elevated IV, presenting opportunities for theta trading.

Image: www.youtube.com

Frequently Asked Questions about Option Theta Trading

- Q: Can theta trading be a reliable form of passive income?

- A: While theta decay generates consistent income streams, it is not a form of passive income as it requires active monitoring and management of positions.

- Q: What are the risks involved in theta trading?

- A: Theta trading primarily carries the risk of rapid adverse price changes in the underlying asset, known as “gamma risk.”

- Q: Can theta trading be combined with other trading strategies?

- A: Yes, theta trading can be effectively combined with other strategies, such as covered calls or collar strategies, to enhance returns and manage risk.

Option Theta Trading Strategy

Image: tickertape.tdameritrade.com

Conclusion

Option theta trading is an effective and time-tested strategy for generating consistent returns in the financial markets. By harnessing the power of time decay and employing sound trading principles, aspiring traders can embark on a rewarding journey in this lucrative niche. Remember, knowledge is the key to success in the ever-evolving world of options trading. Are you ready to explore the fascinating world of option theta trading and unlock the potential for financial growth?