Introduction

In the labyrinthine world of finance, theta reigns supreme as the mysterious force that governs the value of time in options trading. Theta, like a ticking clock, relentlessly gnaws at the value of options contracts as the expiration date approaches. This captivating guide will delve into the intricate world of theta, empowering you with the knowledge to harness its enigmatic power and maximize your trading strategies.

Image: luckboxmagazine.com

Understanding Theta

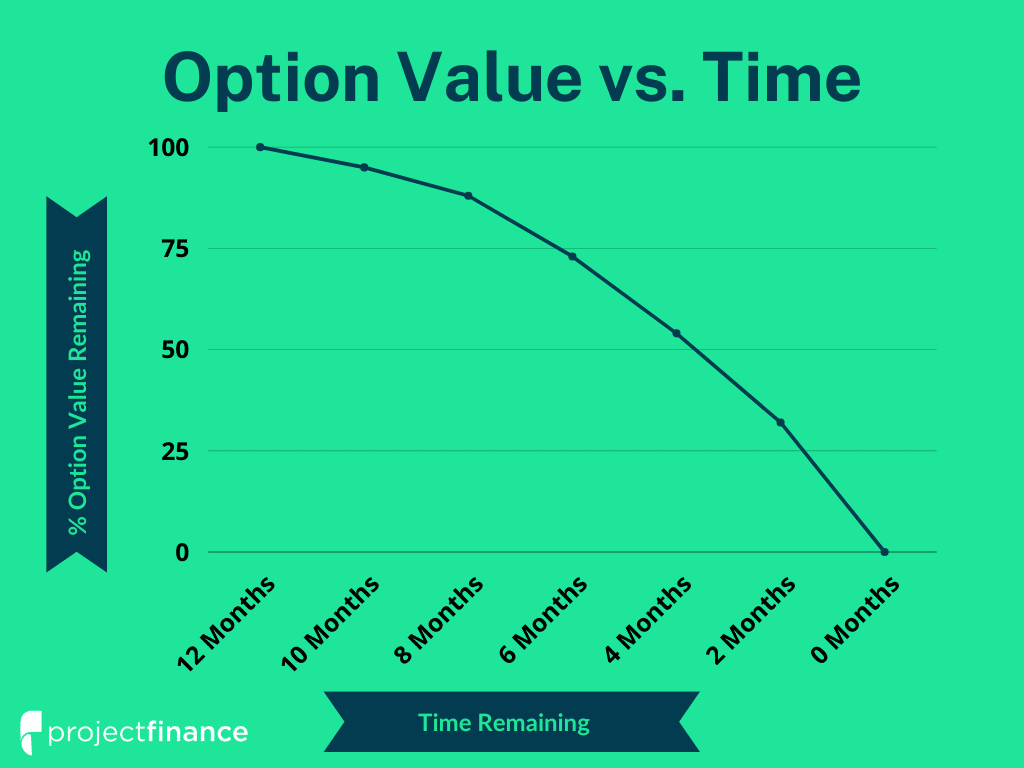

Theta represents the rate at which the value of an option decreases over time. This concept stems from the inherent “time value” embedded in every option contract. As the expiration date nears, the time value of an option dwindles, and theta accelerates its downward trajectory. Long options (calls and puts) lose value due to theta decay, while short options (reverse calls and reverse puts) gain value.

Impact of Factors on Theta

Theta’s influence is modulated by several key factors that determine the rate of time value decay.

-

Time to Expiration: The closer an option gets to its expiration date, the more significant the impact of theta. Options with shorter time to expiration experience more rapid theta decay.

-

Price of the Underlying: When the underlying asset price is far from the option strike price, theta decay tends to be lower.

-

Volatility: High volatility in the underlying asset can partially offset theta decay by increasing the likelihood of price fluctuations.

Leveraging Theta in Trading Strategies

Seasoned traders employ theta to their advantage through various strategies:

-

Theta Harvesting: Selling options at or near their expiration date to capitalize on the accelerated time value decay.

-

Theta Neutral: Constructing portfolios that balance the opposing effects of theta on long and short options, neutralizing time value decay.

-

Theta Scalping: Buying and selling options with short durations to exploit minor price fluctuations caused by theta decay.

Image: www.projectfinance.com

Expert Insights and Actionable Tips

“Trading options without understanding theta is like sailing a ship without a compass. It’s crucial to appreciate theta’s implications and incorporate it into your trading decisions.” -John Carter, veteran options trader

-

Monitor theta values closely to gauge the rate of time value decay.

-

Consider the time to expiration and the factors that influence theta decay when selecting options.

-

Employ theta harvesting strategies to generate income through the steady erosion of time value.

Theta In Options Trading

Image: pippenguin.com

Conclusion

Theta, the enigmatic ruler of time in options trading, holds the power to reshape your trading destiny. By unraveling its secrets, you can unlock the gateway to calculated decisions, strategic portfolio construction, and a deeper understanding of the options market. Embrace theta’s captivating influence, and let its gentle whisper guide your path to financial success.

Remember, armed with the knowledge embodied in this comprehensive guide, you can harness the power of theta and navigate the ever-evolving landscape of options trading with confidence and precision. As the timeless words of Seneca echo, “Luck is what happens when preparation meets opportunity.” May theta be your trusted companion on this transformative journey of financial empowerment.